This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

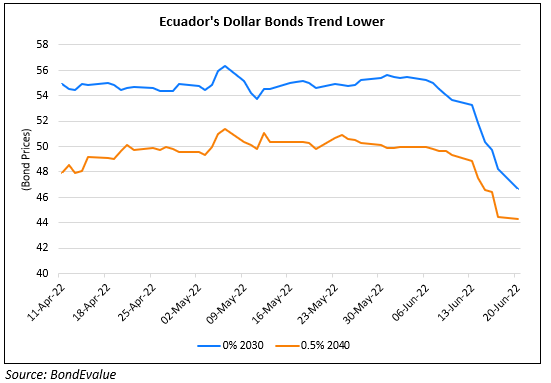

Ecuador’s Dollar Bonds Drop on Fewer Positive Catalysts

May 20, 2024

Ecuador’s dollar bonds dropped by 1-2 points across the curve, however the exact reason for the was not known. After Goldman Sachs and BancTrust shed their bullish calls on Ecuador notes, BofA analysts also joined them in downgrading their call on Ecuador’s bonds to market-weight from overweight. BofA cited that frequent electricity blackouts coupled with weak economy could reduce the popularity of President Daniel Noboa’s administration. They also cited presence of fewer positive catalysts following the sharp rally witnessed by the Ecuador bonds.

Its 3.5% 2035s dropped by 1.7 points to trade at 51.9 cents on the dollar, yielding 17.38%.

Go back to Latest bond Market News

Related Posts:

Ecuador’s Dollar Bonds Drop over 10% Last Week

June 20, 2022

Ecuador Bonds Drop on Debt Renegotiation Talks

December 15, 2023

Ecuador’s Dollar Bonds Rise on VAT Increase Resolve

February 8, 2024