This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt Cuts Rates by 225bp, First Cut Since 2020

April 21, 2025

Egypt’s central bank implemented its first interest rate cut since 2020, last week, reducing the overnight lending rate by 225bp to 26%. It also lowered the deposit rate to 25%, adding that more rate cuts were likely. This decision was influenced by a significant decline in inflation, which fell from a peak of 38% in September 2023 to under 14% in March 2025. The central bank anticipates inflation to moderate through 2026, supported by fiscal consolidation efforts. Additionally, preliminary data for 1Q2025 indicates economic growth exceeding the 4.3% recorded in 4Q2024, suggesting a strengthening economy. The latest rate cut follows a substantial tightening in March 2024, when policy rates were increased by 600bp and the Egyptian pound was devalued as part of an $8bn IMF support package.

Egypt’s dollar bonds were trading higher across the curve, with its 7.625% 2032s up 0.6 points at 84.2, yielding 10.9%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Egypt Seeking $2.5bn Loan from Banks

August 12, 2022

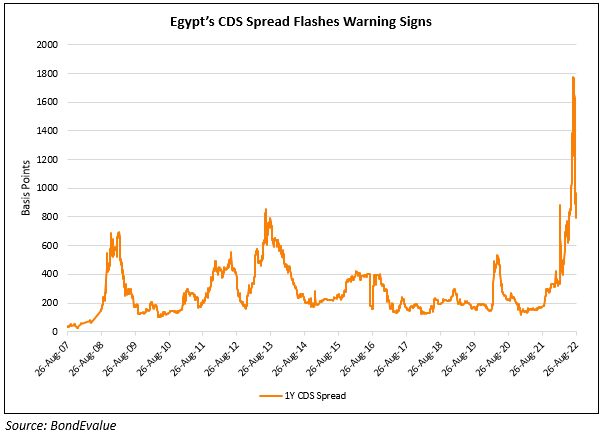

Egypt CDS Spreads Jump as Economic Health Worries Linger

August 29, 2022