This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Eli Lilly, Charter Communications Price $ Bonds; Kosmos Downgraded to B-

August 19, 2025

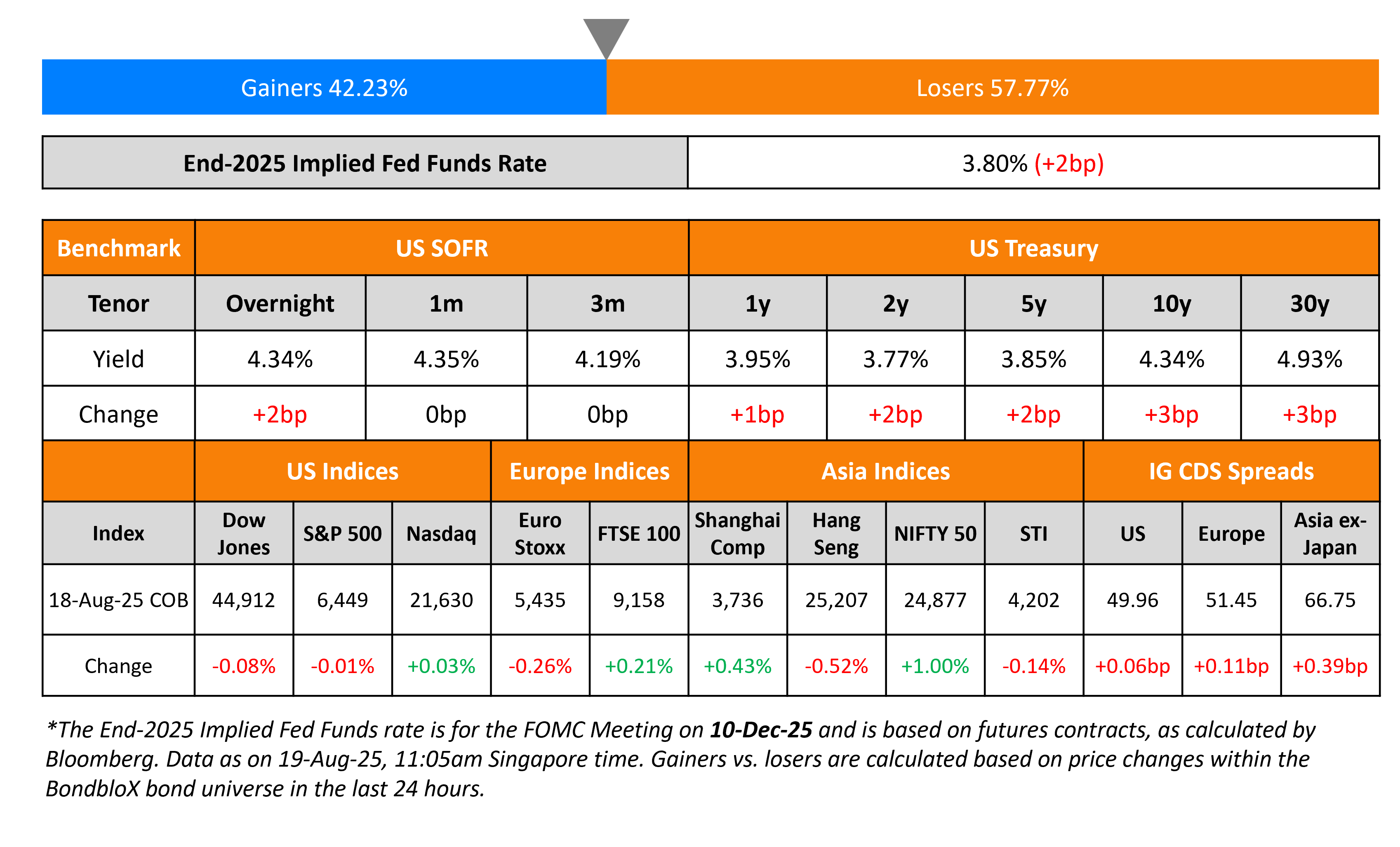

US Treasury yields rose by 2-3bp on Monday. There were no major macro catalysts as markets next await Fed Chairman Jerome Powell’s comments at Jackson Hole later this week. Separately, US President Donald Trump said that he has started making arrangements for a meeting between the Presidents of Russia and Ukraine.

Looking at US equity markets, the S&P and Nasdaq ended flat on Monday. US IG and HY CDS spreads widened by 0.1bp each. European equity markets ended mixed. The iTraxx Main CDS spreads were 0.1bp wider and Crossover spreads widened by 0.5bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 0.4bp wider.

New Bond Issues

Eli Lilly raised $6.75bn via a seven-part deal. It raised:

These senior unsecured bonds are rated Aa3/A+. Proceeds will be used for general corporate purposes, which may include the repayment of outstanding commercial paper.

Charter Communications raised $2bn via a two-trancher. It raised $1.25bn via a 10Y bond at a yield of 5.855%, 33bp inside initial guidance of T+185bp area. It also raised $750mn via a 30Y bond at a yield of 6.71%, 38bp inside initial guidance of T+215bp area. The secured notes are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes, repay certain debt including its 6.15% 2026s.

New Bond Pipeline

-

EDF A$ 10Y and/or 20Y Kangaroo Notes

-

Allianz $ PerpNC8.7 RT1

Rating Changes

- Fitch Downgrades Kosmos to ‘B-‘; Places on Rating Watch Negative

-

Moody’s Ratings downgrades BlueLinx’ CFR to B1; outlook stable

- Eli Lilly & Co. Outlook Revised To Positive On Expected Deleveraging; Ratings Affirmed

- Fitch Revises Teledyne’s Outlook to Positive; Affirms IDR at ‘BBB’

Term of the Day: Diaspora Bonds

Diaspora bonds are sovereign bonds that target investors that have emigrated to other countries. The reasons for emigration range from political unrest to better opportunities. For issuing countries, it is considered to be a possible stable source of finance particularly in bad times and can support the sovereign’s credit rating. For investors, it is believed to be a semblance of patriotism for the country of origin whilst also serving to manage risk since debt is serviced in local currency. Kenya is said to be working with to raise as much as $500mn by issuing a diaspora bond.

Talking Heads

On Powell Having Reason to Hedge Jackson Hole Signal as Data Zigzags

Jonathan Pingle, UBS Securities

“Even though I expect him to generally point to lower rates at the next meeting, I do expect him to precondition it on a very data-dependent message…I don’t think he’s going to lock it in…There’s a reason former chairs have used their last Jackson Hole speeches to reflect on their tenure…It’s their opportunity to write their history.”

On San Francisco Fed Offering New Way to Monitor for US Recessions

Rohit Garimella, Òscar Jordà and Sanjay R. Singh

“The national economy has invariably been in recession each time 30 or more states simultaneously experienced accelerating unemployment…The flexibility, clarity, and ease of interpreting makes it a useful addition to the standard tools used by economists”

On UK 30-Year Inflation-Linked Yields Hitting Highest Since 1998

Megum Muhic, RBC

“The back end is becoming unanchored from the front end…It’s basically the opposite environment that we say between the global financial crisis and 2020, where long-end yields were heading lower,”

Top Gainers and Losers- 19-Aug-25*

Go back to Latest bond Market News

Related Posts: