This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

European Banks’ Dollar AT1 Bonds Continue Record Rally; View the Top Performing AT1s in 2025

October 2, 2025

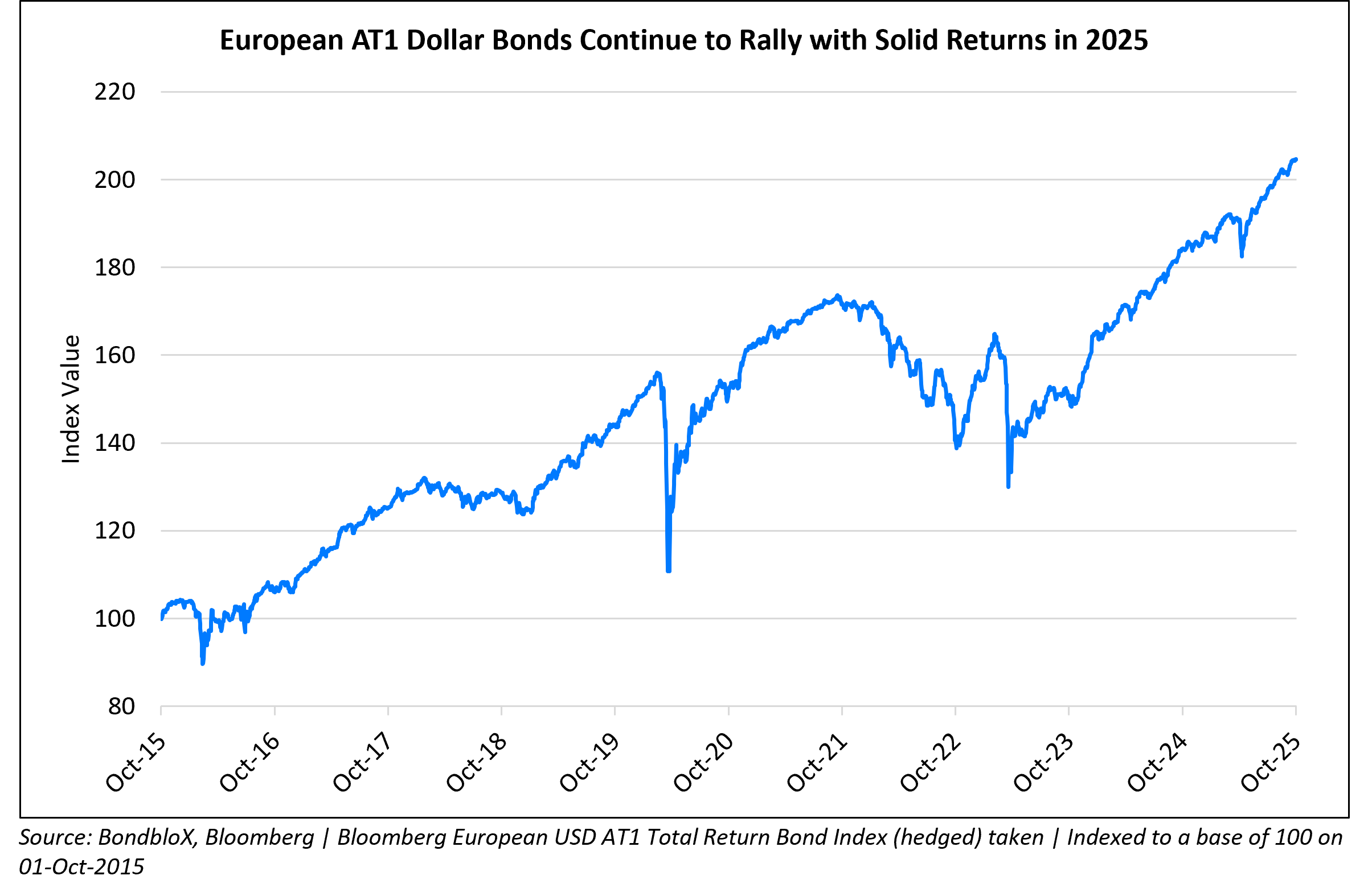

Dollar AT1 bonds of European banks have continued their record rally this year, a move that began after the drop in these bonds following Credit Suisse’s collapse in 2023. The Bloomberg European USD AT1 Total Return Bond Index shows a rally of over 57% since then. In 2025 alone, the index has seen a total return of 9.4%. Bloomberg notes that AT1 buyers have benefitted from a rosy outlook for the region’s banks, where profits have jumped this year thanks to stronger fee, trading income and robust capital buffers. Besides, it also noted that upgrades this year have outweighed downgrades by the biggest margin in about a decade, across both, S&P and Fitch.

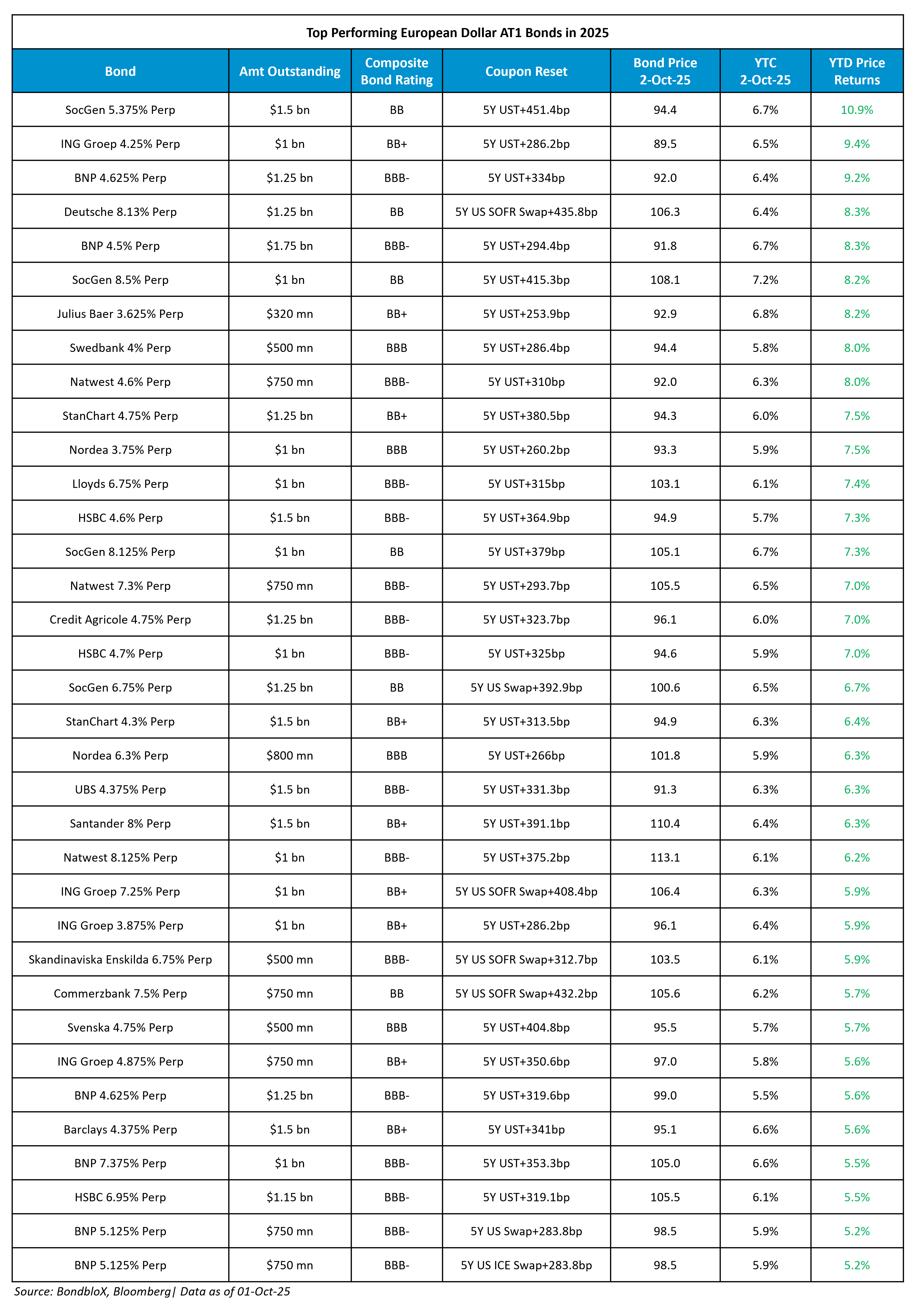

In the regard, we have compiled a list of the top performing AT1 bonds in 2025 of European banks, sorted by their YTD Price Returns. The list has been compiled only for bonds that have seen price returns of greater than 5% since the beginning of this year.

For more details, click here

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024