This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed to Ease Pace of QT, Keeps Rates Unchanged

March 20, 2025

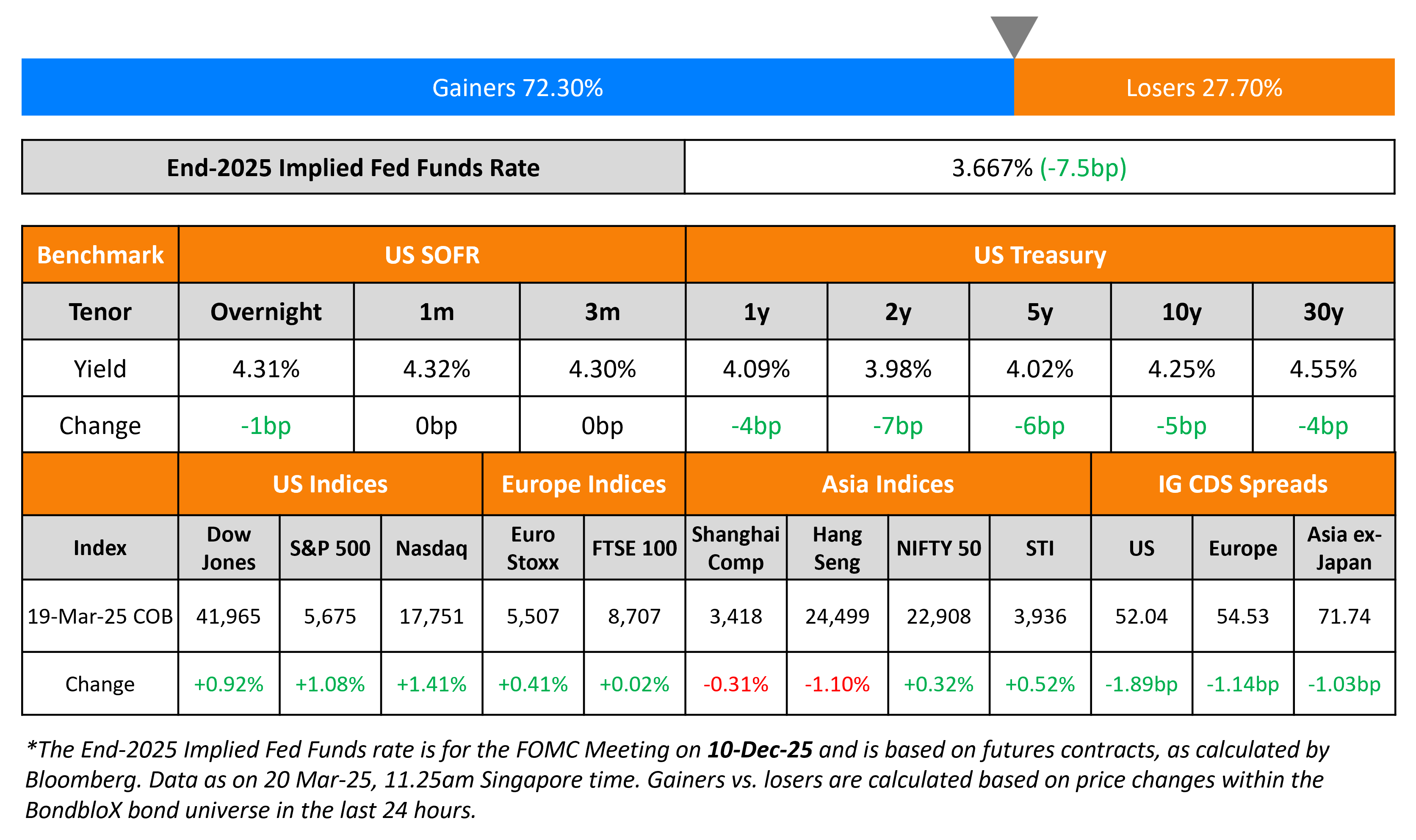

US Treasury yields fell by 5-7bp across the curve, following a dovish Fed meeting. FOMC members unanimously voted to keep the Fed Funds Range unchanged at 4.25-4.50% as expected. Fed Chairman Jerome Powell said that a “good part” of the higher inflation forecast came from the hike in tariffs, however, noting that its impact could be “transitory”. He also acknowledged that hard data indicated a solid economy while the recent weak consumer sentiment surveys may have been outliers. Regarding the dot plots, the Fed expects two 25bp rate cuts in 2025, two more in 2026 and one in 2027 (see image below).

The Fed also said that it will continue reducing its holdings of Treasuries as part of its balance sheet normalization policy, but at a slower pace from April. The new monthly cap of Treasuries that will be allowed to mature and not be replaced will be reduced to $5bn per month from the prior $25bn. The roll-off of its agency MBS will continue as earlier with a monthly cap of up to $35bn.

US equity markets moved higher, with the S&P and Nasdaq higher by 1.1% and 1.4% respectively. Looking at credit markets, US IG and HY spreads CDS spreads tightened 1.9bp and 3.7bp respectively. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads tightened by 1.1bp and 10.4bp respectively. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads were tighter by 1bp. Bank of Japan (BOJ) members unanimously voted to keep its policy rate unchanged at 0.5%, in-line with expectations.

New Bond Issues

- Greenko Energy $ 3.5Y at 7.625% area

Swiss Re raised S$450mn via a 6NC5 bond at a yield of 3.75%, 25bp inside initial guidance of 4% area. The subordinated note issued by Swiss RE Subordinated Finance PLC, is rated A3/BBB+, and guaranteed by Swiss Re Ltd. Proceeds will be used for general corporate purposes.

Muthoot Finance raised $250mn via a tap of its 6.375% 2029s at a yield of 6.651%, 16.1bp inside initial guidance of 6.812% area. The senior secured note is rated BB+/BB. Proceeds will be used for onward lending and other activities, in accordance with approvals granted by RBI.

Barclays raised €1.25bn via a 12NC7 Tier-2 bond at a yield of 4.616%, ~22.5bp inside initial guidance of MS+225/230bp area. The subordinated note is rated Baa1/BBB-/BBB+. Proceeds will be used for general corporate purposes and to further strengthen its capital base.

New Bonds Pipeline

- Shinhan Bank hires for $ bond

Rating Changes

- Bausch Health Cos. Inc. Upgraded To ‘B-‘ On Partial Refinancing; Outlook Negative

- Fitch Upgrades Synchrony Financial to ‘BBB’; Outlook Stable

- Moody’s Ratings downgrades Petkim to Caa1, changes outlook to negative

- Moody’s Ratings changes to stable the outlook on de Volksbank’s deposit and senior unsecured ratings of A2

- International Petroleum Corp. Outlook Revised To Negative On Lower Oil Prices And Cash Flow Outspend, Ratings Affirmed

Term of the Day: Capital Adequacy Ratio

This is the ratio of a bank’s capital in relation to its risk-weighted assets. Capital here includes Tier 1 and Tier 2 capital. Risk weighted assets account for credit, market and operational risks with certain weights. Under Basel III, banks must have a capital adequacy ratio (CAR) at a minimum of 8% of risk weighted assets. CAR is used as a measure to ensure that banks have a cushion to absorb losses and is used while doing stress tests.

Talking Heads

On Fed Needs to Raise Threat of ‘Bad News’ Rate Cuts – Mohamed El-Erian, Cambridge

Fed should postpone rate cuts “in a way that convinces people that you will have the possibility of rate cuts not because inflation is coming down – the so-called ‘good news cuts’ – but because growth is problematic — ‘bad news cuts’… They can no longer maintain the ‘we don’t speculate, we don’t guess’ on policies… got to take a view”

On UK Should Buy Back Long Gilts to Ease Debt Pressure – BofA

“The gilt market is restricting fiscal choices and has become an undesirable political barometer. Gilt issuance needs to adapt, radically and rapidly… offer poor value for taxpayers… It could buy all the gilts at current prices and reissue new par bonds to pay for them… would knock about 16% off the UK‘s debt/GDP ratio”

On ECB’s Path for Interest Rates Not Predetermined – ECB’s De Guindos

“The current situation is one of high uncertainty. Going forward, given this environment of high uncertainty, we continue to maintain our approach to what the monetary policy bias is… will go from meeting to meeting depending on the data, and we don’t have any predetermined path”

Top Gainers and Losers- 20-March-25*

Go back to Latest bond Market News

Related Posts: