This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

February 2025: Strong Rally in Treasuries Pushes 89% of Dollar Bonds Higher

March 3, 2025

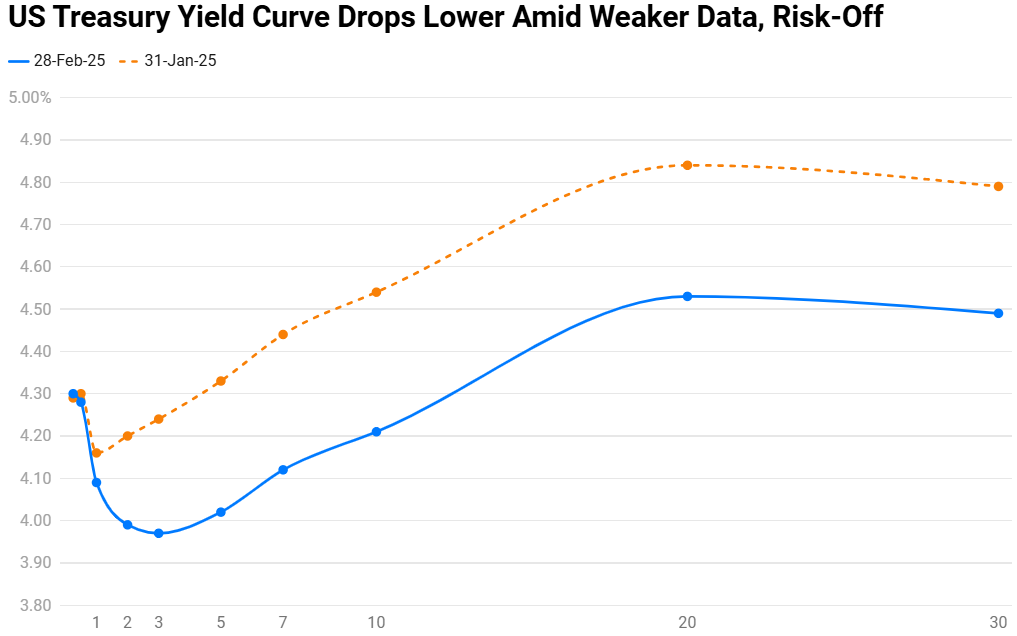

February 2025 was yet another positive month for bond investors with 89% of dollar bonds ending higher (price returns ex-coupons). Both, Investment Grade (IG) bonds and High Yield dollar bonds performed well, with IG outperforming. About 94% of IG dollar bonds and 75% of HY dollar bonds ended in the green. This came on the back of weaker economic data through the latter half of the month, followed by the broad risk-off move that saw Treasury yields decline across the curve. Markets are currently pricing-in a 25bp rate cut by the Fed in June and a second rate cut in September.

February saw the Treasury yield curve shift lower across the board, with the 10Y down 30bp and the 2Y down 20bp. US Non Farm Payrolls (NFP) came-in at 143k, below estimates of 175k, while AHE YoY rose 4.1%, higher than expectations of 3.8%. The unemployment rate declined to 4.0% from 4.1%. Looking at inflation, both US CPI and Core CPI YoY were higher than expectations, rising by 3% and 3.3% respectively. The ISM Manufacturing reading improved to 50.9, while the Services PMI worsened to 52.8. Retail Sales contracted by 0.9%. Later in the month, the consumer confidence index fell at its fastest pace in over three years. Adding to the risk-off sentiment was the drop in equities and dwindling hopes of a Ukraine peace deal.

Most IG dollar bonds traded higher. Among the top gainers, Solaredge's bonds were up 16%, thanks to analysts upgrading/recommending its shares with a positive outlook on the company. Most other IG bonds that rallied across the board were long-duration notes that are typically more sensitive to changes in the Treasury yield.

Under the HY segment, some of the biggest gainers were dollar bonds of Belarus, Ukraine, Gazprom, DTEK, Metinvest that rallied over 10%, amid signals of a peace deal being expected ahead of the Oval office meeting between Trump and Zelensky. Also, Bausch Health's bonds gained over 10% too after a strong Q4 report. Also dollar bonds of popular Hong Kong property developers like Lai Sun, Nan Fung, Hysan and NWD rallied over 7-8% as market sentiment improved in the Hong Kong market. With regard to NWD, the company was able to sell several of its luxury project apartments due to strong demand, albeit at significant discounts. Among the loser, Ecuador's dollar bonds fell over 12% across the curve after its presidential elections entered into a second round as the incumbent Daniel Noboa and his main challenger Luisa González received nearly identical percentages of the vote.

Issuance Volumes

Global corporate dollar bond issuances stood at $287bn in February, 30% lower than the $407bn seen in January. As compared to February 2024, issuance volumes were down 10% YoY. 85% of the issuance volumes came from IG issuers with HY comprising 13% and unrated issuers taking the remaining 2%.

Asia ex-Japan & Middle East G3 issuance stood at $31bn, down 29% MoM, while being up 55% YoY. 80% of the issuance volumes came from IG issuers with HY comprising 16% and unrated issuers taking the remaining 4%.

Largest Deals

Some of the largest deals globally were led by Eli Lilly’s $6.5bn six-trancher, Foundry JV’s $6.1bn five-part deal, Barclays’ $6.5bn four-tranchee, LBBW’s ~$6bn multi-tranche issuance, followed by HSBC's $5.5bn four-trancher TLAC, Chevron's $5.5bn seven-trancher, Cisco’s and Johnson & Johnson’s $5bn five-tranchers each.

In the APAC and Middle East, Qatar’s $3bn two-trancher and BHP Billiton’s $3bn three-part deal led the tables, followed by Saudi Electricity’s $2.75bn two-trancher and Ma’aden raising $1.25bn via a two-part sukuk deal.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts: