Talking Points

|

Description

|

Changes from July’s statement

|

- July 28,2021:

- The sectors most adversely affected by the pandemic have shown improvement but have not fully recovered.

- Inflation has risen, largely reflecting transitory factors

- The economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings.

- September 22, 2021:

- The sectors most adversely affected by the pandemic have improved in recent months, but the rise in COVID-19 cases has slowed their recovery.

- Inflation is elevated, largely reflecting transitory factors

- If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.

|

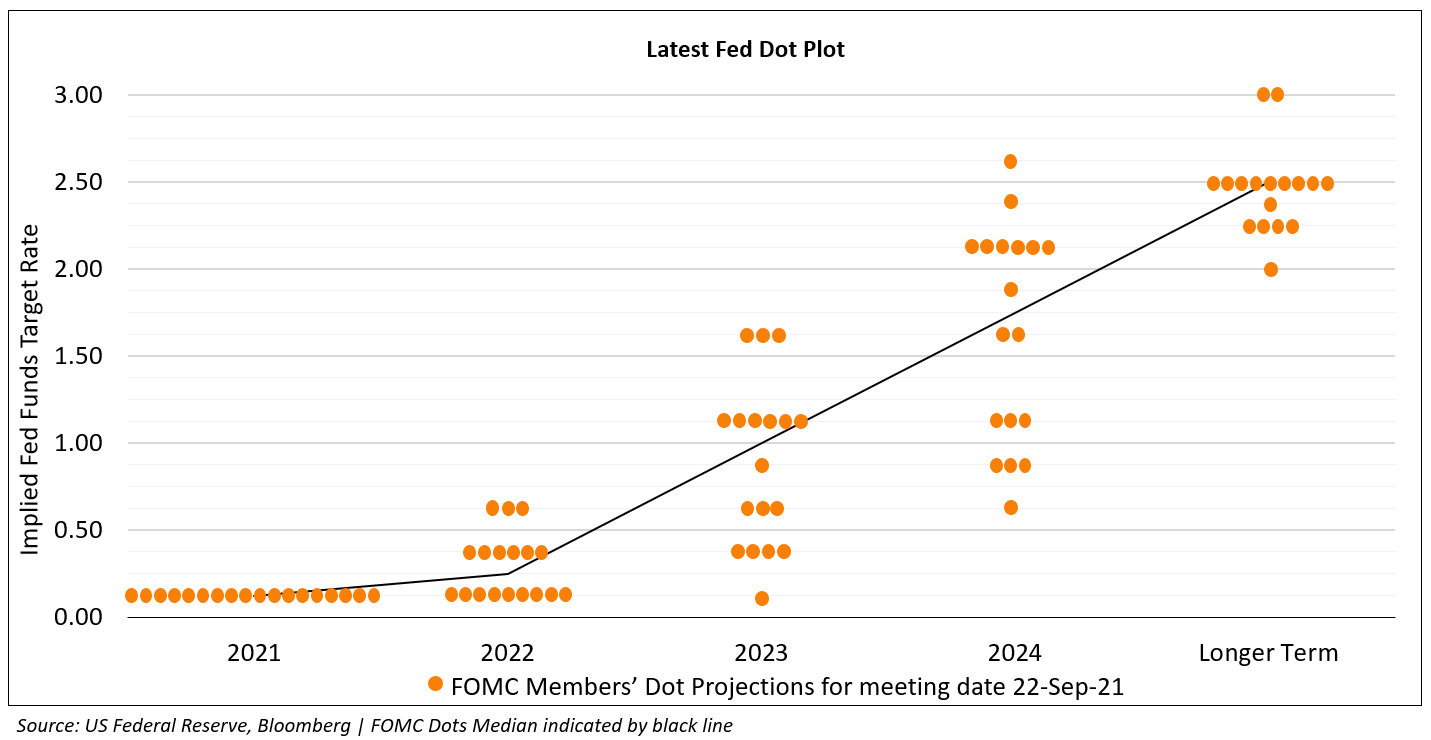

Dot Plots vs. June

|

- June 16, 2021:

- 7 out of 18 members expect at least one rate hike next year

- 2023 median FOMC dots at 0.625%. 13 FOMC members expect at least one rate hike by 2023

- September 22, 2021:

- 9 out of 18 members expect at least one rate hike next year

- 2023 median FOMC dots at 1% . 17 FOMC members expect at least one rate hike by 2023

- New 2024 FOMC dots are released. Median dots for 2024 is at 1.75%

- Longer-term median dot is unchanged at 2.5%

|

Summary of Economic Projections (SEP)

|

- Median Real GDP expected at 3.8% and 2.5% for 2022 and 2023

- Median Unemployment rate expected at 3.8% and 3.5% for 2022 and 2023

- Median Core PCE inflation expected at 2.2% for 2022 and 2023

|

On Tapering and Rate Hike Path

|

- While no decisions are made on tapering, as the recovery remains on track, a gradual tapering process that concludes around the middle of next year is likely to be appropriate

- The timing and pace of the reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff

- Holdings of longer-term securities will keep financial conditions accommodative

- Drawdown of the $120bn monthly bond purchases could begin after the November 2-3 policy meeting as long as job growth through September is reasonably strong (Press Conference)

|