This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

European Bank AT1s Yield Spread Over Tier 2s at 3Y Lows; View Top Yielding European Dollar Tier 2s

October 16, 2024

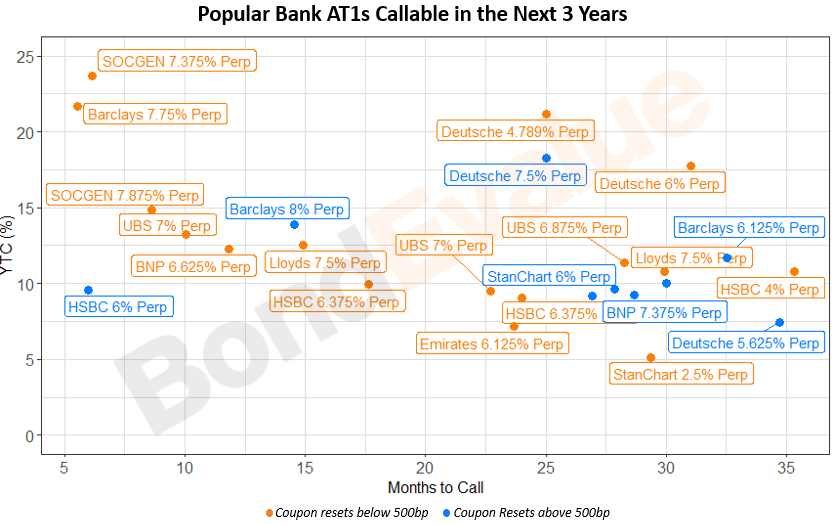

The yield pickup that European bank AT1s offer over comparable Tier 2s has compressed to less than 300bp, levels last seen in 2021, as per Bloomberg data. With the yield differential between both at nearly 600bp during the same time last year, the recent compression has seen some asset managers readjust their portfolios. For instance, Robeco’s head of credit, Joop Kohler, said that they have been reducing exposure to “relatively expensive” AT1s over the past three months and are “preferring Tier 2 and senior non-preferred”. While both AT1s and Tier 2s are subordinated notes, the capital structure hierarchy ranks Tier 2s as senior to AT1s in the event of a liquidation.

In this light, we have put together a list of the highest yielding Tier 2 bonds by European banks, sorted by the Yield to Call.

Go back to Latest bond Market News

Related Posts:

Bank AT1 Perps Slip Following SVB Collapse

March 14, 2023

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023