This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ESG Bonds – Everything You Need to Know

March 15, 2022

What are ESG Bonds and Why ESG?

ESG bonds are debt instruments used by issuers to raise money for a positive Environmental, Social, Governance (ESG) impact. The first such bond was issued by European Investment Bank in 2007 and the market has only grown since then. The positive impact of these bonds might sound vague at first, but these bonds tend to come with specific, measurable impacts that issuers seek to achieve as given in their bond documents (scroll down for more on documentation). Given the transition to carbon neutrality, EVs, gender equality etc., these bonds have gathered interest in recent times. There are now specific ESG-focused investment funds capitalizing on the growth in this space. Further, the market has grown sharply, with a CAGR of 63% in the five years until 2021 (see the interactive chart below).

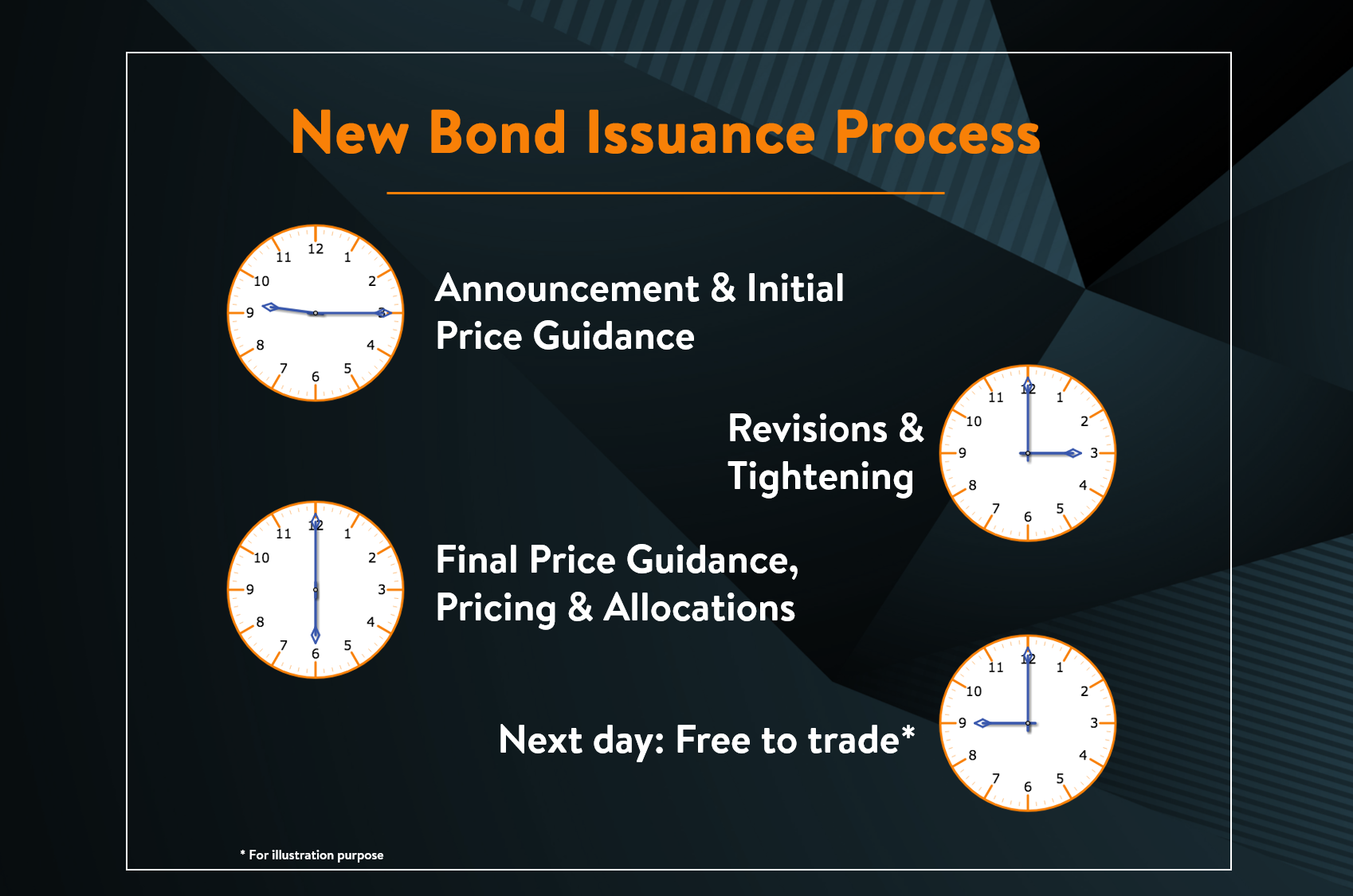

Issuers of ESG bonds cover the entire spectrum of institutions, ranging from sovereigns, financial institutions/banks, non-financial corporates and supranational agencies. These institutions could issue ESG bonds either in their home currency or a foreign currency. The issuance process also does not differ from the existing bond issuance approach – banks/underwriters are hired, the bond is then announced, followed by the initial price guidance, bids being invited, the final price guidance and finally the pricing of the bond. For more about the new issue process, click here.

Types of ESG Bonds

Broadly, there are four types of ESG bonds:

- Green Bonds: Bonds issued to specifically fund projects (new/existing) that have a positive environmental impact. Examples include renewable energy, clean transportation, carbon neutrality, sustainable water, wastewater management etc.

- Social Bonds: Bonds issued to specifically fund projects (new/existing) that have a positive social impact. Examples include affordable basic infrastructure, affordable housing, employment generation, workforce diversity etc.

- Sustainability Bonds: Bonds issued where proceeds are exclusively applied for a combination of both green and social projects.

- Sustainability-Linked Bonds (SLBs): These bonds are not to be confused with sustainable bonds, and get their name from the commitment that issuers make on ESG objectives/targets and not based on use of proceeds. Issuers can use proceeds from these bonds for general purposes but are required to achieve the targets set out by them. In case the issuer does not meet the target(s), SLBs have coupon step-ups in place as a penalty to the issuer.

While most ESG bonds fall among one of the above four categories, there are a few other types of ESG bonds that are less common like Transition Bonds, Sustainability Re-linked Bonds, Blue Bonds , Rhino Bonds etc. Most ESG bonds also tend to follow a global standard like the ICMA's green/social/sustainability bond principles, UN SDG principles etc., hence giving them credibility. For more details on the types of ESG bonds and a comparison of ESG vs non-ESG bonds, click here

Important ESG Documents for Investors

With the rapid growth in ESG bonds, the industry has been gravitating towards a more standardized approach in a bid to make it easier to compare ESG bonds of the same type. The following key documents are typically available for most ESG bonds that can help investors better understand, compare and analyze ESG bonds:

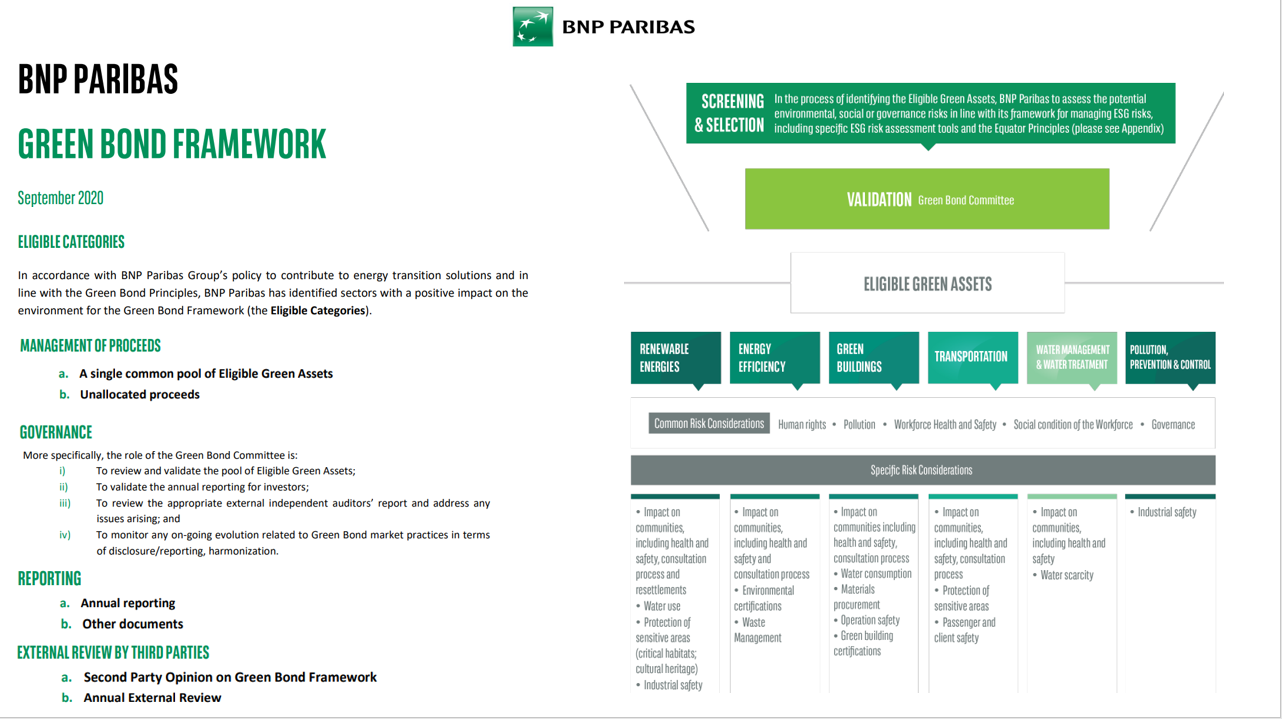

- ESG Framework: Issuers publish an ESG framework document such as a Green Bond Framework that outlines the contours of the issuer's ESG objectives, where the proceeds of these bonds will be used and what would the expected impact be. The framework also tends to point out how it aligns itself with a global standard, like the ICMA's principles.

- ESG External Review: An External Review provider is an independent institution that reviews and provides its opinion on the issuer's ESG framework. Think of it like a credit rating agency reviewing an issuer and providing a rating. While external reviewers do not provide a particular rating of the ESG framework, they opine. External review providers can come in two types:

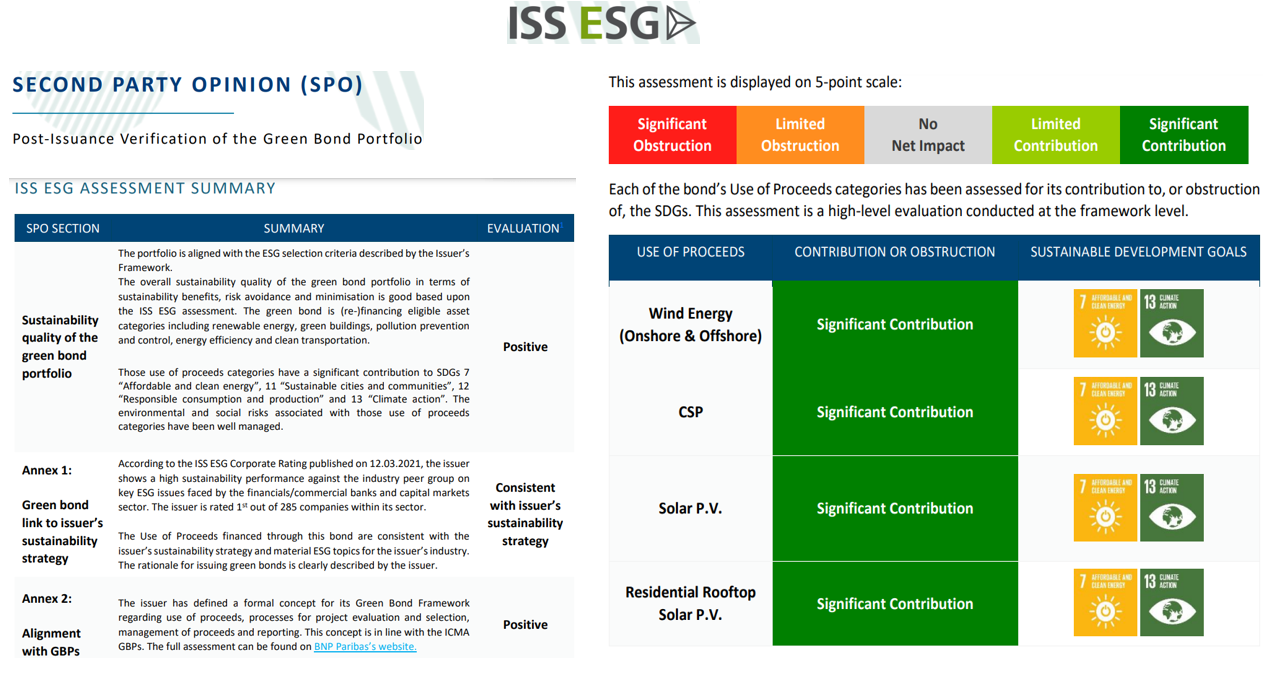

- Second-Party Opinion (SPO): SPO companies publish a detailed document mentioning whether their review of the framework is credible, impactful and aligns with standard principles. The SPO companies generally hold conversations with issuers to understand the ESG impact of their business processes, planned use of proceeds, management of proceeds and reporting aspects. Most prominent companies here include Sustainalytics, CICERO, DNV, ISS ESG, S&P and Vigeo Eiris.

- Independent Assurance Report: These are brief documents that could come in the form of pre/post issuance verification reports. Most audit companies like the Big 4 - PwC, EY, Deloitte, KPMG - typically publish these reports. This report gives a limited assurance conclusion as to whether there is any cause to believe that the assertions of the company do not meet criteria they have mentioned

- Issuer ESG Report: This is usually an annual update provided by the issuer, reporting the impact of their ESG initiatives. This includes the specific areas where the proceeds from the bonds were used and how much of the funds were allocated across these ESG projects.

Where to Find ESG Bonds & Documents

While these documents are typically scattered and difficult to source/find, we have made it easier for investors and professionals by providing all key ESG information including the above documents complemented by the latest bond prices, yields, z-spreads, news and analytics.

Click here to access ESG bond data on the BondEvalue App.

Example - BNP 1.675% Green Bond Due 2027

We have provided an example of BNP Paribas' USD 1.675% green bonds due 2027 that were issued in June 2021. Snippets of BNP Paribas' green bond framework and the external review report can be viewed by scrolling below.

Issuer ESG Framework of BNP Paribas

External Opinion Provider

Go back to Latest bond Market News

Related Posts:

ESG Bonds – How Different (or Not) Do They Trade vs. Non-ESG Bonds?

December 18, 2024

New Bond Issue Process – Explained

December 13, 2024