This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

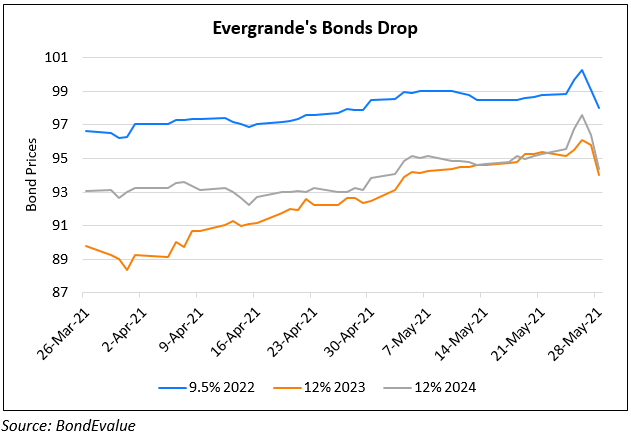

Evergrande To Sell Onshore Bonds Worth $1.3bn to Pay Debts Due

April 23, 2021

China Evergrande plans to sell onshore bonds worth CNY 8.2bn ($1.3bn) to repay upcoming debts. The bonds will be issued by subsidiary Hengda Real Estate with a 5Y maturity and proceeds from the sale will be used to meet an early repayment request due on May 6 made by the investors of bonds worth CNY 15bn ($2.3bn) maturing in 2023. CEO Xia Haijun recently said “We will further halve our debts over the next two years and hit 350 billion yuan or less by June 2023…And we aim to meet two of the metrics (regulators’ three-red lines) by the end of this year and achieve all three by 2022”.

Evergrande’s 12% 2023s issued by Hengda was down 0.36 to trade at 92.25 while Evergrande’s 8.75% 2025s were up 0.16 to trade at 81.213.

For the full story, click here

Go back to Latest bond Market News

Related Posts: