This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Speakers Comment on the Policy Path; HSBC Launches S$ Bond

May 20, 2025

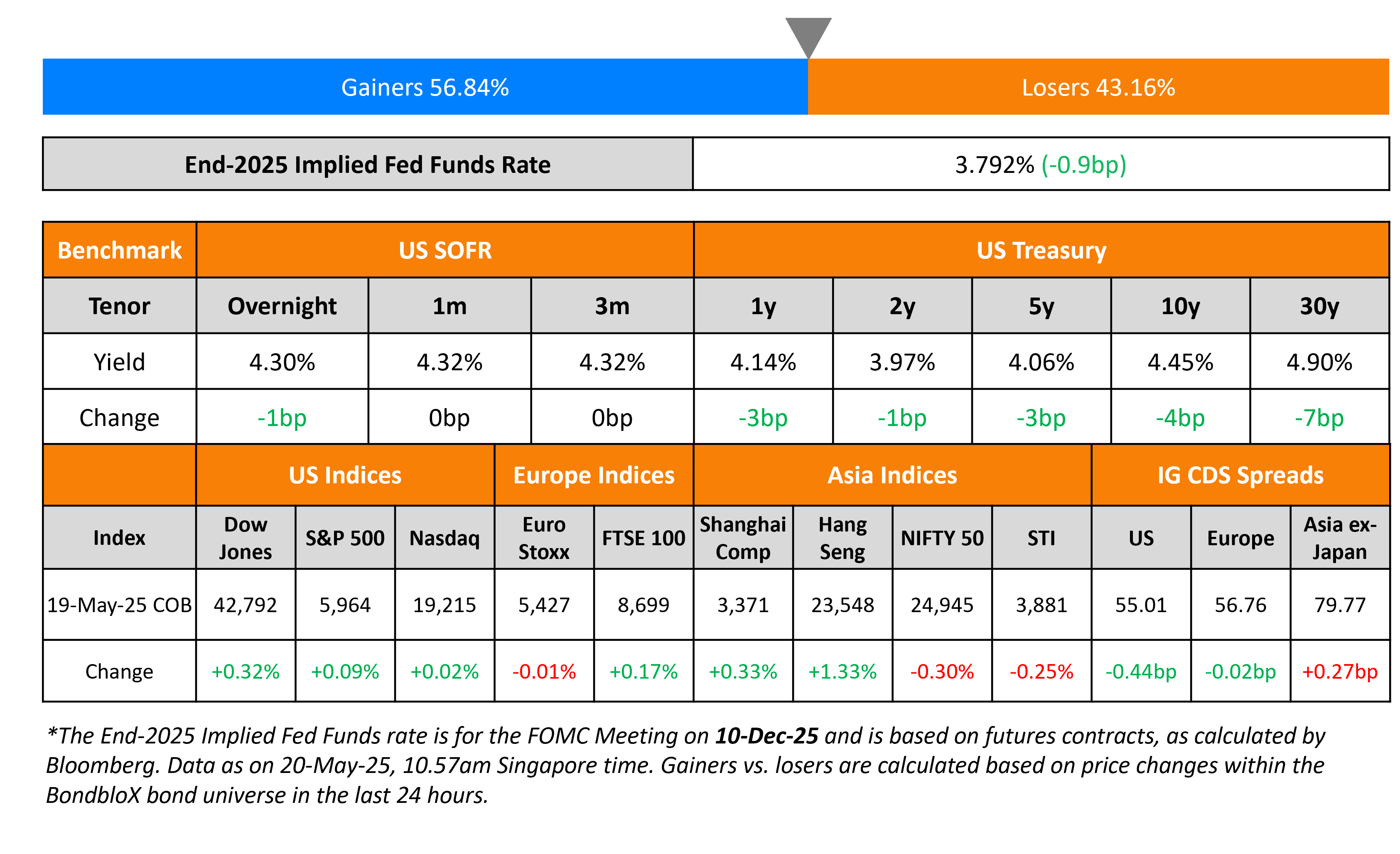

US Treasury yields eased slightly with the 10Y yield lower by 4bp. Several Fed speakers opined on the path of the central bank’s policy with their views – New York Fed President John Williams said that it will “take some time to get a clear view” on the economy’s performance amid the trade policy uncertainty. He added that the Fed can take its time to slowly figure out interest rate changes. Atlanta Fed President Raphael Bostic reiterated that he expects one rate cut this year. Fed Vice-Chair Phillip Jefferson said that the Fed’s stance was in a “very good place” and had a “moderately restrictive” impact.

Looking at equity markets, the S&P and Nasdaq were broadly steady on Monday. Looking at credit markets, US IG and HY CDS spreads tightened by 0.4bp and 1.5bp each. European equity markets ended mixed. The iTraxx Main CDS spreads were flat, while Crossover CDS spreads tightened by 1.4bp. Asian equity markets have opened broadly higher today. Asia ex-Japan IG CDS spreads were wider by 0.3bp.

New Bond Issues

- Kubota Credit Corp USA $ 3Y at T+120bp area

- HSBC S$ 8NC7 at 3.7% area

- Korea Land & Housing Corp $ 2Y at T+90bp area

Rabobank raised $1.75bn via a three-part deal. It raised:

- $500mn via a 2Y senior preferred note at a yield of 4.372%, 20bp inside initial guidance of T+60bp area.

- $500mn via a 2Y senior preferred FRN at SOFR+59bp vs. initial guidance of SOFR equivalent area

- $750mn via a 6NC5 senior non-preferred bond at a yield of 4.99%, ~25.5bp inside initial guidance of T+115/120bp area

The senior preferred notes are rated Aa2/A+/AA-, while the senior non-preferred bond is rated A3/A-/A+. Proceeds will be used for general corporate purpsoes.

Credit Agricole raised $1.75bn 6NC5 bond at a yield of 5.222%, 30bp inside initial guidance of T+145bp area. The senior non-preferred note is rated A3/A-/A+. Proceeds will be used for general corporate purposes.

Intesa Sanpaolo raised €1bn via a PerpNC8 AT1 bond at a yield of 6.375%, 50bp inside initial guidance of 6.875%. The junior subordinated note is rated Ba3/BB/BB-, and received orders of over €3.6bn, 3.6x issue size. If not called before 26 May 2033, the coupon will reset to the 5Y Mid-Swap plus 403.8bp. A trigger event will occur if the bank’s standalone or the group’s consolidated CET1 ratio fall below 5.125%. Proceeds will be used for general banking purpsoes and for regulatory capital purposes. The new bond is priced at a new issue premium of ~79.5bp over its existing 5.875% Perp callable in September 2031 that currently yields 5.58%.

Korea Railroad raised $400mn via a 3Y bond at a yield of 4.643%, 42bp inside initial guidance of T+105bp area. The senior unsecured note is rated Aa3. Proceeds will be used for general corporate purposes including refinancing of existing debt.

New Bonds Pipeline

- KEXIM hires for € 3Y/5Y bond

- Alinma hires for $ PerpNC5.5 AT1 Sukuk bond

- Nomura hires for € 5Y bond

- Aviva hires for € 600 mn 31.25NC11.25 Tier 2 bond

- Al Rayan hires for $ 5Y Sukuk bond

- Pampa Energia hires for $ 8Y bond

- Telecom Argentina hires for $ 8Y bond

Rating Changes

-

Moody’s Ratings upgrades Eletrobras to Ba1; outlook stable

-

Moody’s Ratings upgrades Piedmont Healthcare (GA) to Aa3; outlook revised to stable

-

Novo Nordisk A/S Upgraded To ‘AA’ from ‘AA-‘ On Sustainable Strong Ongoing Growth Prospects; Outlook Stable

-

Moody’s Ratings downgrades Codelco’s ratings to Baa2; outlook changed to stable from negative

-

Moody’s Ratings downgrades Dometic’s ratings to Ba3; outlook stable

-

Fitch Revises Telecom Italia’s Outlook to Positive; Affirms IDR at ‘BB’

Term of the Day: Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Talking Heads

On Fed officials taking cautious view on US markets amid downgrade

Atlanta Fed President Raphael Bostic

The downgrade “will have implications for the cost of capital and a bunch of other things, and so it could have a ripple through the economy”

New York Fed President John Williams

Investors “have viewed and continue to view” the U.S. as “a great place to invest, including Treasuries, fixed income assets, so I think that that narrative is still there.”

Minneapolis Fed President Neel Kashkari

“Right now there’s a question mark being raised about what is the U.S. competitive position going to be relative to other advanced economies around the world”

On Warning Markets Are Underestimating Geopolitical, Inflation Risks – Jamie Dimon, JPMorgan

“Credit today is a bad risk… people who haven’t been through a major downturn are missing the point about what can happen in credit… market came down 10%, it’s back up 10%; I think that’s an extraordinary amount of complacency… chance of inflation going up and stagflation is a little higher than other people think”

On Seeing High-Grade Debt Demand Up After US Cut – JPMorgan

“If our rates colleagues are correct that the impact on yields is likely to be modestly higher rates, then we believe the near term impact on spreads will not be significant”

Top Gainers and Losers- 20-May-25*

Go back to Latest bond Market News

Related Posts: