This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

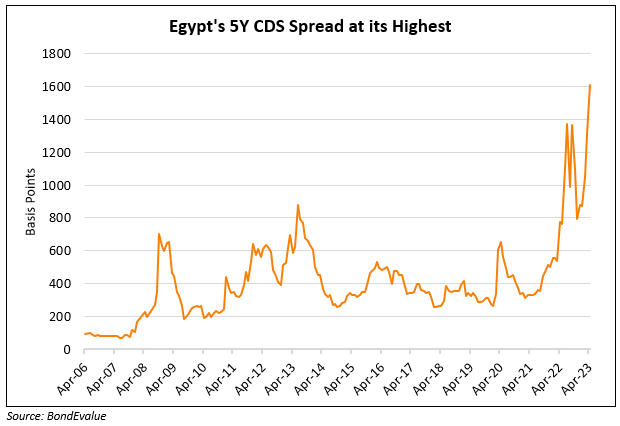

Egypt’s Dollar Bonds Continue to Trend Lower; 5Y CDS at its Highest

April 21, 2023

Egypt’s dollar bonds were down over 1.2 points yesterday as they continue to trend lower since the start of the year. Egypt’s dollar bonds have been under pressure primarily due to its weakening currency, high inflation and steadily declining reserves. The currency’s 12M forward contract weakened past EGP 44 to the dollar for the first time. Earlier last week, the nation’s inflation came at 32.7% in March, its fastest pace since 2017. Egypt has about $39bn in in USD and EUR denominated debt, including $3.3bn due next year. Goldman strategists write, “Egypt has significantly higher short-term external vulnerabilities than the rest of these sovereigns”, referring to Nigeria, Kenya, Angola and Senegal. They add that the performance of Africa’s high yielding sovereigns tended to be “very highly correlated to Egypt’s”.

Egypt’s 5Y CDS spread is at its highest levels of 1608bp. Its dollar bonds are trading at ~50 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Pimco calls for Indian Sovereign Bond

May 26, 2017