This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt’s Dollar Bonds Rise on Abu Dhabi $22bn Beach Strip Plan

February 9, 2024

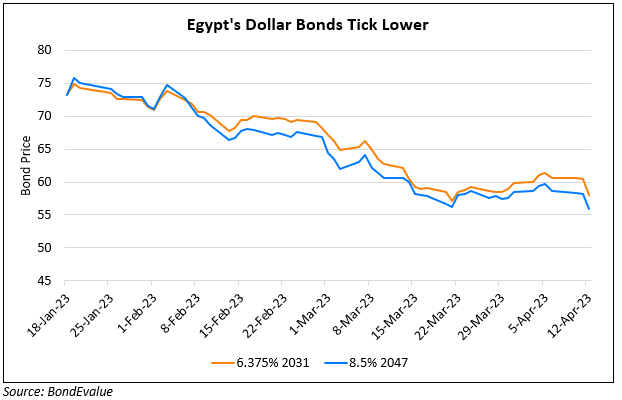

Egypt’s dollar bonds rose by 1.8-2 points across the curve after reports that Abu Dhabi is in advanced talks to buy and develop premium land on Egypt’s Mediterranean coast in a project worth ~$22bn. Sources note that Egypt may retain ownership of about 20% of the territory. The deal with Abu Dhabi is said to help Egypt amid its foreign-exchange crisis and provide liquidity to manage a successful devaluation in the near future. Earlier last week, the IMF said that they were “very close” to agreeing on a new financial package for Egypt.

Egypt’s 3.875% 2026s were up 2 points to trade at 87.12, yielding 11.21%.

Go back to Latest bond Market News

Related Posts: