This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Reduces QT Pace, Keeps Rates on Hold

May 2, 2024

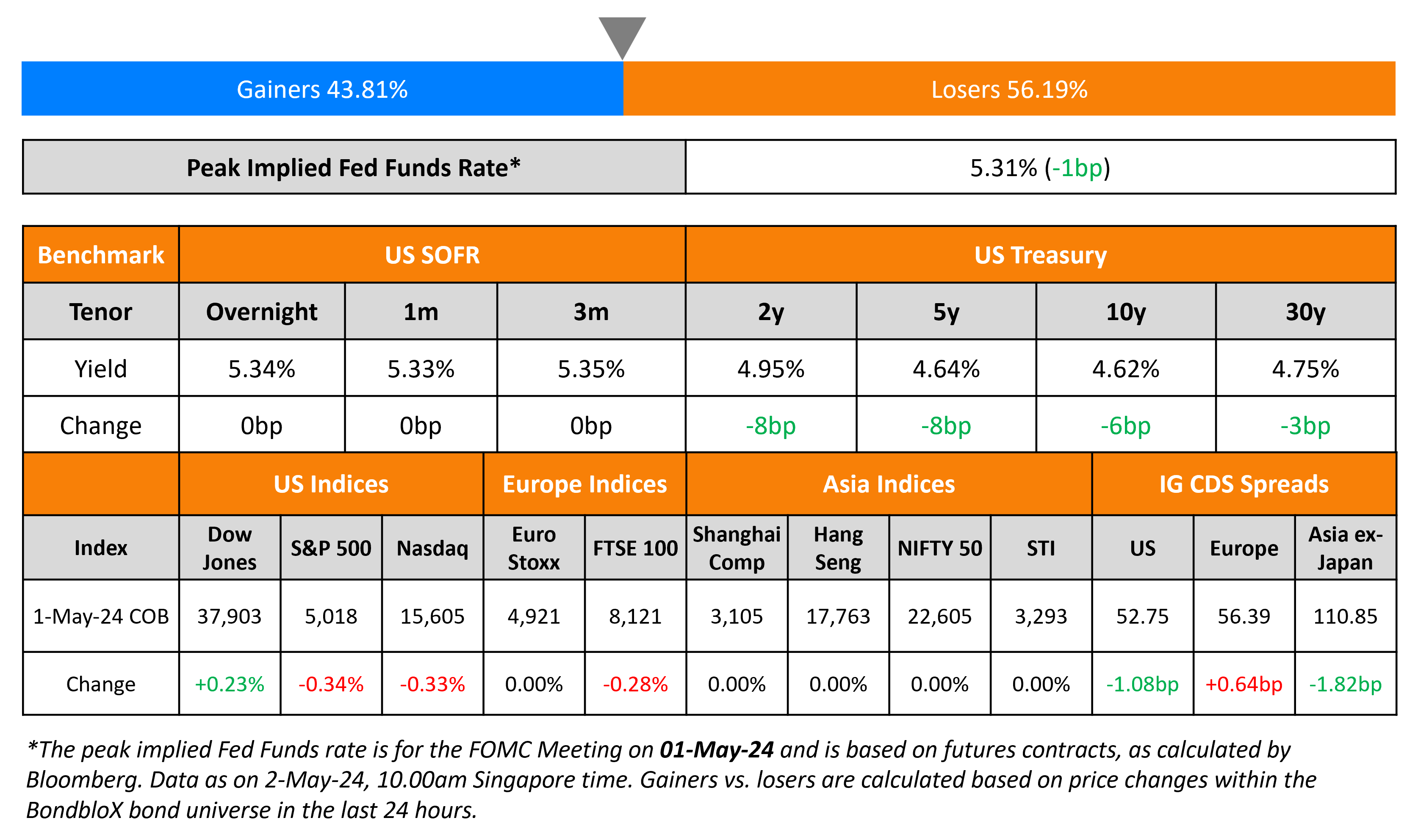

US Treasury yields eased ~6-8bp across the curve after the FOMC meeting yesterday. The Federal Reserve kept rates on hold as expected, with the Fed Funds range at 5.25-5.50%. Fed Chairman Jerome Powell said that it “will take longer than previously expected” for FOMC members to become comfortable that inflation will resume the decline towards 2%. Thus, while noting that rate increases remain unlikely, he indicated that policy rates could remain on hold for a more extended period. Regarding its quantitative tightening programme, the Fed also announced a reduction in the cap of Treasuries it allows to mature (and not replaced) to $25bn per month vs. the current cap of up to $60bn. The cap on MBS’ however will remain at $35bn per month. This will be in effect from June 1.

Also, the US ISM Manufacturing Index slipped into contractionary territory, coming in at 49.2 in April vs. expectations of 50.0 and the March’s 50.3 reading. However, looking at the sub-components, the inflationary gauge measured by the Prices Paid Index came at 60.9 vs. expectations of 55.4. ISM New Orders and ISM Employment contracted to 49.1 and 48.6. Earlier on Tuesday, the US ADP Payrolls rose by 192k in April, higher than expectations of 183k and the prior month’s 184k reading.

S&P and Nasdaq ended lower by 0.3% each. US IG CDS spreads tightened 0.2bp and HY spreads were 4bp tighter. Most European and Asian equity indices were closed due to labor day holidays. The iTraxx main CDS spreads widened 0.6bp and the crossover CDS spreads widened 6.4bp. Asia ex-Japan CDS spreads tightened 1.8bp.

New Bond Issues

Abu Dhabi Developmental Holding Company (ADQ) raised $2.5bn via a two-part debut issuance. It raised $1.25bn via a 5Y bond at a yield of 5.498%, 35bp inside initial guidance of T+115bp area. It also raised $1.25bn via a 10Y bond at a yield of 5.565%, 35bp inside initial guidance of T+125bp area. The senior unsecured notes are rated Aa2/AA (Moody’s/Fitch).

Iliad Holding raised $750mn via a 7NC3 bond at a yield of 8.5%, ~25bp inside initial guidance of 8.75% area. The senior secured bonds are unrated. The bonds have a change of control put at 101. The bonds also The bonds have a make whole call at T+50bp, with an optional redemption at 104.25, 102.125 and 100 on 15 April 2027, 15 April 2028 and 15 April 2029 respectively.

New Bonds Pipeline

- Korea Expressway hires for $ 3Y/5Y bond

Rating Changes

-

Fitch Upgrades CEMEX’s IDRs to ‘BBB-‘; Outlook Stable

- Fitch Upgrades MUFG Bank and MUTB to ‘A’, Affirms Group IDR at ‘A-‘

- Fitch Upgraded BRF to ‘BB+’ from ‘BB’; Outlook Stable

- NVIDIA Corp. Upgraded To ‘AA-‘ On Continued Strong AI Investment Cycle; Outlook Stable

- Moody’s Ratings changes outlook to positive, affirms Brazil’s Ba2 ratings

-

Fitch Revises Outlook on Beijing Capital Group to Negative, Affirms at ‘BBB-‘; Removes UCO

Term of the Day

Make Whole Call

A Make Whole Call (MWC) is a type of call option on a bond that gives the issuer the right to redeem a bond before its maturity date by compensating (making whole) bondholders for future coupon payments. MWC provisions were introduced in the 1990s and are rarely exercised by issuers. If exercised, the issuer has to pay a lump sum amount to the bondholders that represent the net present value of future foregone coupon payments, typically stated as a formula in the bond prospectus.

MWCs are different from traditional call options in that investors are compensated for foregoing future coupon payments. With traditional call options, the issuer can exercise the call option at the predefined call price without having to pay bondholders for foregoing future coupons. This makes MWCs beneficial to bondholders as compared to traditional call options and are typically expensive for the issuer to exercise.

Talking Heads

On Bond Mutual Funds Rake in $108bn to Break Two-Year Exodus

Bloomberg Intelligence analyst, David Cohne

“Investors have continued to pile into bond funds for elevated yields. Part of it is investors wanting to get the yield now, in case the Fed does decide to cut”

VettaFi’s Lara Crigger

“Fixed income is hot, and it’s not really a story about the vehicle of access so much as it about yields”

On With Fed on Hold, Companies’ Buybacks Offer Equity Markets a Tailwind

Mathieu Racheter, head of equity strategy at Julius Baer

“The surge in buybacks will certainly be a tailwind for stocks this year”

George Ball, chairman at Sanders Morris Harris

Buybacks won’t have the “strength or durability” they had in the past

On Rate-Hike Risk Creeping Up on EM as Bonds Falter

Cliff Ambrose, founder at Apex Wealth

“Certain countries stand out as potentially vulnerable to enacting rate hikes. Those overly reliant on external financing, exposed to commodity-price fluctuations, or grappling with political instability”

Omotunde Lawal, head of EM credit at Baring Investment

“If inflation truly does show signs of resurgence, the vulnerable segments would be largely the crude importers”

Top Gainers & Losers- 02-May-24*

Go back to Latest bond Market News

Related Posts:.png)