This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt’s and El Salvador Bonds Gain After Reports of Nearing IMF Deal

February 2, 2024

El Salvador’s bonds have rallied by 4-6 points over the week after its president Nayib Bukele told investors that the country was working to reach an agreement with the IMF. Bukele vowed to continue paying bondholders while he held talks with the IMF, however the statement from the Finance ministry did not reveal how much the government is seeking from the IMF and under what terms.

El Salvador’s 8.625% 2029s bond rose by 4.4 points over the week and currently trades at 91.5 cents on the dollar, yielding 10.85%.

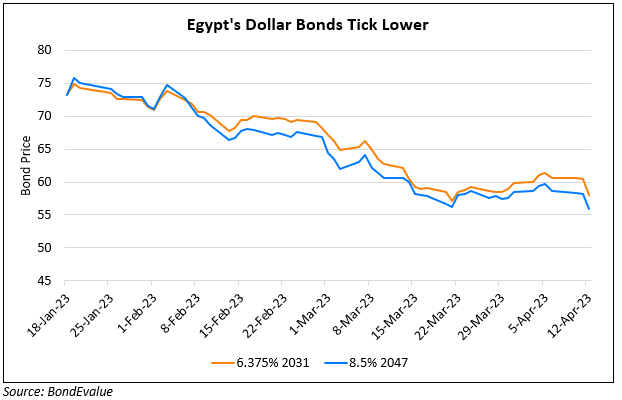

Similarly, Egypt’s bonds were also among the top gainers yesterday rising by 1-5-2 points after the IMF managing director Kristalina Georgieva said the lender was very close to a loan deal with Egypt. The IMF made it clear that they were concerned about the war in Gaza, hence pushing ahead with the expanded loan deal. The IMF had earlier stopped disbursements to Egypt on a $3bn loan after it did not meet conditions to move to a flexible exchange rate and reduce the footprint of the state and the military in the economy.

Egypt’s 5.875% 2025s was up by 1.8 points over the last 2 days to trade at 92.5 cents on the dollar, yielding 12.06%

Go back to Latest bond Market News

Related Posts: