This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ecuador’s Dollar Bonds Move Higher

September 9, 2024

Dollar bonds of Ecuador were higher across the curve, by 1-3 points. This comes after sources reported that Goldman Sachs and BofA were laying the groundwork for a debt swap deal for Ecuador. This is to help the nation manage its debt financing costs. The transaction would be a debt-for-nature swap wherein, a portion of its existing debt will be refinanced by selling a new bond at better terms. The saving will go toward nature conservation to protect part of the Amazon rainforest. Last year, Ecuador completed the largest ever debt-for-nature swap, that was expected to generate over $1bn worth of savings for the government.

Ecuador’s 6.9% 2030s were up 2.1 points to 74, yielding 13.4%

For more details, click here

Go back to Latest bond Market News

Related Posts:

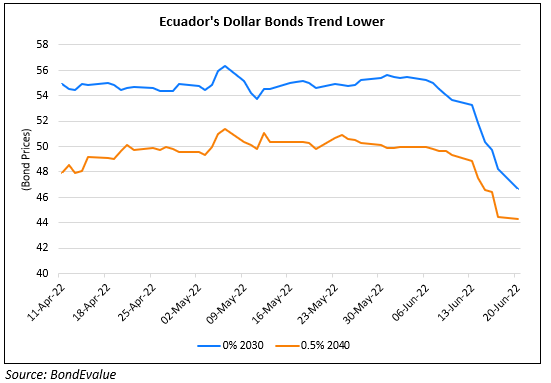

Ecuador’s Dollar Bonds Drop over 10% Last Week

June 20, 2022

Ecuador Bonds Drop on Debt Renegotiation Talks

December 15, 2023

Ecuador’s Dollar Bonds Rise on VAT Increase Resolve

February 8, 2024