This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt Downgraded to B- by S&P

October 23, 2023

Egypt was downgraded by S&P to B- from B due to recurring delays in the implementation of monetary and structural reforms and deterioration of the net foreign asset position of systemic banks. Egypt’s debt servicing costs continue to remain high with 40% of government revenue consumed in interest payments. Despite an agreement with the IMF to move to a flexible exchange-rate system, Egypt is yet to liberalize its currency, leading to a reduction in badly needed remittance and investment inflows, alongside weaker private sector confidence. In addition, there is limited transparency around the financing sources and import content of ongoing “national projects”. According to S&P, Egypt’s economy could be negatively impacted as it shares border with Gaza which has been involved in conflict with Israel. Earlier this month, Moody’s downgraded Egypt to Caa1 citing worsening debt affordability trend.

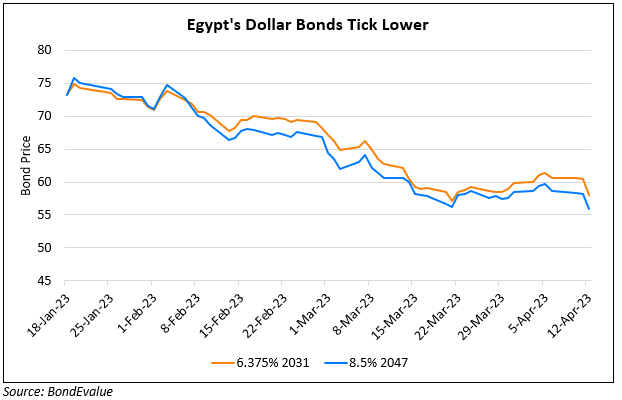

Egypt’s dollar bonds were trading stable with its 2027s through 2029s at 60-66 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

Egypt Downgraded to B3 by Moody’s

February 8, 2023

Egypt-World Bank Agree On $7bn 5-Year Partnership

March 24, 2023