This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Leaves Rates Unchanged and Signals it will Stay on Sidelines

December 13, 2019

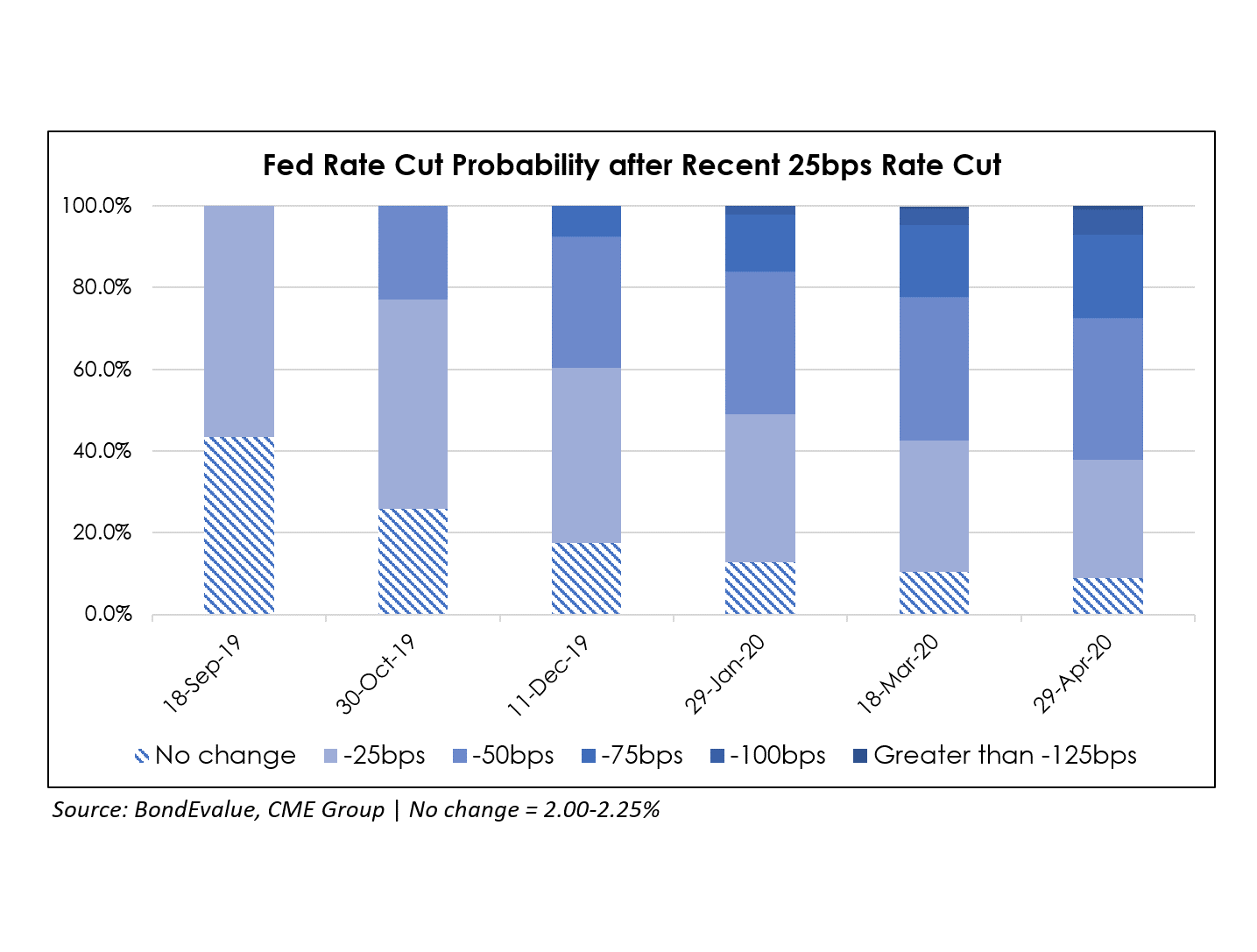

The US Federal Reserve left the fed funds rate range unchanged earlier this week at 1.50% to 1.75%, indicating that it intends to remain sidelined for the moment. Both comments made by Fed Chairman Jerome Powell and the Fed statement confirmed this as the central bank’s stance going forward unless there is a change in the outlook for the economy or inflation.

Despite Chairman Powell saying that the Fed does not respond to headlines on trade developments, economists believe that with the trade tariff dateline looming on December 15, outcomes on trade could change the Fed’s position especially if it alters economic outlook. He also expressed that the Fed needs to see a move in inflation – which currently is at a level stubbornly below the Fed’s target – that is significant and persistent before it raises interest rates again.

The markets interpreted Powell’s comments as dovish and accommodative, meaning that the central bank is leaning towards an easing policy of keeping interest rates low, rather than a tightening policy of raising interest rates. The Fed had cut interest rates 3 times between July and October this year before indicating intentions to hold back on future cuts. Issuing new forecasts for the economy and interest rates, it called for no change in interest rates in 2020.

Go back to Latest bond Market News

Related Posts: