This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

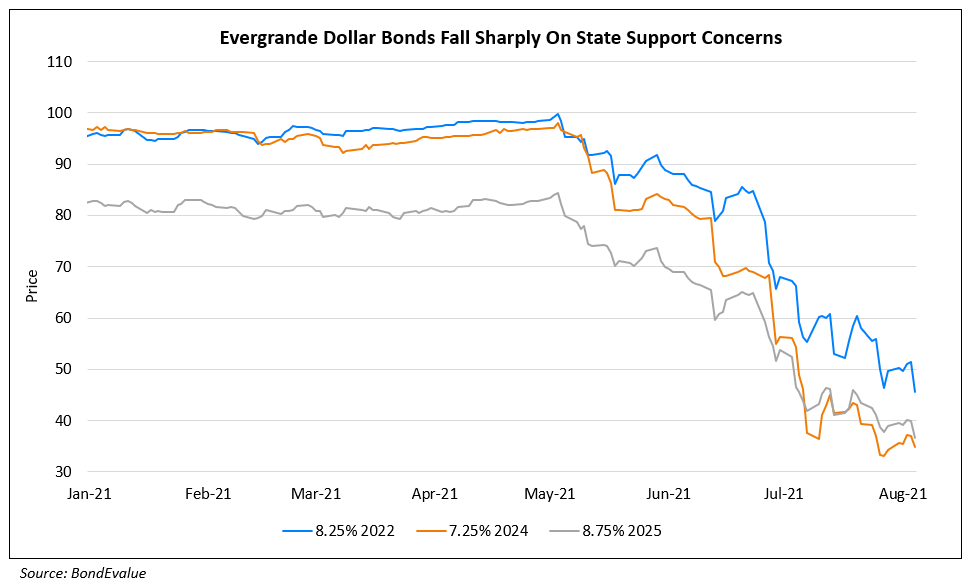

Evergrande’s Dollar Bonds Sell-Off on Dim Hopes of State Supports

August 27, 2021

Dollar bonds of China Evergrande sold-off sharply on Friday morning following reports of a lack of state support. As per media reports, senior Guangdong officials are in disagreement over the extent of support to offer the highly indebted developer as the central government has asked for a “market-oriented” approach to its mounting debt, as per Bloomberg. Evergrande’s bonds fell a further ~10% following the reports led by its 8.25% bonds due March 2022 falling by 11.25% to 45.58 cents on the dollar.

As pressure mounts on the world’s most indebted developer to get its growing liabilities (currently at ~$300bn) under control, the company is said to be mulling a series of asset sales to shore up cash. As per Bloomberg, the potential assets that can be sold include:

- Its 90% stake in online sales platform FCB Group, valued at $18bn based on a March valuation

- Its property management subsidiary for as much as $4.9bn

- Its entire stake in its EV unit, valued at $4.2bn based on Thursday’s closing price

- Its remaining stake in Shengjing Bank for as much as $2.8bn

- Its Hong Kong headquarters for about $1.3bn as per Sing Tao Daily

- Its holding in internet business HengTen worth about $1.2bn

- Large residential plot in New Territories, Hong Kong for ~$1bn

- Its water business, that could be worth “several hundred million dollars”, as per people familiar

- Its 9.8% stake in local property consulting firm E-House valued at $60mn

- Its tourism business, whose value is unknown

- Its mainland residential properties, particular in the heart of the Greater Bay Area, whose value is unknown

Go back to Latest bond Market News

Related Posts: