This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt Lining Up $1.5bn in Funding By Year End

October 13, 2023

Egypt is expecting to borrow at least $1.5bn by the end of the year, a per Finance Minister Mohamed Maait. A part of this will come through a sale of bonds in the Asian market as dollar-denominated funding has dried up, especially given IMF’s delayed reviews of its $3bn rescue program. Of the total amount, about $500mn would be raised each, via a debut issuance of Panda bonds and its second issuance of Samurai bonds. The minister said that Egypt has received guarantees for up to $545mn on the Panda bonds from ADIB and ADB. On the other hand, the Samurai issuance is expected to be a private placement guaranteed by Africa Finance Corp. Also, another $500mn loan is in the pipeline with Kuwaiti insurance company, Dhaman, being a lead guarantor. Egypt’s funding needs or 2024 amounts to about $24bn and would need to finance this via debt issuances and asset sales.

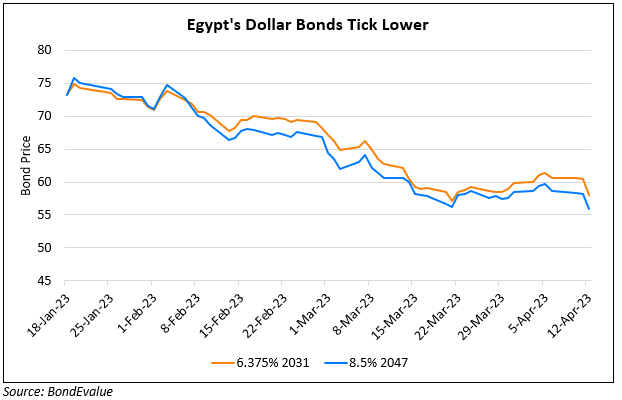

Egypt’s dollar bonds were trading weaker with its 7.5% 2027s down 1.9 points to 67.2, yielding 22%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

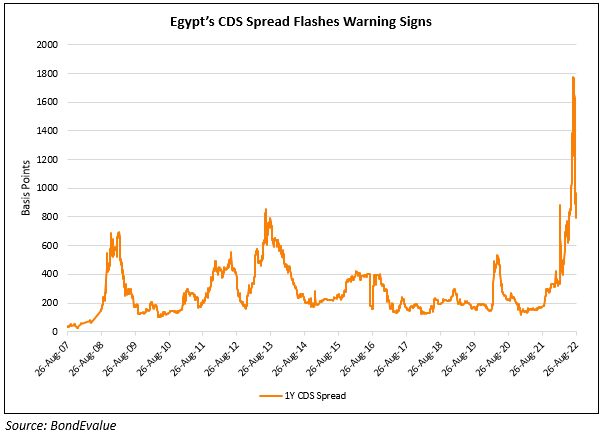

Egypt CDS Spreads Jump as Economic Health Worries Linger

August 29, 2022

Egypt Downgraded to B3 by Moody’s

February 8, 2023