This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande Reports 2021 and 2022 Results with Massive Losses

July 18, 2023

China Evergrande has finally reported its long delayed financial results for the financial years 2021 and 2022. It saw an eye-watering loss of $66bn in 2021 and a further $15bn loss in 2022. The company, which defaulted in late 2021 said that the losses were due to write-down of properties, losses on financial assets and finance costs amongst other factors. Its total assets have dropped 20% YoY to $250bn over the last two years. Charles Macgregor, head of Asia of Lucror Analytics said, “Results are meaningless if the business model is broken”. The developer is currently in talks with creditors regarding its debt restructuring and is expected to report creditor support votes in the near future.

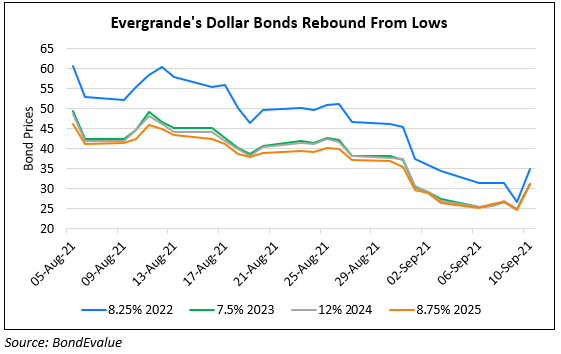

Evergrande’s dollar bonds are trading at deep distressed levels of 6-7 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Evergrande’s EV Listing Plan Scrapped

September 27, 2021

Local Governments Seize Control of Evergrande’s Home Presales

September 28, 2021