This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed to Buy Bonds from the Secondary Market

March 24, 2020

Financial markets are rallying this morning after the US Federal Reserve announced new measures, implying unlimited quantitative easing to support the flow of credit to households and businesses. Treasuries had a choppy session ending the day mostly unchanged. This morning, Japan’s Nikkei 225 has risen 7%, Australian S&P ASX 200 is up 2.9%, Korea’s KOSPI surged 6.25% and Hang Seng index climbed 4.1%. Regionally, the MSCI Asia Pacific ex-Japan index is up 3.9%. The S&P futures are up 3.1% after Wall Street’s overnight fall when the Dow Jones Industrial Average dropped 3.04%, the S&P 500 retreated 2.93% and the Nasdaq Composite edged down 0.27%. The primary dollar bond market in Asia has remained stalled even though US corporates are paying up to get deals done. US high grade market saw seven borrowers sell $19.4bn of new debt yesterday.

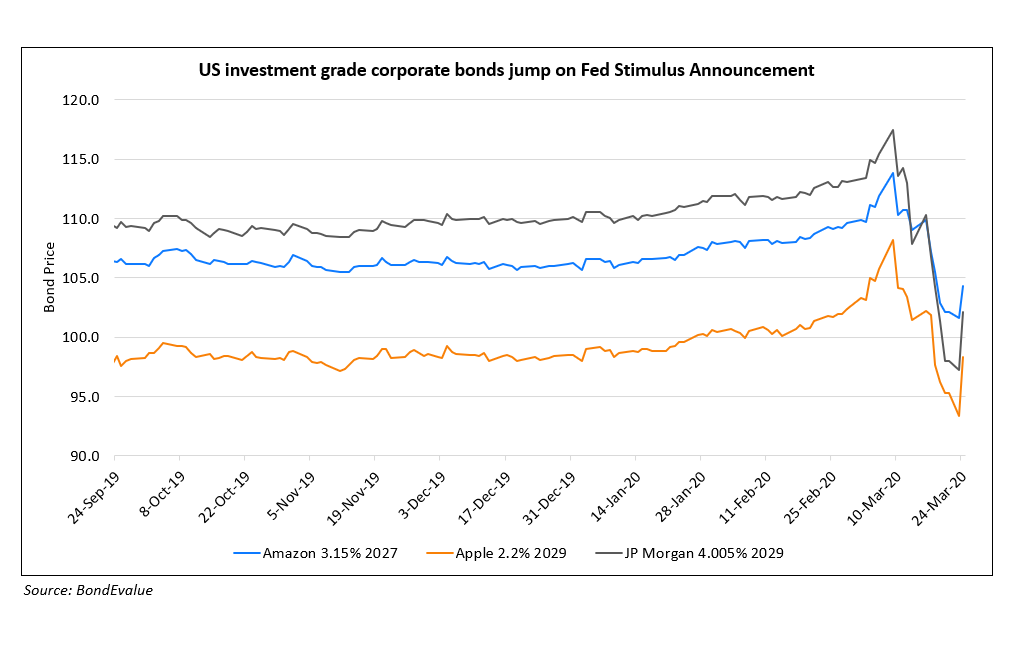

US Investment Grade bonds got a lift after the Fed announced new facilities to support large employers. The chart above shows how some popular US investment grade names reacted to the Fed announcement. It will be interesting to see the impact of this stimulus measure on Asian credit.

Fed Announces New Measures, Includes Support to Investment Grade Large Employers

The Fed announced another slew of measures to support households, businesses and the US economy. Among these are two measures to support credit to large employers – the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF). A third facility, Term Asset-Backed Securities Loan Facility (TALF) will also be introduced to support the flow of credit to consumers and businesses. The Department of the Treasury will make an initial $30bn investment to facilitate these three measures.

The PMCCF will allow companies access to credit so that they are better able to maintain business operations and capacity during these challenging times. The facility is open to investment grade companies and will provide bridge financing of four years. A borrower may defer payments during the first six months of the loan (extendable at the Fed’s discretion) but then cannot pay dividends or make stock buybacks during that time. The interest rates used by the Fed to lend will be informed by market conditions. The facility will include a commitment fee at 100 bps.

The SMCCF will allow secondary market purchases of corporate bonds issued by investment grade U.S. companies. The facility will also allow purchases of U.S.-listed exchange-traded funds whose investment objective is to provide broad exposure to U.S. investment grade corporate bonds. The facility has a limit of 10% of the issuer’s maximum outstanding bonds in the last year (March 22, 2019 to 2020) and not more than 20% of any particular ETF as of March 22, 2020. In terms of pricing, the Fed will purchase these eligible corporate bonds at fair market value in the secondary market and will avoid purchasing ETFs when they trade materially higher than the estimated NAV of the underlying portfolio.

These facilities will be available until September 30, 2020 as of now, but could be extended. To read more details about these facilities as well as the other measures introduced, please refer to the Fed Press Release.

For the full story, click here.

SoftBank to Sell $41bn in Assets, Raise Funds for BuyBacks and Debt Reduction

Japan’s SoftBank Group Corp that poured nearly $100bn into expensive, cash-burning startups in the bull market of the last few years, says that it will sell billions of dollars in assets to support its plunging stock price and shore up its debt laden balance sheet as ratings downgrade loom ahead. This could include $14bn in Alibaba Shares, part of its slice of Sprint Corp., as well as selling a stake in its domestic telecommunications arm, SoftBank Corp. After more than a 40% shave of market value since its February Peak, SoftBank shares surged 21% in Tokyo on Tuesday.

For the full story, click here.

Despite this, Apollo Global Management’s hedge funds have placed a short bet against bonds issued by SoftBank citing that these bonds were mis-priced considering SoftBank’s debt load and exposure to tech-startups.

Chinese Dollar Bonds Show Value of Government Backing

Both Chinese and American Dollar bonds have taken a beating last month by the potential hit to corporate earnings from the coronavirus containment measures across the globe. But Chinese Investment Grade debt is faring much better than their American peers. Although there are many reasons for this, one key difference is investor confidence in the Chinese government providing an effective backstop for important borrowers.

For the full story, click here.

Top Gainers & Losers – 24-Mar-20*

China keen to boost its ‘black sheep’ corporate bonds

China’s new securities law lacked clear guidance on corporate bonds, which led many in the DCM space to call for a separate law on bond issuance and trading. However, Chinese government officials are now keen to provide support to private corporate bonds, which have been the ‘black sheep’ of China’s bond market given the high number of defaults in 2019.

For the full story, click here.

China has issued $201bn of local government recovery bonds

Year-to-date local government bond issuance in China has reached 1.41 trillion yuan ($201bn), which accounts for about 76% of the quota issued in advance. Special bonds’, used for development of infrastructure such as transport, environment protection and agriculture, sales reached 1 trillion yuan, accounting for 79% of the advance quota.

For the full story, click here.

Other Stories

Go back to Latest bond Market News

Related Posts: