This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt Dollar Bonds Jump on Speculation of Investments from Saudi Arabia

October 16, 2024

Egypt’s dollar bonds rose by 1-1.5 points across the curve, on the back of speculation that Saudi Crown Prince Mohammed bin Salman’s visit could lead to new investments in the country. The move came after local media suggested multibillion dollar deals were likely to be announced. Although no official confirmation of investments was provided, the anticipation alone positively influenced Egypt’s dollar bonds. Some of its notes have even reached two-year highs. Earlier this year, investors’ confidence was bolstered by Egypt securing over $57bn in commitments from lenders and partners, along with reforms that included currency devaluation and interest rate hikes. Analysts have said that the above has made Egypt an attractive option for investors, especially for carry trades, due to a significant policy-rate differential over the US. As a result, some portfolio managers have spoken about their optimism of a continued strong performance from Egyptian bonds due to regional support and attractive yields.

Its 8.875% 2050s rallied by 1.5 points to trade at 83.9, yielding 10.73%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

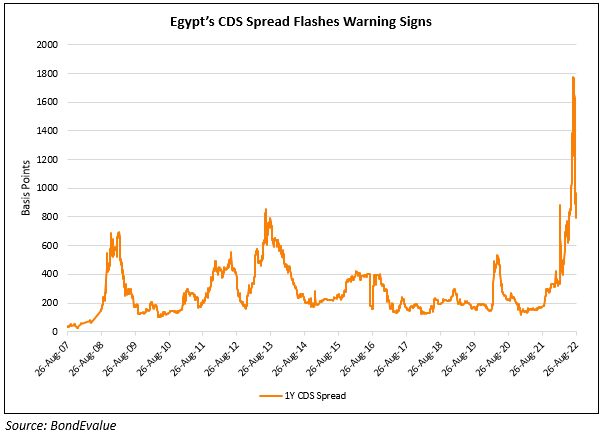

Egypt CDS Spreads Jump as Economic Health Worries Linger

August 29, 2022

Egypt-World Bank Agree On $7bn 5-Year Partnership

March 24, 2023