This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande to repay maturing June 28 Bond; To Sell $386mn Stake in Calxon

June 22, 2021

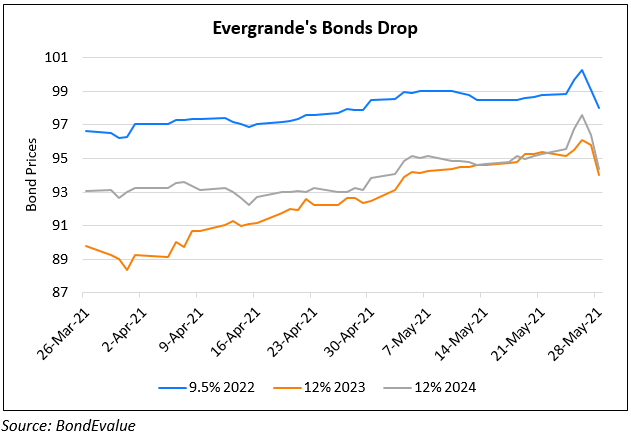

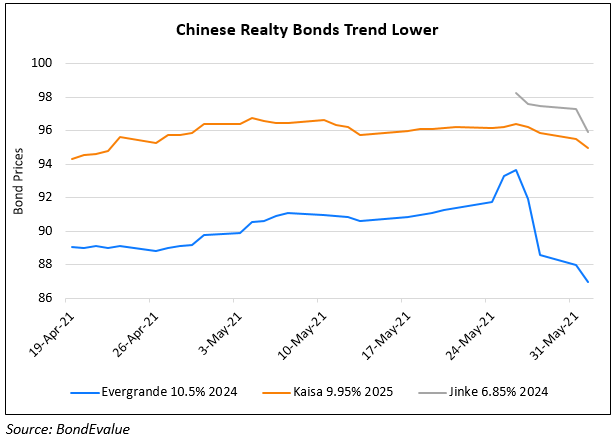

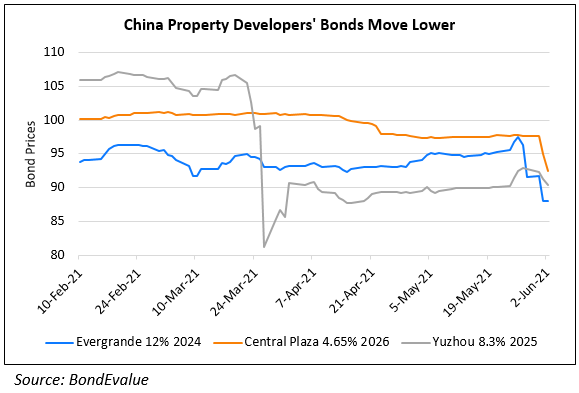

China Evergrande said that it will repay its $1.47bn 6.25% bonds due June 28 a few days prior to maturity. Separately, the company would be selling 29.9% of its stake in its smaller unit Calxon. Evergrande’s unit Kailong owns 57.75% in Calxon and after the stake sale, would give up its voting rights. The stake sale is worth about CNY 2.5bn ($386mn) and sources say that the move will ‘enhance Evergrande’s cash flow, and resolve the issue of owning a controlling stake in a competitor.’ Evergrande’s bonds were on a falling trend in the last two weeks due to a series of events – regulators asking banks to stress test their exposure to Evergrande, Beijing’s tightened rules on banks’ cash management products and WeNews’ coverage that the CBIRC was examining more than CNY 100bn ($15.7bn) of transactions between the developer and Shengjing Bank. Its dollar bonds are off their lows and are inching higher.

Evergrande’s 12% 2024s were up 0.4 to 82.4.

Go back to Latest bond Market News

Related Posts: