This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ecuador Plans Return to Bond Market After 6 years

January 26, 2026

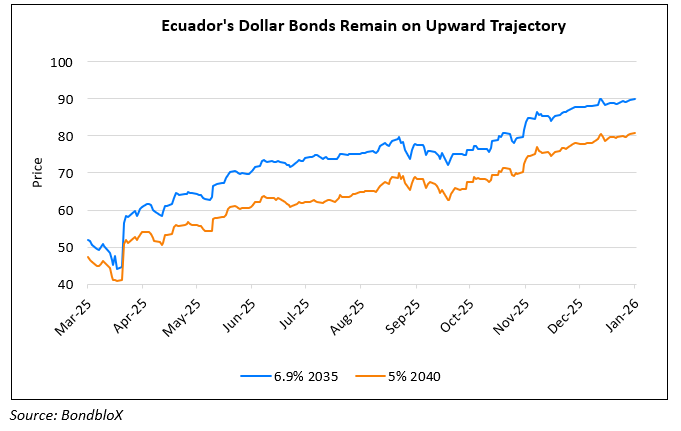

Ecuador is planning its first international bond sale since 2019, aiming to raise up to $4bn, potentially as soon as next week, according to sources. The government is considering a multi-tranche offering, possibly including 7Y and 12Y bonds, and may also add a 30Y maturity, though plans are not yet final. Finance Minister Sariha Moya said the government expects yields below 10%, inline with 7-9% yields on Ecuador’s outstanding dollar bonds. The potential deal comes amid strong emerging-market issuance, with EM sovereigns selling $65bn in hard-currency debt so far this year, up over 75% YoY, as per Bloomberg. Ecuador had restructured $17.4bn of its debt during the pandemic. Its dollar bonds have been standout performers over the last year as seen in the chart below, following President Noboa’s victory in April.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018