This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande Bonds Fall after Court Orders Bank Account Freeze

July 19, 2021

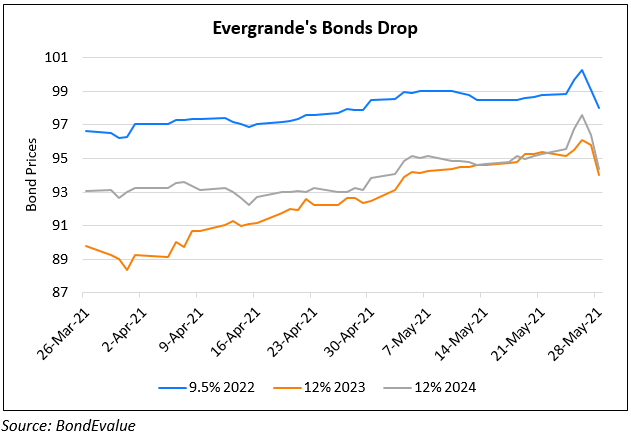

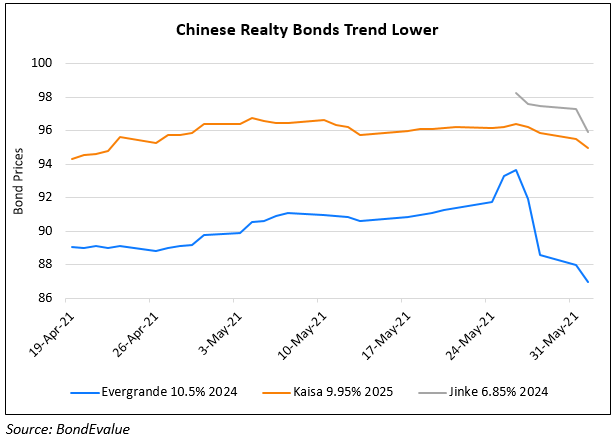

China Evergrande’s bonds fell after a court in Jiangsu province ordered the freezing of a bank account held by its subsidiary Hengda Real Estate Group and its unit at China Guangfa Bank. Bloomberg reported that Guangfa Bank said, “The situation is urgent and its legal interest will be irrevocably damaged if it doesn’t immediately file the asset freeze petition,” according to the ruling. Although the frozen amount is only CNY 132mn ($20mn), it points to a larger liquidity issue with the real estate group. Evergrande, the world’s most indebted real estate company, was in focus earlier this month after liquidity concerns over outstanding commercial bills worth $32bn. Evergrande along with its subsidiaries Hengda Real Estate and Tianji Holding were recently downgraded by Moody’s and were placed on a review for a further downgrade. Evergrande and Hengda’s rating was lowered to B2 and Tianji’s ratings were downgraded to B3. Fitch also downgraded the property developer and its subsidiaries to B last month.

Evergrande’s bonds were in the red. Its 9.5% 2022s and 8.75% 2025s and were down 1.73 and 1.79 to trade at 82.98 and 63.11 respectively. Hengda’s 11.5% 2022s and 12% 2023s were down 0.42 and 0.04 to trade at 73.24 and 67.63 cents on the dollar.

Go back to Latest bond Market News

Related Posts: