This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande Sells Stake in Unit for $3bn; Aeromexico Secures $1bn DIP Funding; Softbank Bonds Rise on Strong Q2 Earnings

August 14, 2020

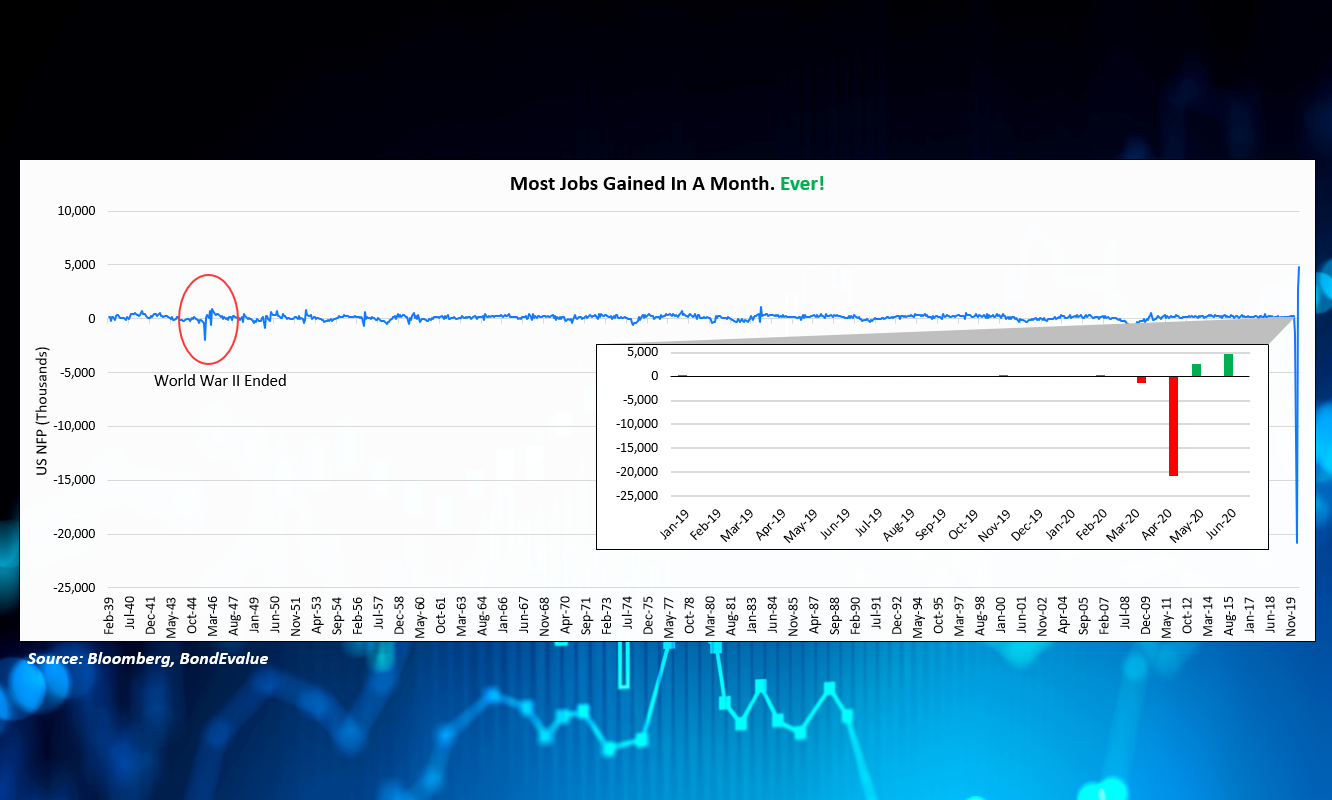

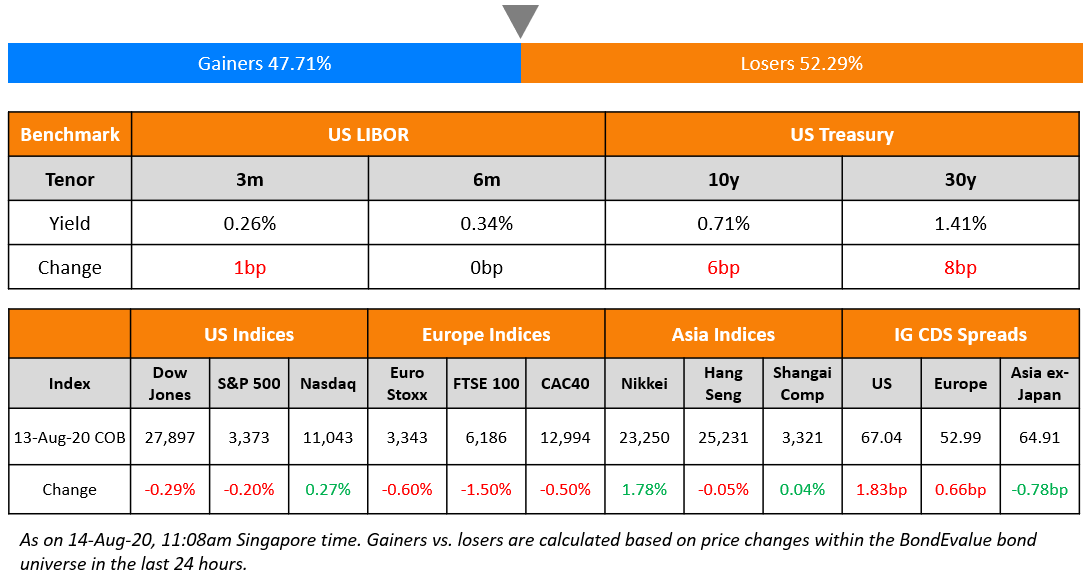

Asian markets are opening with a lack of direction after a mixed session overnight. Initial jobless claims in the US declined by 228K to 963K indicating a continued recovery although only 9.3 million out of the 22 million jobs lost earlier this year have been regained. Still no update on the next US covid-19 fiscal package. European equities broke a streak and ended the day lower. US treasuries were down after weak demand for yesterday’s record $26bn 30Y bond auction pushing yields higher by 3-5bp in the long end. US and Europe IG CDS spreads were 1bp wider. In the Asian primary market, South Korea overtook China to lead the sales of socially responsible bonds for this year.

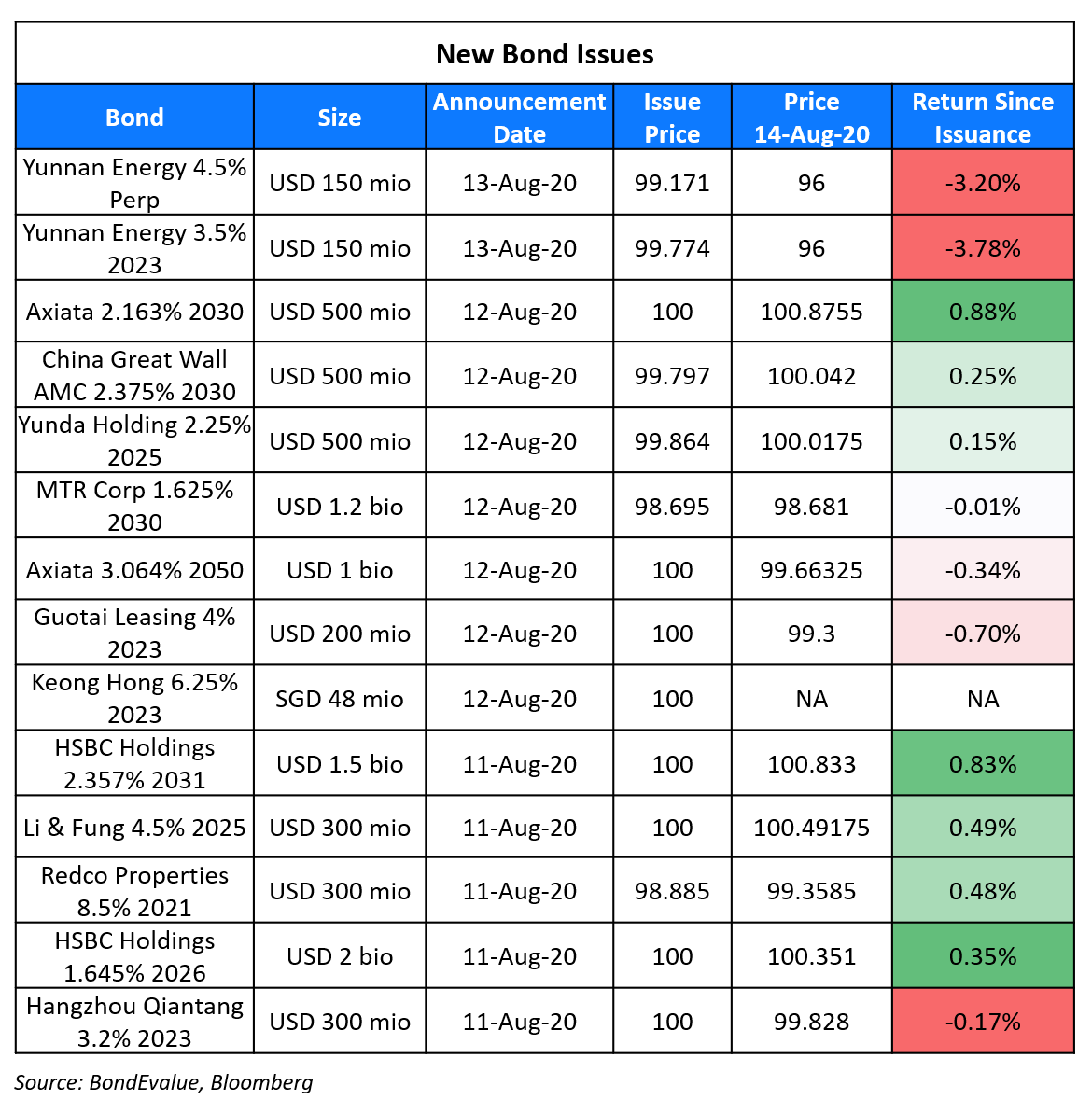

New Bond Issues

Yunnan Provincial Energy Investment Group raised $300mn from a dual-tranche bond offering. It raised $150mn via 3Y bonds to yield 3.58%, 62bp inside initial guidance of 4.2% area. It also raised $150mn via a Perpetual non-call 3Y (PerpNC3) bond to yield 4.8%, 40bp inside initial guidance of 5.2% area. The 3Y bonds have an expected rating of BBB while the Perps have an expected rating of BBB–. Combined orders were over $1.7bn when final guidance was announced, 5.67x issue size. The Perp’s coupon would reset at an initial spread of 461bp wide of prevailing 3Y Treasuries plus a 300bp step-up if not called on the first call date of August 20, 2023. Both tranches will be issued by wholly owned British Virgin Islands subsidiary Yunnan Energy Investment Overseas Finance and guaranteed by the parent company.

Rating Changes

PT Modernland Realty Tbk.’s Guaranteed Notes Downgraded To ‘CC’; Issuer Rating Remains At ‘SD’

Moody’s reviews Montage Resources’ ratings for upgrade upon acquisition by Southwestern Energy

Evergrande Sells Stake In Property Management Unit for $3 Billion

Chinese real estate developer China Evergrande Group announced via an exchange filing that it has entered into an agreement to sell a 28% stake in its property management unit Mangrove 3 Ltd. for HKD 23.5bn ($3bn) in a bid to bring in strategic investors before a possible IPO for the unit. Fourteen investors bought into the deal, including Chan Hoi Wan, also a major shareholder in Chinese Estates Holdings Ltd, who purchased 5.4% and Huatai International which bought 4.8%. Evergrande said that Sequoia Capital, CITIC Capital and Tencent Holdings also invested in the unit.

For the full story, click here

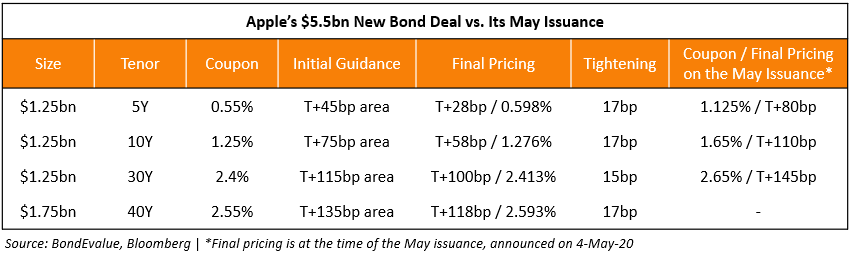

Apple Raises $5.5 Billion Via Four Tranche Bond Deal

iPhone maker Apple Inc. joined the list of high grade corporates to capitalize on low rates to issue new bonds. Apple returned to the primary bond markets with a $5.5bn four-tranche deal just three months after its massive $8.5bn issuance in May this year. This breaks its trend of tapping the bond markets just once a year since 2017. The pricing on the new bonds, rated AA+, is significantly tighter compared to its issuance in May, with the coupon on the new 5Y tranche more than half of the 5Y issue in May. We have summarized details of the new deal with a comparison to the May issuance in the table below.

Apple is expected to use proceeds from the new bond deal to buy back stock and pay dividends, according to people with knowledge of the matter. Apple’s new bond deal follows US tech giants Google and Amazon that have also borrowed at record low yields in the recent weeks.

For the full story, click here

In other news on Apple, popular game ‘Fortnite’ maker, Epic Games has launched a lawsuit against Apple for its practice of charging an exorbitant 30% of all in-App purchases for Apps listed on its App Store, known as the “Apple tax”. The Fortnite App was thrown out of the App Store after it violated its rule of collecting in-App revenues via the App Store only. The rules do not permit App developers from offering an alternative payment option to App users. In its lawsuit, Epic Games said that Apple “imposes unreasonable restraints and unlawfully maintains a total monopoly” over the distribution of apps used on Apple devices. The lawsuit added, “With Apple’s unlawful conditions and policies, Apple ensures that the App Store is the only distribution channel for developers to reach iOS app users, giving Apple overwhelming monopoly power in the iOS app distribution market.” Fortnite is one of the top grossing Apps on the App Store, generating estimated revenues of $34mn a month from in-App purchases. The Apple tax has caught the attention of the US Congress recently as it is investigating anti-competitive behavior by the the large tech companies.

For the full story, click here

Aeromexico Secures $1 Billion Lifeline from Apollo Global

Mexico’s flag carrier Aeromexico announced on Thursday that it has secured a $1bn debtor-in-possession financing (Term of the day, explained below) from Apollo Global Management. The DIP facility consists of two tranches and can only be used for certain expenses, including working capital expenses, general corporate purposes and restructuring costs. Aeromexico Chief Executive Andres Conesa said, “This is a critical milestone in the ongoing process to transform our company with the goal of driving long-term, sustainable growth for Aeromexico,”. Aeromexico had filed for Chapter 11 bankruptcy protection in June this year on the back of the adverse effect of the pandemic on air travel. The new funding, subject to bankruptcy court approval, will provide the airline with liquidity to meet its future obligations in a timely manner and allow it to operate through the restructuring process. Aeromexico’s 7% bonds due 2025 are trading unchanged at 22 cents on the dollar on the secondary markets currently.

For the full story, click here

SoftBank Makes a Comeback With a $11.8 Billion Profit in Q2

Second quarter brought good news for the SoftBank Group as it reported a profit of ~$12bn. This was a fine comeback after the conglomerate had suffered a record loss of $18bn last year. The recovery of Masayoshi Son’s conglomerate comes from the following:

- Return of Vision Fund to profit with an investment gain of $2.8bn after posing a record loss in the previous quarter. The gain came from a rally in the Uber and Slack stocks during the quarter

- The fund’s performance also improved due to the listing of Lemonade, in which SoftBank had invested $300mn. Lemonade is a US based Home Insurance start up now valued at $1bn

- A share buyback plan resulted in an increase in the share price of the company and an overall increase in its valuation

- The company has taken up restructuring, which includes a reduction in its stake in Alibaba and a possible sale of its chip designer subsidiary ‘Arm’ to Nvidia

As per the company’s financial report “SoftBank Vision Fund recorded gain on investments of ¥296,577 million ($2.8mn) in the first quarter, an improvement of ¥1.4 trillion ($13.1mn) from the prior quarter, supported by a recovery in fair value of investments centered on listed portfolio companies due to a rebound in public equity markets. The impact on portfolio companies from the COVID-19 pandemic varies significantly across sectors. Online businesses such as e-commerce and food delivery have seen an increase in customer engagement, while businesses such as travel and hospitality remain adversely impacted. The pandemic is expected to continue to affect each portfolio company differently in the future.”

In related news, SoftBank committed $1.1bn to WeWork to help the company tide through the pandemic slowdown. The senior secured debt is part of the original $9.5bn package planned to support WeWork after its IPO fell apart last year. WeWork had disclosed on Thursday that its sales dropped 12% in the second quarter compared to the first quarter. Softbank’s 5.125% and 6.25% bonds due 2027 and 2028 traded up by ~4 points this week to 107 and 115 respectively on the secondary markets.

For the full story, click here

Thyssenkrupp Gives a Loss Warning of €1 Billion For Its Steel Division

Thyssenkrupp revealed on August 12 that its steel unit is ailing and could suffer operating losses of ~ €1bn ($1.18bn) in the current financial year. This comes amid a loss in demand from the auto industry as car sales have plunged due to lockdowns in several countries due to the pandemic. Europe’s second largest steelmaker saw a drop of 24% QoQ in orders compared to last year, resulting in operating losses of €841mn ($993.5mn) in the first nine months of the financial year (ending September 30) compared to losses of €75mn ($88.6) last year. “No steelmaker is making a profit at the moment. But in terms of performance, we’re certainly lagging the competition,” alarmed Chief Financial Officer Klaus Keysberg. The losses could force the company to negotiate with rivals including India’s Tata Steel, Sweden’s SSAB and Germany’s Salzgitter for a possible partnership. At a broader level, the company said that the businesses were stabilizing and have fared better than expected. Chief Executive Martina Merz commented “We came through the crisis slightly better than initially feared in the third quarter overall.” The company’s shares plunged 16.2% on the news while its bonds trended lower by a few basis points on the secondary markets.

For the full story, click here

AT&T Adds Streaming Service “Crunchyroll” On Its List of Assets For Sale

AT&T is looking to sell WarnerMedia’s Anime streaming service, Crunchyroll to Sony Pictures for an estimated $1.5bn, according to The Information. Sources familiar with the situation said that the acquisition by Sony would complement its competing Funimation anime distribution platform. This is the latest effort by AT&T to trim costs at WarnerMedia amid the pandemic and follows an announcement earlier this week of massive layoffs starting this week. AT&T has also allegedly considered selling Warner Brothers’ gaming unit to potential buyers that include Take Two Interactive, Electronic Arts and Activision Blizzard for $4 billion. Other assets that are said to be for sale include WarnerMedia’s CNN Center in Atlanta and AT&T’s subsidiary DirecTV. AT&T’s bonds have fallen by ~2-5 points over the past week with its 4.5% and 4.35% bonds due 2035 and 2045 trading at 119.9 and 116.5 respectively on the secondary markets.

For the full story, click here

Southwestern Energy to Buy Montage Resources for $870M; Montage Bonds Spike

Southwestern Energy Co revealed on Aug 12 that it would acquire Montage Resources Corp through an all stock purchase. With the purchase of the Texas oil and gas producer, Sourthwestern would become the third largest producer in Appalachia and the combined entity anticipates an annual free cash flow of ~$100mn beginning 2021. The deal will result in 1.8656 Southwestern shares for each Montage share held by Montage shareholders. The $870mn can be broadly broken into ~$200mn worth of shares and ~$670mn in debt. Bill Way, Southwestern Energy president and CEO said in a press release, “Consistent with our strategy, this transaction is expected to deliver increased free cash flow, improved returns and long-term value to shareholders,”. Southwestern has concurrently launched an underwritten public offer of 55mn shares with a 30-day option to buy up to 8.25mn additional shares. The proceeds would be used to honor Montage’s 8.875% bonds due 2023 in case the acquisition goes through. Moody’s has placed Montage’s rating on review for upgrade after the announcement.

For the full story, click here

Term of the Day

Debtor-in-Possession Financing

Debtor-in-possession (DIP) Financing is a funding option available to distressed companies that have filed for Chapter 11 bankruptcy protection, where lenders believe that the company has a realistic chance of turning itself around. DIP financing is not an option available to distressed companies that simply want to liquidate the company. DIP financing can be a lifeline for distressed companies as it may find it hard to borrow from typical channels after filing for Chapter 11.

From a lender’s perspective, DIP financing can be attractive given the special treatment of such financing under US bankruptcy laws, which dictate that DIP lenders are to be paid before other creditors. DIP financing is subject to court approval wherein the distressed borrower must prove to the courts that the existing or older creditors will not be made worse by the new financing.

For more on DIP financing, click here

Talking Heads

On the pace of future rates cuts, after the Mexico central bank cut rates by 50bp to 4.5%

In a statement by Bank of Mexico (Banxico)

Considering “risks for inflation, economic activity and financial markets, major challenges arise for monetary policy and for the economy in general,” Banxico said.

“Looking ahead, the available room for maneuver will depend on the evolution of the factors that have an incidence on the outlook for inflation and its expectations, including the effects that the pandemic might have on both factors,” Banxico said.

Nikhil Sanghani, assistant economist at Capital Economics

“With higher fuel inflation likely to push the headline rate close to 4.0% over the coming months, the upper end of Banxico’s target range, other board members may start to become jittery about further easing,” said Sanghani. “There are signs that Banxico’s easing cycle may begin to slow down,” said Sanghani.

On the lacklustre demand for US long-dated Treasury bonds

Gennadiy Goldberg, senior US rates strategist at TD Securities

“They have very aggressively stepped up the size of their auctions,” he said. “This may be the market’s way of saying ‘we are struggling here’.”

“The Treasury is playing chicken with the Fed,” said Mr Goldberg. “If the market starts to get sloppy, the Fed has to step in.”

On Hong Kong’s largest green bond issuance by MTR Corp

Sean McNelis, global co-head of debt capital markets at HSBC,

McNelis said: “Hong Kong has quickly become one of the region’s most active and diverse green bond markets, across both the issuer and investor communities. MTR’s US$1.2 billion transaction is the largest of its kind yet seen in the city, and the significant oversubscription demonstrates the appetite both for strong corporate names and the green format more broadly.”

On credit investors going ‘all in’ on corporate bonds

Barnaby Martin, head of European credit strategy at Bank of America

Martin said demand for corporate bonds is exceptionally high because of the “liquidity backstop that central banks have put in place.” “[Investors] feel that central banks have their back, that central banks will be accommodative and keep doing what they’re doing for a very long time,” he added.

Colin Reedie, co-head of global fixed income at Legal and General Investment Management

“We certainly feel more constructive on the asset class when the Fed and other central banks have got their arms around [us],” said Reedie. “It’s a safety net.”

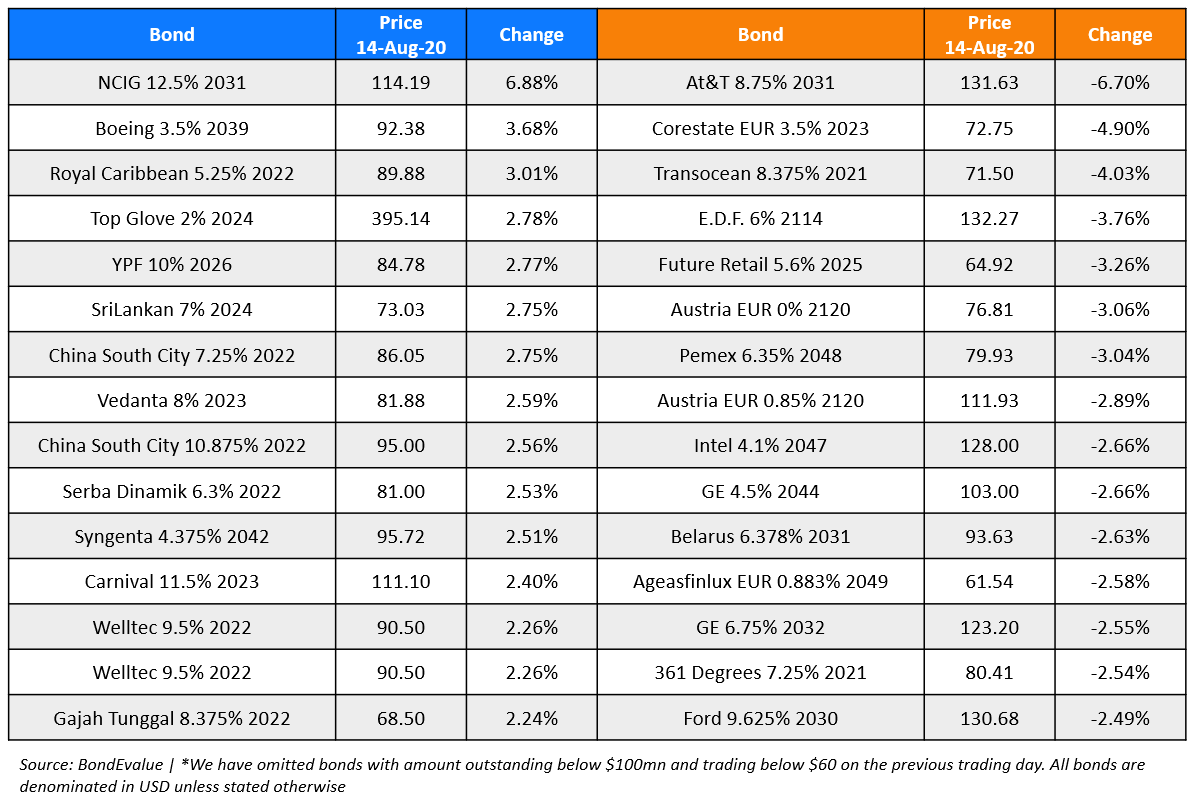

Top Gainers & Losers – 14-Aug-20*

Go back to Latest bond Market News

Related Posts: