This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

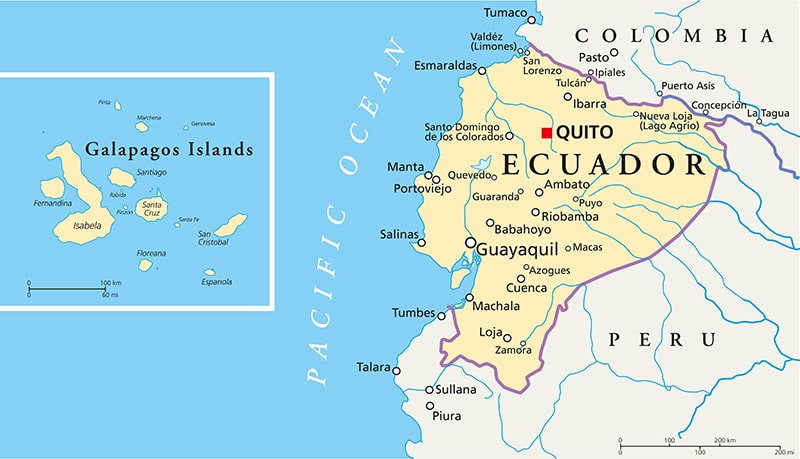

Ecuador’s Dollar Bonds Tick Higher on Planned Return to International Debt Markets

January 19, 2026

Ecuador is preparing to return to international debt markets for the first time since 2019, hiring banks to coordinate roadshows, as per sources. The government plans to sell USD-denominated bonds to fund a buyback of its notes due in 2030 and 2035, whilst aiming to improve its debt profile and reduce medium-term debt service pressures. Bloomberg notes that the potential deal coincides with an EM bond surge, with sovereign sales up 73% compared to last year. Ecuador’s Finance Minister Sariha Moya expects the new bonds to yield less than 10%, noting that its current dollar notes trade between 7-9%. Sources note that their reaccess to markets follows a successful reform program and a prior $17.4bn restructuring during the pandemic. With $900mn in debt payments due this month, Ecuador remains open to additional financing options, including debt-for-nature swaps and multilateral guarantees from the World Bank and IDB.

Ecuador’s dollar bonds were trading higher across the curve. For instance, its 6.9% 2030s were up by 1.6 points to 99.5, yielding 7.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018