This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt Secures IMF $8bn Deal After Rate Hike, Devaluation

March 7, 2024

Egypt devalued their currency by over 30% and also hiked interest rates by a record 600bp. It raised the overnight lending rate to 28.25% and its overnight deposit rate to 27.25% in an effort to control inflation that stands at 29.8%. The currency weakened to beyond EGP 50 from about EGP 30.90 to the dollar. The central bank said it would let the currency trade freely. With this, the nation secured an $8bn deal with the IMF, much higher than the $3bn, 46-month Extended Fund Facility (EFF) they struck in December 2022, based on a more flexible exchange-rate system. On top of the $8bn deal, Egypt would also obtain a $1.2bn loan from the IMF for environmental sustainability.

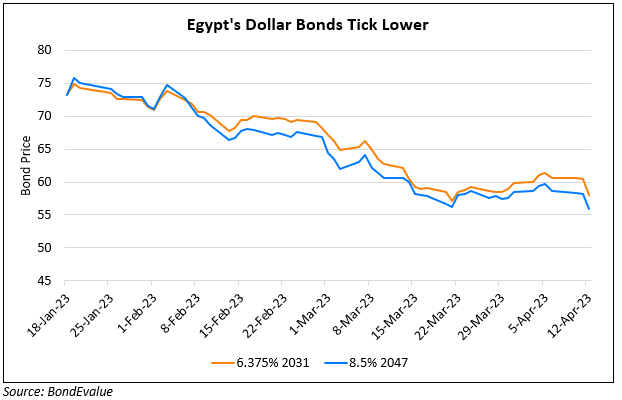

Egypt’s dollar bonds have been among the best performing sovereign dollar bonds this year with YTD returns of over 20% thanks to a string of positive updates. This includes the positive expectations for an IMF deal alongside UAE agreeing to invest $35bn for development projects. Its 7.625% 2032s fell by 2 points to 86.89, yielding 10%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

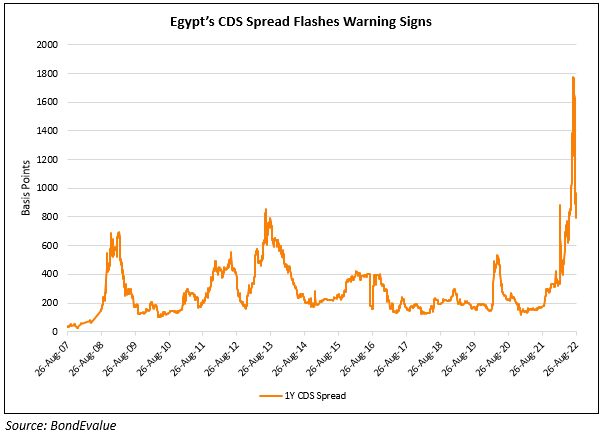

Egypt CDS Spreads Jump as Economic Health Worries Linger

August 29, 2022

Egypt Downgraded to B- by Fitch

November 6, 2023