This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Officials Barkin and Waller Sound a Hawkish Tone

June 19, 2023

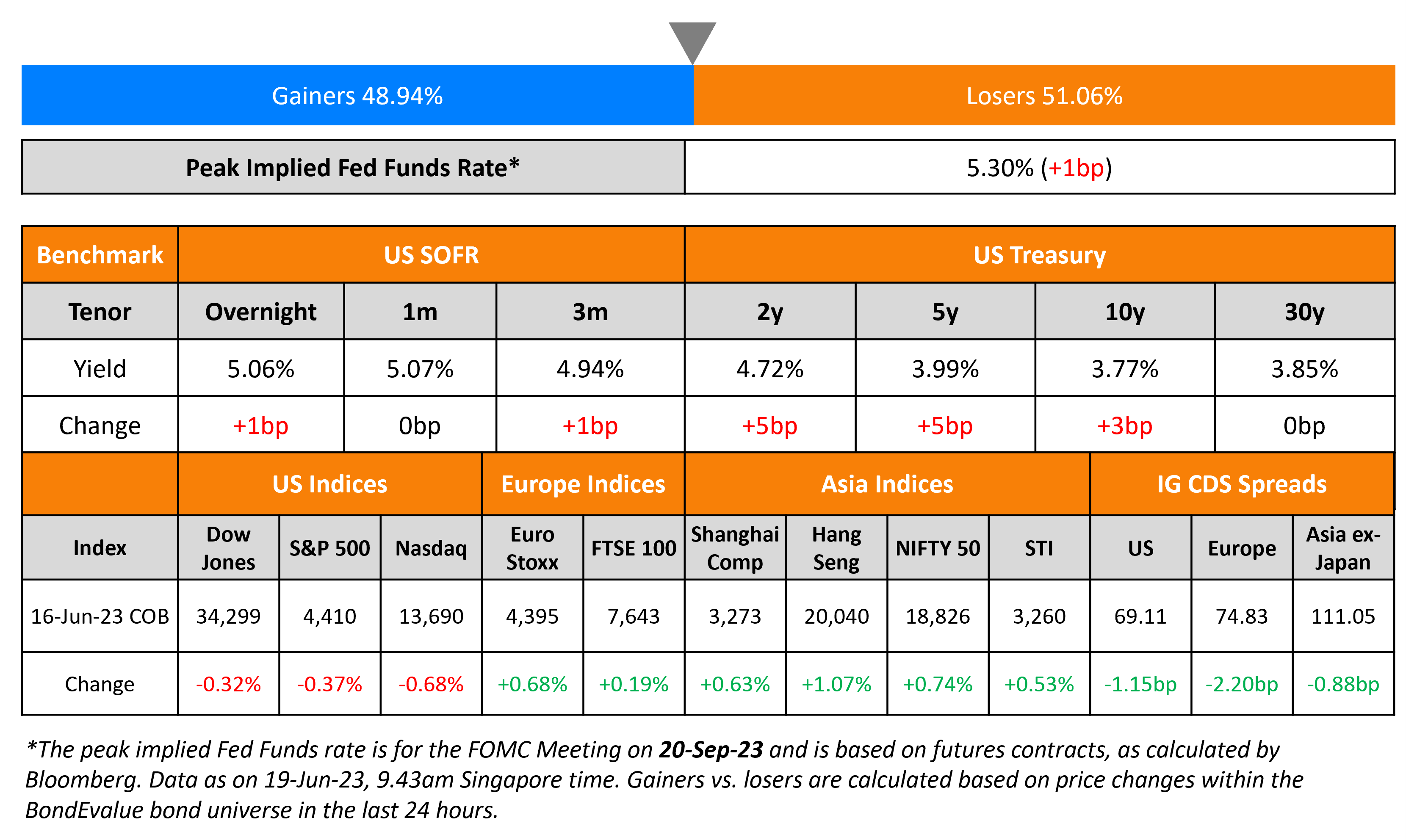

US Treasury yields inched higher across the curve on Friday. This came after hawkish comments from Fed officials Thomas Barkin and Chris Waller who indicated that they were aligned towards more policy tightening amid inflation not falling as quickly (scroll to Talking Heads for more details). On the economic data front, the University of Michigan June consumer sentiment report showed a 4.7 point jump to 63.9, well above the forecasted 60 print. The survey for one-year inflation expectations saw a sharp drop to 3.3% from 4.2%. Market participants continue to expect the Fed to hike rates by 25bp in July with a 72% probability. The peak Fed Funds rate moved 1bp higher to 5.30% for September. US equity indices ended lower with the S&P and Nasdaq down by 0.4-0.7%. US IG and HY CDS spreads tightened 1.2bp and 4.1bp respectively.

European equity indices closed higher. European main CDS spreads were 2.2bp tighter and Crossover spreads tightened 11.8bp. Asia ex-Japan CDS spreads tightened further by 0.9bp with Asian equity markets have opened mixed this morning.

New Bond Issues

New Bonds Pipeline

- Nonghyup Bank hires for $ 5Y Agriculture Supportive Social bond

- Hyundai America hires for $ ESG bond

Rating Changes

- Azul S.A. Downgraded To ‘CC’ From ‘CCC-‘ On Distressed Debt Exchange Announcement, Outlook Negative

- Fitch Revises Outlook on FWD General Insurance to Stable; Affirms IFS Rating at ‘BBB+’

ICYMI: We Are Merging Our Brands BondEvalue and BondbloX

We are excited to share that we will be merging our two brands – BondEvalue, our bond information service, with BondbloX, our award-winning bond exchange. BondbloX will be the name of the combined brand going forward.

Term of the Day

Will Not Grow Bonds

Bonds whose size is fixed and cannot be increased are called ‘Will Not Grow (WNG)’ or ‘No Grow’ bonds. Sometimes, issuers increase the final size of a deal to accommodate investor appetite. WNG bonds however have a fixed size and will not be increased. For example, green bonds often fall into this category as per the Climate Bonds Initiative (CBI). The CBI says that issuers need to show that there are enough green projects to match the amount that they intend to raise and for some, the number of suitable projects is limited. This according to them shows why green bonds tend to be smaller than vanilla bonds from the same issuer whereas for others there is more flexibility and the final size of the deal can be increased to accommodate investor appetite.

Germany’s LBBW bank has hired for a three-tranche WNG bond issuance.

Talking Heads

“I would be nervous about credit given the benign credit landscape we’ve had in the past 15 years…If we look bottom-up, high-yield defaults look quite daunting. There is considerable risk when it comes to earnings and defaults…Higher interest rates tend to break things…We don’t want to take much risk in areas we don’t have a competitive advantage.”

On the Rate of Decline of US Inflation – strategists at Goldman Sachs

“Although we expect further declines in inflation going forward, markets appear considerably more optimistic than we are about the pace of cooling. Markets are ignoring the potential for “delayed-onset inflation” in sectors such as healthcare.”

“We have given eurobond holders literally all the information that is required on the debt sustainability analysis…They’ve seen what we have done on the domestic front so I’m sure that there’s going to be some very hard discussions and negotiations going forward but I’m confident that we will find a place to land that will be good for everyone.”

On Fed Policymakers’ Stance on Inflation

Christopher Waller, Fed Governor

“Core inflation is not coming down like I thought it would,” Federal Reserve Gov. Christopher Waller said at an economics conference in Norway. “Inflation is just not moving and that’s going to require, probably, some more tightening to try to get that going down.”

Thomas Barkin, Richmond Fed President

“I am still looking to be convinced of the plausible story that slowing demand returns inflation relatively quickly (to the 2% target)…If coming data doesn’t support that story, I’m comfortable doing more.”

Austan Goolsbee, Chicago Fed President

“There are conflicting pieces of evidence coming in on the economy: are we too hot and need more, have we done enough by raising the interest rate five full percentage points over the last year…For me, the forecast is pretty benign, and the question is, are we on that golden path (of cooling inflation without starting a big recession), or not.”

On the Bond Issuance Challenges Faced by Chinese Property Developers

Credit Analysts from HSBC

“We see challenges with respect to developers regaining access to refinancing in both the onshore and offshore bond markets…We also believe the offshore dollar high-yield-bond primary market will be shut to mainland China property high-yield developers in the second half this year.”

Jeff Zhang, analyst at Morningstar

“We do not expect offshore debt financing to swiftly increase in the short run, mainly due to elevated funding costs under US rate hikes compared to declining interest rates onshore.”

Esther Liu, director of corporate ratings at S&P

Weak investor confidence and the depreciation of the yuan also make a significant increase in the volume of offshore bond issuance unlikely.

Edward Chen, director of corporate ratings at S&P

“Higher-rated developers may be able to issue dollar bonds, but due to rising interest rates, offshore borrowing cost will unlikely be low.”

Zerlina Zeng, senior credit analyst at CreditSights

“Most offshore credit investors remain cautious about China property bonds, as China’s home sales are softening and property investment remains depressed.”

Top Gainers & Losers – 19-June-23*

Go back to Latest bond Market News

Related Posts: