This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

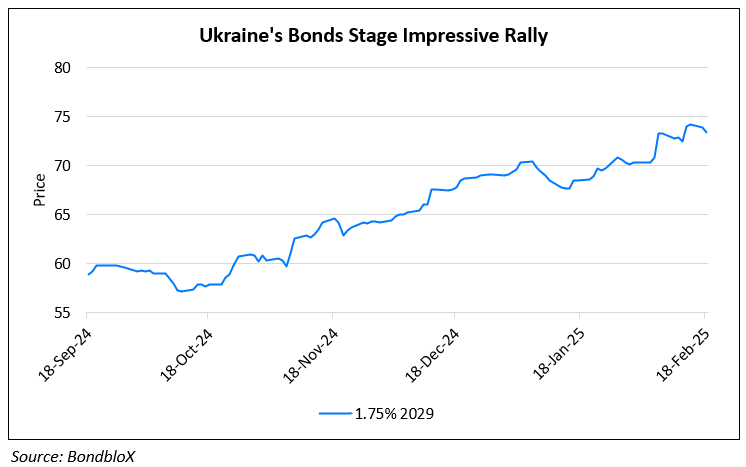

EM Investors Question Further Upside in Ukraine’s Bonds

February 18, 2025

Ukraine’s dollar bonds have been one of the best performing bonds in emerging markets. For instance, its 1.75% 2029s have rallied over 20% since issuance in late-August last year, and up over 5% YTD. The rally has been led by anticipation of a peace deal to end the war with Russia, particularly over the past couple of weeks leading up to the Munich Security Conference. However, recent updates have dampened prospects for a deal and investor sentiment. This includes President Trump reaching out to Putin without consulting with Ukraine or EU members, and his administration confirming that Europe will not be part of the peace talks.

“I believe Ukraine will likely walk away from the deal, which means the war is unlikely to end anytime soon — a negative outlook for Ukraine bonds,” said Timothy Ash, senior EM sovereign strategist at RBC BlueBay Asset Management. Thys Louw, a portfolio manager at Ninety One UK Ltd. said, “We think we are getting to a stage in the bond rally where the details of any peace deal will start to matter…The easy trade is done.”

For more details, click here

Go back to Latest bond Market News

Related Posts:

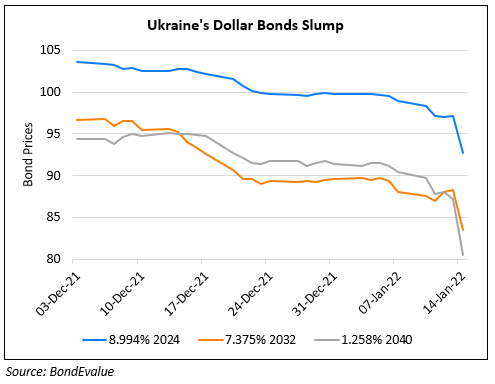

Ukraine’s Dollar Bonds Slump on Worries over Potential Invasion

January 14, 2022

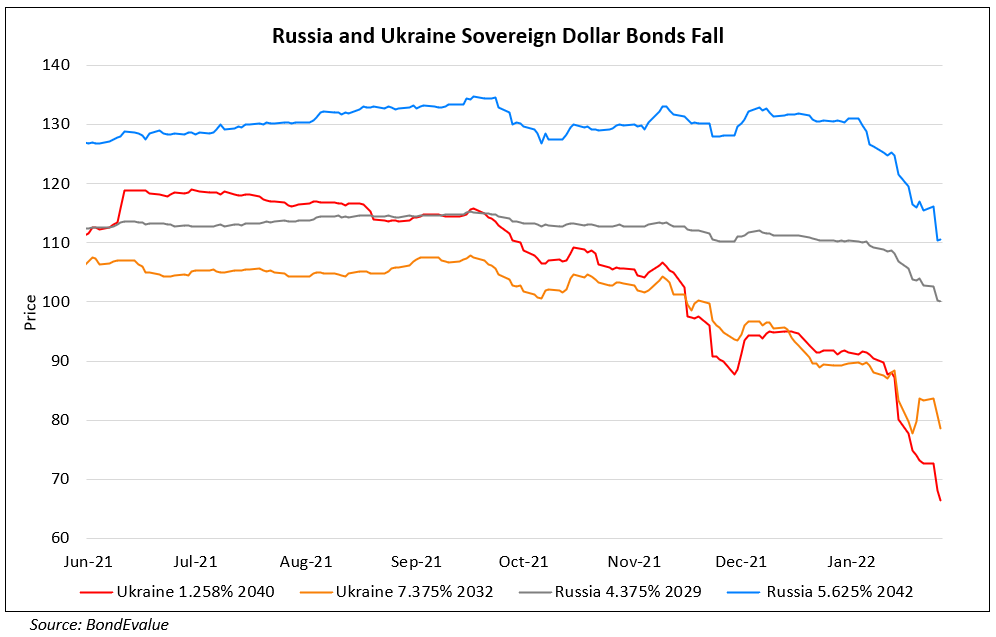

Ukraine & Russia’s Dollar Bonds Slip on Escalating Tensions

January 26, 2022

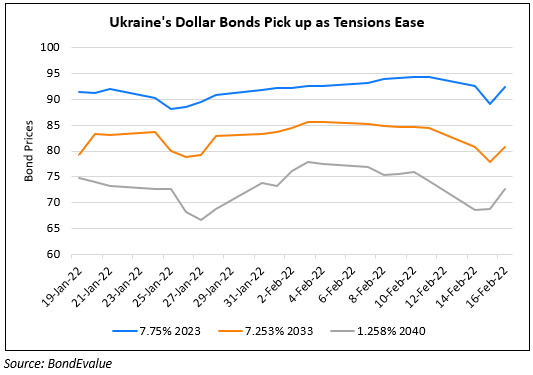

Ukraine Bonds Rally as Russia Says Troops Pulled Back

February 16, 2022