This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

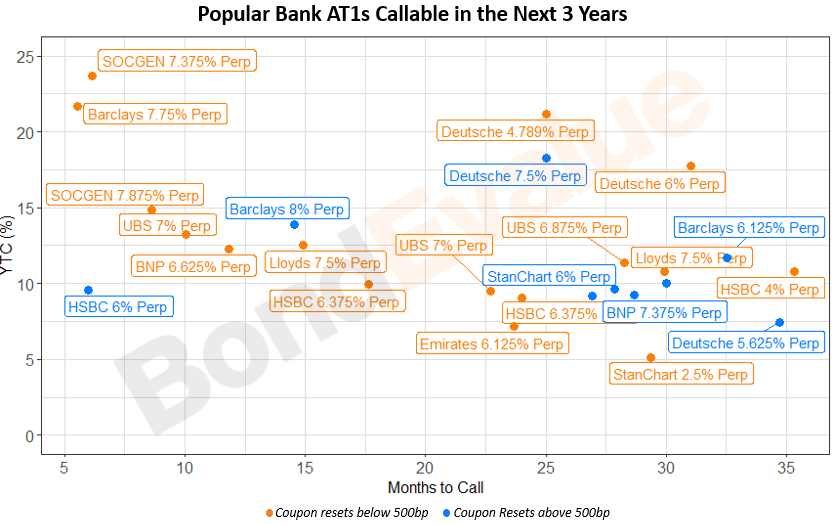

European Banks Have $85bn of AT1s Callable Through 2025

September 7, 2023

About $85bn of European bank AT1s are nearing their call dates through 2025. With the A1 market bouncing back following the $17bn write-off of Credit Suisse’s Perps, Bloomberg notes that several issuers are likely to come to primary markets to refinance their notes. This week, issuers like Erste Group and Intesa Sanpaolo tapped the primary markets for their AT1 issuances and drew almost 3x orders. Andrea Seminara, CEO at Redhedge Asset Management said, “It now makes sense for banks to pre-finance for next year as momentum is good. There has been strong feedback and good appetite”. Similarly, Gordon Shannon, a PM for TwentyFour Asset Management said, “Last week’s events were pretty constructive in showing the investiblility of AT1s — Intesa showing the market is open for replacement while UBS had a great set of results”.

In the chart below, we have plotted popular European banks’ EUR & USD denominated AT1s callable through 2025. Hovering over each bond will give you details including the coupon reset, next call date, current price and yield-to-call.

Go back to Latest bond Market News

Related Posts:

Chinese Banks to Call Back $12bn in Perpetual Bonds amid Surge in Rates

September 20, 2022

UniCredit Set To Redeem Its 6.625% Perps in June

March 27, 2023

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023