This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Cuts by 25bp as Expected; FOMC Meeting Sends Mixed Signals

September 18, 2025

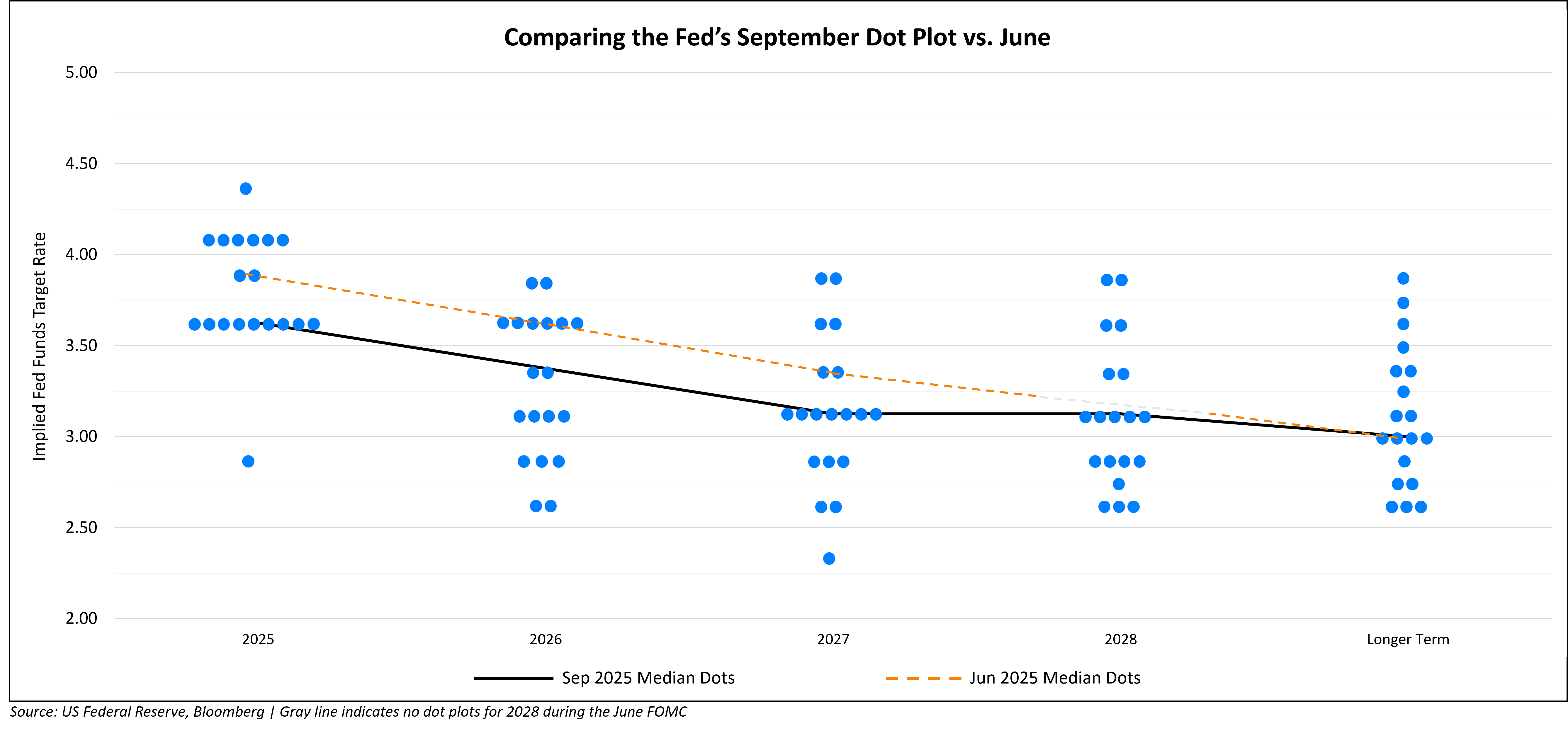

US Treasury yields moved higher by ~4bp after a mixed tone in the FOMC meeting. The FOMC cut rates as expected, by 25bp with the Fed Funds Range now at 4.00-4.25%. US President Trump’s new Fed Governor pick, Stephen Miran, was the only member who voted for a 50bp cut, while the others voted for a 25bp cut. However, as seen in the September dot plot below, there was a mixed opinion regarding the expected end-2025 Fed Funds Rate. In the press conference, Jerome Powell said that the Fed was in a meeting-by-meeting situation and that policy was not on a preset course. He added that the latest rate cut was a “risk management cut”.

.png)

Other major points from the FOMC meeting and the Summary of Economic Projections (SEP) are given below:

- Downside risks to employment have risen. Powell highlighted that the revised jobs number meant that the labor market was no longer solid. He added that the payrolls were only one factor that suggested a cooling in the jobs market.

- The tariff inflation passthrough was slower and smaller than expected. Further, on inflation, Powell stated that tariffs are likely contributing 0.3-0.4% to Core PCE.

- Increased GDP growth projections to 1.6% in 2025 (vs. 1.4% in June), 1.8% in 2026 (vs. 1.6% in June), and 1.9% in 2027 (vs. 1.8% in June).

- Projected Unemployment Rate remained unchanged at 4.5% in 2025, 4.4% in 2026 (vs. 4.5% in June) and 4.3% in 2027 (vs. 4.4% in June).

- Projected Core PCE Inflation remained unchanged at 3.1% in 2025, 2.6% in 2026 (vs. 2.4% in June) and at 2.1% (unchanged) in 2027.

Looking at US equity markets, the S&P and Nasdaq closed lower by 0.1% and 0.3% respectively. US IG and HY CDS spreads were wider by 0.5bp and 1.7bp respectively. European equity markets ended mixed. The iTraxx Main CDS and Crossover spreads were 0.1bp and 1.2bp tighter respectively. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were 0.1bp wider.

New Bond Issues

New Bond Pipeline

- Seazen plans $250mn issuance

- China Ping An $ bond issuance

Rating Changes

-

Broadcom Inc. Upgraded To ‘A-’ As AI Momentum Continues; Outlook Positive

-

Moody’s Ratings downgrades Eramet to B1 from Ba3; outlook remains negative

-

Moody’s Ratings downgrades four Formosa companies to Baa2; outlook remains negative

-

Vistra Holdings Downgraded To ‘B’ On Slower Deleveraging; Outlook Stable

-

Fitch Downgrades Oriflame to ‘RD’ on Missed Coupon; Upgrades to ‘CC’

-

Fitch Revises LD Celulose’s Outlook to Positive; Affirms IDR at ‘BB-‘

Term of the Day: Fed Dot Plot

The Fed dot plot is a visual representation of interest rate projections of members of the Federal Open Market Committee (FOMC), which is the rate-setting body within the Fed. Each dot represents the Fed funds rate for each year that an anonymous Fed official forecasts. The dot plot was introduced in January 2012 in a bid to improve transparency about the range of views within the FOMC. There are typically 19 dots for each year, representing the median rate of each voting member on the committee.

Talking Heads

On Dollar Boost from Fed to Weigh on Asian Currencies

Brendan McKenna, Wells Fargo

“The dollar strength that materialized post-FOMC was broad based and it’s tough to imagine Asia FX being excluded from that dollar rally”

Takeru Yamamoto, Sumitomo Mitsui Trust

“The dollar was sold immediately after the announcement because the FOMC had been expecting to make two more interest-rate cuts within the year, but the dollar was bought back because only one cut is expected next year”

Jayati Bharadwaj, TD Securities

“We remain bearish the US dollar and see any technical US dollar bounces as good opportunities to sell”

On Powell Rallying Fed Colleagues as Economic, Political Risks Grow

Aditya Bhave, BofA Securities

“The hawkish voices are going to get louder the lower policy rates go because the inflation picture isn’t going to clear up,”

Stephanie Roth, Wolfe Research

“Both sides of the mandate are being challenged…Moving too much in either direction could significantly put the other side of the mandate off balance.”

Anna Wong, Eliza Winger and Stuart Paul, Bloomberg

“Updated dot plot underscored divisions on the committee…it appears the Fed’s reaction function has shifted in a more dovish direction.”

On Tech Stocks Shuddering as Rate Cut Sparks Rotation to Cheaper Bets

Ivan Feinseth, Tigress Financial Partners

“Some of this is a ‘sell-the-news trade’ for growth stocks because there was so much desire for rate cuts leading up to this moment that sent US stocks to records…After a big rally, tech stocks with rich valuations are due for a breather.”

John Cunnison, Baker Boyer Bank

“Lower rates will support riskier parts of the stock market, from small caps to non-profitable tech…current equity valuations seem stretched for growth and big tech shares after a big rally.”

Top Gainers and Losers- 18-Sep-25*

Go back to Latest bond Market News

Related Posts: