This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Eurozone Headline Inflation Cools, Core Remains Stubborn; BOJ Announces JGB Purchase

August 1, 2023

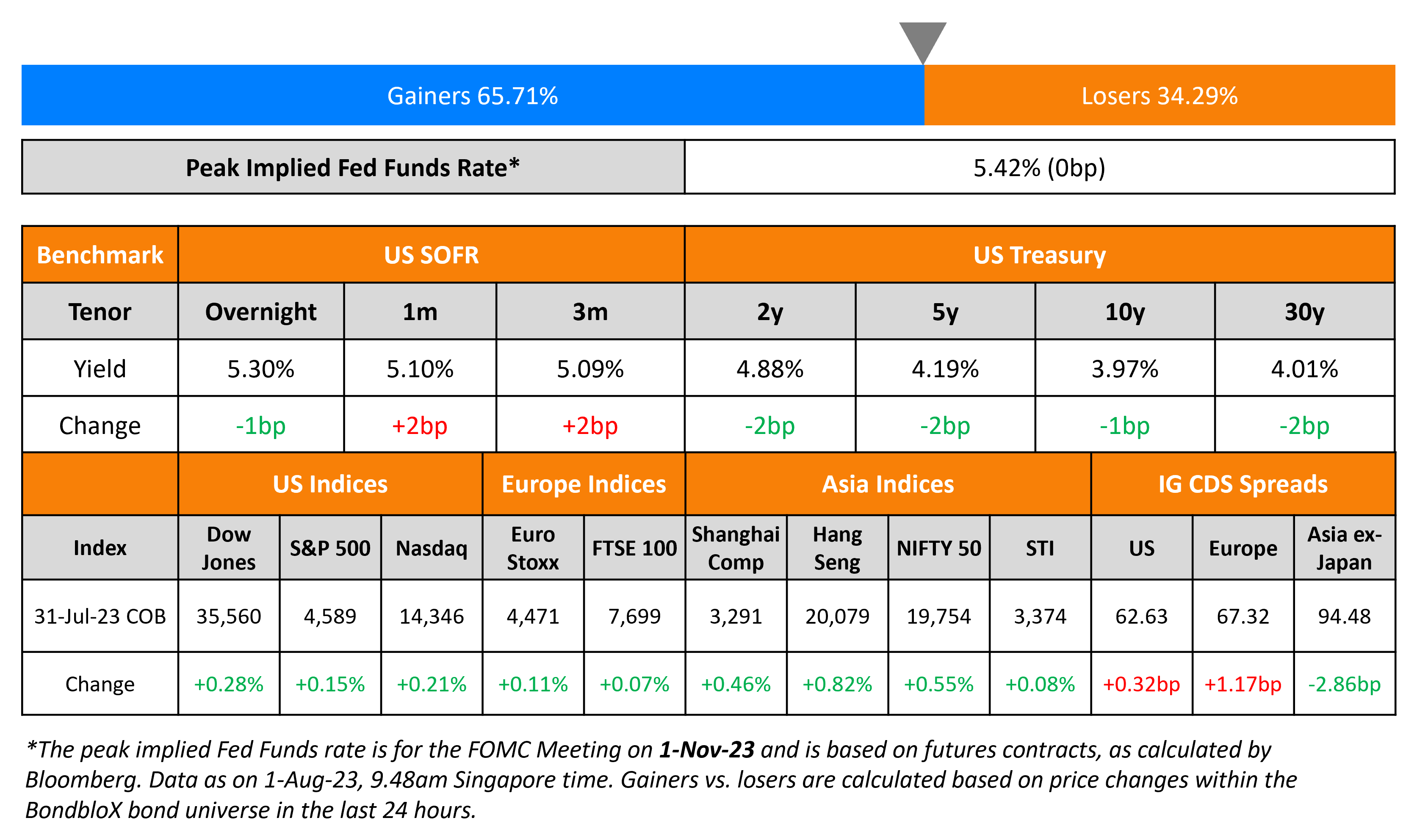

Treasury yields were marginally lower by 1-2bp on Monday. The Dallas Fed Manufacturing Index came at -20, better than forecasts of -25, however, still underscoring a contraction in the manufacturing sector. Separately, the US Treasury boosted its quarterly borrowing estimate to $1tn from $733bn, higher than it expected in May. The peak Fed Funds rate was unchanged at 5.42%. US IG credit spreads widened 0.3bp while HY CDS spreads were wider by 0.7bp. The S&P and Nasdaq ended marginally higher by ~0.2% each.

European equity indices closed slightly higher too. The Euro-area preliminary inflation print was a mixed bag. Headline inflation for July slowed to 5.3% YoY vs. expectations of a 5.5% increase. However, core inflation was at 5.5%, unchanged from the prior month and higher than forecasts of 5.4%. European main CDS spreads were 1.2bp wider and Crossover CDS widened 4.3bp. Asia ex-Japan CDS spreads continued to tighten by 2.9bp to 94.5bp. Asian equity markets have opened flat this morning. China’s Manufacturing PMI rose to 49.3 from 49 last month, beating forecasts of 49.2. However, this figure continued to stay below 50 for a fourth consecutive month, indicating weakness and contraction in the manufacturing sector. The BOJ made an unscheduled announcement to buy ~$2bn of JGBs with the 10Y JGB rate falling below 0.6%. This comes just days after it announced flexibility regarding the caps of its Yield Curve Control (Term of the Day, explained below) policy.

.png)

New Bond Issues

Santander raised $3.5bn via a two-part deal. It raised $1.5bn via a 5Y senior preferred bond at a yield of 5.588%, 35bp inside initial guidance of T+175bp area. It also raised $2bn via a 10Y Tier 2 bond at a yield of 6.921%, 27bp inside initial guidance of T+325bp area. The senior preferred notes have expected ratings of A2/A+/A while the tier 2s have expected ratings of Baa2/BBB+/BBB. The new tier 2s are priced 30.1bp wider than Macquarie’s 6.798% 2033s (rated Baa2/BBB/BBB+) yielding 6.62% and 77.1bp wider than National Bank of Australia’s 6.429% 2033s (rated Baa1/BBB+/A-) yielding 6.15%.

Lloyds raised $2bn via a two-tranche deal. It raised $1.5bn via a 4NC3 fixed rate bond at a yield of 5.985%, 27bp inside initial guidance of T+175bp area. If not called after 3 years, the coupon will reset to the 1Y US Treasury plus a spread of 148bp. The UK bank also raised $500mn via a 4NC3 floating rate note at a yield of 6.895%. The floating coupon will be set at the overnight SOFR+156bps, and will be paid quarterly. The senior unsecured bonds have expected ratings of A3/BBB+/A. Proceeds will be used for general corporate purposes.

China Cinda raised $400mn via a 3.5Y bond at a yield of 5.839%, 45bp inside initial guidance of T+175bp area. The senior unsecured bonds have expected ratings of BBB+ (S&P). The bonds have a change of control put at 101 and a make-whole call. Proceeds will be used for the repayment of existing debt. The new bonds offer a new issue premium of 9.9bp over its existing 4.4% 2027s that yield 5.74%.

GS Caltex raised $300mn via a 5Y bond at a yield of 5.457%, 37bp inside initial guidance of T+165bp area. The senior unsecured bonds have expected ratings of Baa1/BBB, and received orders over $2.9bn, 9.7x issue size. Proceeds will be used for general corporate purposes.

Rating Actions

- American Airlines Group Inc. Upgraded To ‘B+’ On Reduced Financial Risk; Issue-Level Ratings Raised

- Fitch Affirms Las Vegas Sands’ IDR at ‘BB+’; Outlook Revised to Positive from Negative

Term of the Day

Yield Curve Control

Yield Curve Control (YCC) is a policy that targets long term interest rates by buying or selling long term bonds to keep the interest rate from rising above it’s target. This is a measure taken to stimulate economic growth. Yield curve controls are also sometimes referred to as Interest Rate Pegs. The Bank of Japan (BOJ) is famous for having a YCC policy in place where they peg the yield on 10-year Japanese Government Bonds (JGB) to fight persistently low inflation.

Talking Heads

On Targeting Latin America Bonds as Central Bankers Gear Up for Rate Cuts – BlackRock

Pablo Goldberg, head of research for EM debt

“t is a good time to enter fixed-income. For us, the opportunity is much more in those places where central banks have a lot of room to cut rates… We’ll have a weaker dollar market that will allow us to continue capturing this carry, and that continues to be extremely attractive, especially in Latin America”

On Turkey Dollar-Bond Rally Under Threat as Policy Pivot Drags

Paul Greer, PM at Fidelity

“Given Turkey’s large external financing requirement, large current-account deficit and inadequate monetary policy, we expect the rally to slow down from here into August”

Gordon Bowers, a London-based analyst at Columbia Threadneedle

“For spreads to tighten materially from here, we need to see sustained implementation of orthodox monetary policy”

On Schroder Shorting Japan Bonds, Pimco Liking Yen as part of BOJ Plan – Schroders

Tomoya Masanao, Pimco’s co-head of Japan and co-head of APAC PM

“In our view, this is de-facto exit from the yield-curve control, or at least a major step towards that… room for nominal yields to go higher”

Kellie Wood of Schroders

“We still see room for further yield increases and a steepening of the JGB curve”

Adrian Zuercher, head of global asset allocation at UBS Global Wealth Management

“Japanese yen is a fantastic trade. It’s a long game — we do think it’s the best trade to play Japan currently”

On Clock on the Fed’s ‘soft landing’ may already be ticking

Antulio Bomfim, head of global macro for the global fixed income team at Northern Trust Asset Management

“We all wish we could slow the economy ‘just enough. The margin of error is quite high … You are seeing an economy that is resilient in terms of activity but also stubborn on underlying inflation … The risks of doing too little – that asymmetry – is still there.”

Fed Chair Jerome Powell

“We need to see that inflation is durably down … Core inflation is still pretty elevated. We think we need to stay on task. We think we’re going to need to hold policy at restrictive levels for some time. And we need to be prepared to raise further.”

Top Gainers & Losers –01-August-23*

Other News

Go back to Latest bond Market News

Related Posts: