This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Holds Rate Steady at 4.25-4.50%; Hyundai Capital, CaixaBank, Telefonica Price New Bonds; GarantiBank, Tesco Upgraded

June 19, 2025

The Fed held interest rates steady at 4.25-4.50% in FOMC yesterday. In their new economic projections, policymakers forecast economic growth slowing down to 1.40% this year, and unemployment rising to 4.50% and inflation well above the current level of 3.00% by the year end. 10 Fed officials are targeting more than two rate cuts by the end of year, whereas 7 officials suggest zero rate cuts for 2025.

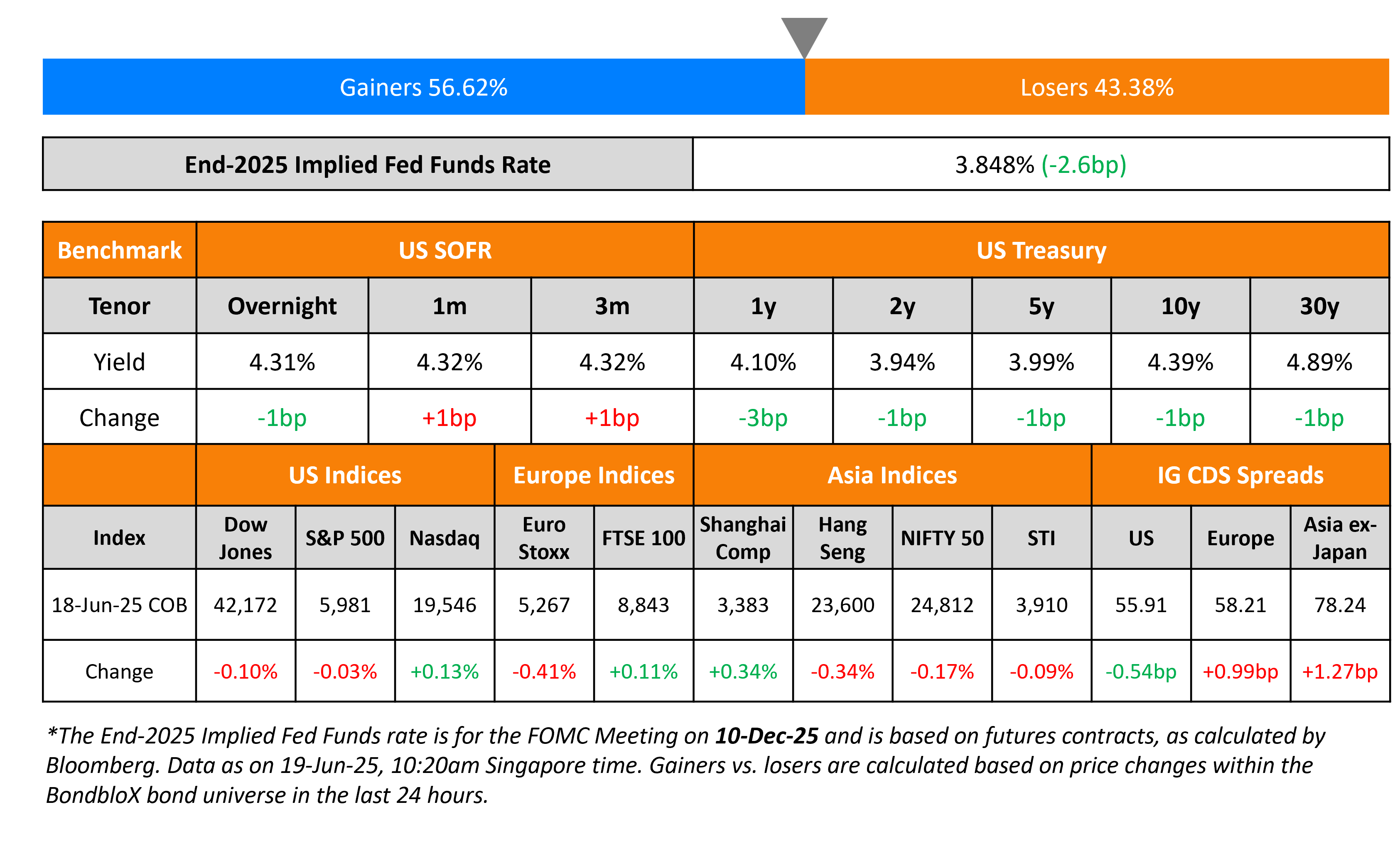

US Treasury yields closed a tad lower yesterday. Initial jobless claims for the previous week came in at 245k, in-line with expectations, and a tad lower vs. the prior week’s revised reading of 250k. As per the latest update as of this morning, Bloomberg reported that senior US officials are “preparing for the possibility of a strike on Iran in the coming days”. This comes a day after US President Donald Trump met with advisors to weigh on possible intervention in the ongoing Israel-Iran war. Iranian Supreme Leader Ayatollah Ali Khamenei earlier said his country wouldn’t surrender and warned US against any intervention.

The Brazilian Central Bank raised the Selic benchmark rate by 25bp to 15.00%, the highest since 2006, in a bid to combat inflation. Looking at the US equity markets, S&P closed almost flat, while Nasdaq closed higher by 0.13% yesterday. In credit markets, US IG CDS spreads and HY CDS spreads tightened by 0.5bp and 3.4bp respectively. European equity markets closed mixed yesterday. The iTraxx Main CDS spreads and Crossover CDS spreads widened by 1bp and 3.3bp respectively. Asian markets have broadly opened lower today, with HSI down by 2% at the time of writing. Asia ex-Japan CDS spreads widened by 1.3bp.

New Bond Issues

Hyundai Capital raised €1.2bn via a two trancher. It raised €600mn via a 3Y bond at a yield of 2.895%, 44bp inside initial guidance of MS+125-130bp area. It also raised €600mn via a 6Y bond at a yield of 3.526%, 44bp inside initial guidance of MS+165-170bp area. The senior unsecured bonds are rated A3/A-/A-. Proceeds will be used for general corporate purposes. This was a debut euro denominated deal by the company.

CaixaBank raised €1.5bn via senior preferred bonds in a two-part deal:

- It raised €500mn via 4NC3 FRN at a yield of 3M Euribor+65bp, 25bp inside initial guidance. It received orders of over €1.2bn, 2.4x the issue size. The coupons will be paid quarterly.

- It raised €1bn via 10Y Green bond at a yield of 3.488%, 35bp inside the initial guidance of MS+130bp area. It received orders of over €1.8bn, 1.8x the issue size. The coupons will be paid annually.

These senior preferred bonds are A3/A/A rated, and proceeds will be used for general corporate purposes.

Telefonica raised €750mn via a 10Y bond at a yield of 3.941%, ~37.5bp inside the initial guidance of MS+175-180bp area. The senior unsecured bond is rated Baa3/BBB-/BBB and will pay coupons annually. It received orders of €1.6bn, ~2.1x the issue size. Proceeds will be used for general corporate purposes.

Rating Changes

Term of the Day: Chapter 15

Chapter 15 is a legal bankruptcy filing where a foreign debtor files for bankruptcy in US courts. In general Chapter 15 bankruptcy is an ancillary case to a primary proceeding brought in another country, typically the debtor’s home country. As an alternative, the debtor may commence a complete Chapter 7 or Chapter 11 bankruptcy case in the US provided its assets in the US are sufficiently complex to warrant a full-blown domestic bankruptcy case. Bloomberg notes that non-US based companies that are in financial jeopardy tend to file for Chapter 15 bankruptcy to ensure that they will not be sued by creditors in the US or have assets seized there. Chapter 15 gives foreign creditors the right to participate in US bankruptcy cases and prohibits discrimination against foreign creditors.

Talking Heads

On Investors Torn Between Selling Equities or Buying the Dip

Richard Privorotsky, Goldman Sachs

“Will the US stay on sidelines or be forced into conflict? Markets have been conditioned to fade these kinds of geopolitical headlines…”

Charlie McElligott, Nomura Securities

…notes a “sneaky” advance in the S&P 500 skew and the so-called volatility of volatility while spot indexes climbed close to all-time highs…

Ed Yardeni, Yardeni Research

“Stock investors should be back to trying to sort out the same issues as before Israel attacked Iran on Friday, including President Donald Trump’s tariffs, his Big Big Beautiful Budget Bill…”

On Regulators’ Plans For US Bank Leverage Relief

Steven Zeng, Deutsche Bank

“Lowering the capital requirements instead of a Treasury carve-out from the SLR is a weaker form of regulatory easing…Spreads between long-term swap rates and Treasury yields tightened on Wednesday…I still think a full carve-out is the most effective way to bolster market liquidity…”

Wells Fargo Analyst

“We think that many market participants were anticipating a carve out of UST assets from the denominator…”

BMO Capital Markets analyst

“We’re skeptical that lowering SLR will trigger a massive round of buying in U.S. Treasuries from major U.S. banks…”

On Malaysia Scoring Record Flows As Bond Investors Favour Asia

David Chao, Invesco

“We’re in a very good environment for Asian investments…The ingredients are in place for Asia, for emerging markets to outperform…”

Shah Jahan Abu Thahir, Bank of America

“Emerging market assets fundamentally will do well when U.S. rates are dropping, and U.S. dollar is weakening…”

Sue Lee, Citi Group

“We’re seeing this fixed income interest across the board in the bigger and small EM countries – Thailand, Philippines, Indonesia and India…”

Top Gainers and Losers- 19-Jun-25*

Go back to Latest bond Market News

Related Posts: