This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ecuador, Goldman, Aramco and Others Price $ Bonds

January 27, 2026

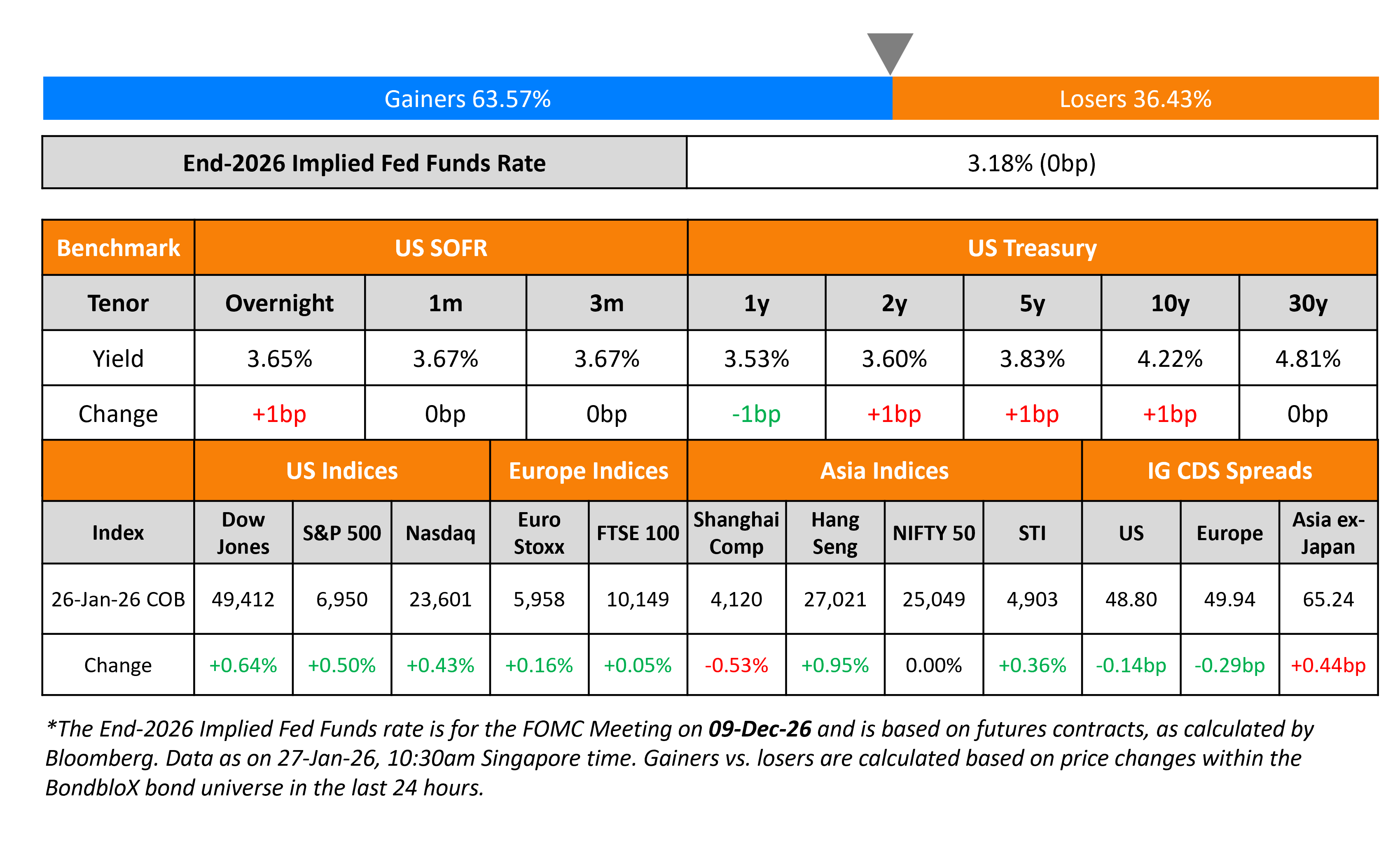

US Treasury yields were stable on Monday. The delayed preliminary Durable Goods print for November grew by 5.3% beating expectations of 4.3%. Similarly, the Capital Goods Orders print came in at 0.7% beating expectations of 0.3%. Markets are pricing-in no change in the Fed Funds Rate in the two-day FOMC meeting that begins today.

Looking at US equity markets, the S&P and Nasdaq ended 0.4-0.5% higher. US IG CDS spreads tightened by 0.1bp and HY CDS spreads were 0.8bp tighter. European equity indices ended higher too. The iTraxx Main CDS spreads were 0.3bp tighter and the Crossover CDS spreads were 0.3bp tighter. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were wider by 0.4bp.

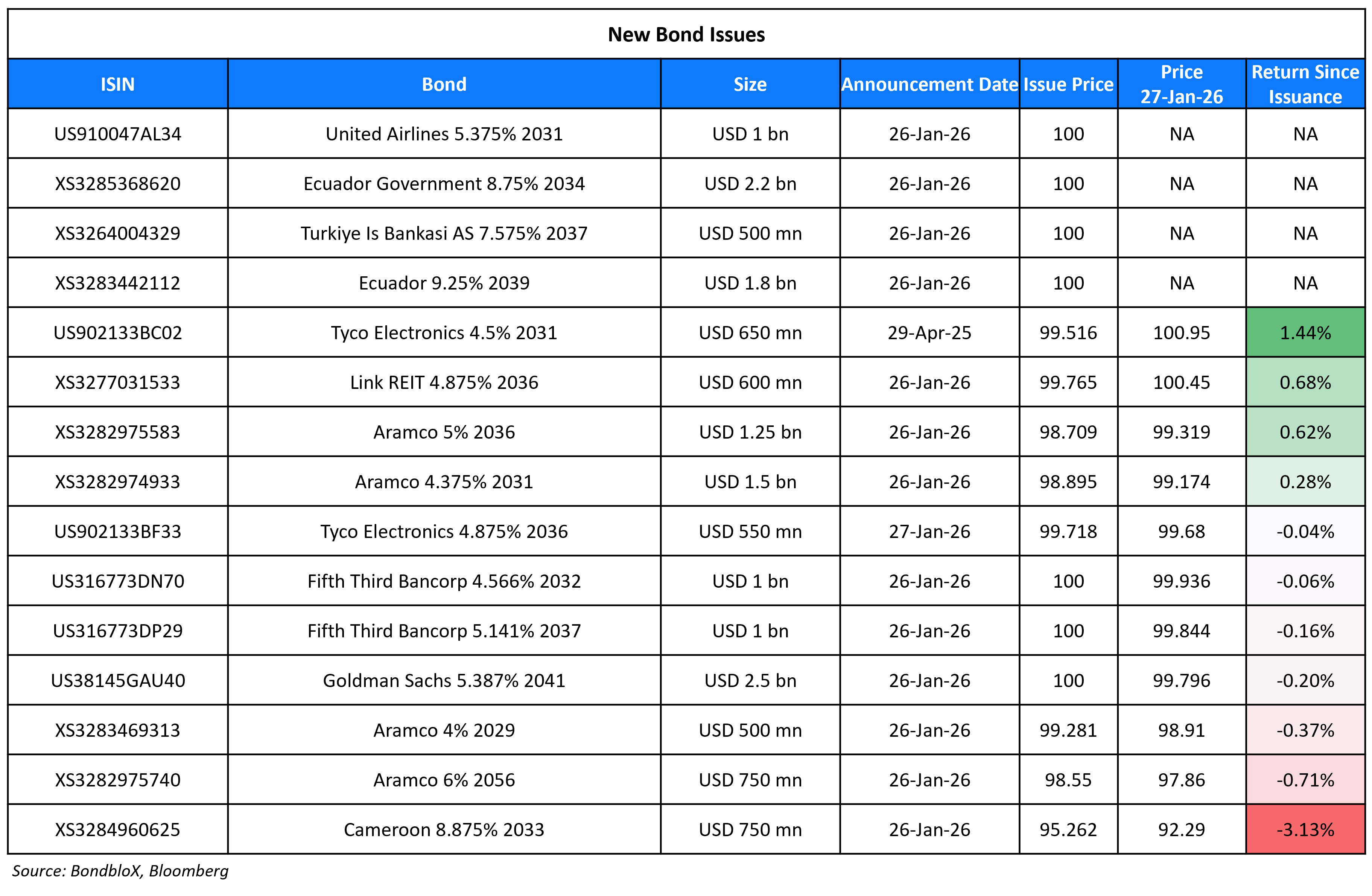

New Bond Issues

- Macquarie Bank $ 2Y/2Y FRN at T+60bp/SOFR eq. areas

- PT Perusahaan Listrik Negara $ 5Y/10Y at 5.15%/5.85% areas

- Hong Kong Electric $ 10Y at T+100bp area

- Ausnet A$ 30NC10 FXD/FRN at SQ ASW/3mBBSW + 205-210bp areas

Ecuador raised $4bn via a two-tranche offering. It raised $2.2bn via an 8Y bond at a yield of 8.75%, 62.5bp inside guidance of 9.375% area. It also raised $1.8bn via a 13Y bond at a yield of 9.25%, 62.5bp inside initial guidance of 9.875% area. The senior unsecured notes are rated B-/B- (S&P/Fitch). Proceeds will be used for general budgetary purposes and for refinancing of outstanding bonds due 2030 and 2035.

United Airlines raised $1bn via a 5Y bond at a yield of 5.375%, 12.5bp inside initial guidance of 5.50% area. The senior unsecured bond is rated Ba1/BB+/BB+ (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes, including future debt repayment.

Goldman Sachs raised $2.5bn via a 15NC10 bond at a yield of 5.387%, 22bp inside initial guidance of T+140bp area. The subordinated note is rated Baa2/BBB/BBB+ (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

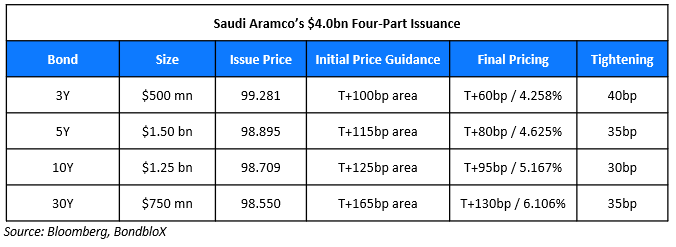

Saudi Aramco raised $4bn via a four-trancher. It raised:

The senior unsecured notes are rated Aa3/A+ (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

Turkiye Is Bankasi AS (ISCTR) raised $500mn via a 11NC6 Tier-2 bond at a yield of 7.575%, 42.5bp inside initial guidance of 8.00% area. The subordinated note is rated B by Fitch, and received orders of over $1.2bn, 2.4x issue size. Proceeds will be used for general corporate purposes.

Link REIT raised $600mn via a 10Y bond at a yield of 4.875%, 35bp inside initial guidance of T+105bp area. The senior unsecured note is rated A by S&P. The issuer is Link Finance Cayman 2009 Ltd. and the notes are guaranteed by entities of Link REIT. Proceeds will be used for general corporate purposes.

The Republic of Cameroon raised $750mn via a 5Y bond at a yield of 10.125%. The senior unsecured notes are rated B-/B (S&P/Fitch). Proceeds will be used for general budgetary purposes.

New Bonds Pipeline

- Bahrain $ Long 8Y sukuk and $ 12Y

- Watercare Services A$ 5.5Y/10Y bonds

- Banco BTG Pactual investor calls

Rating Changes

- Newfold Digital Holdings Group Inc. Upgraded To ‘CCC+’ Following Debt Restructuring, Rating Off Watch, Outlook Stable

- Moody’s Ratings upgrades Calpine Corporation and affirms Constellation Energy Generation

- Fitch Downgrades Kosmos Senior Unsecured Rating to ‘CCC’; Affirms ‘CCC+’ IDR

- Fitch Downgrades SES to ‘BBB-‘; Outlook Stable

Term of the Day: Pre-Capitalized Securities (P-Caps)

Pre-Capitalized Securities or P-Caps, refer to a unique type of asset-backed security issued by a company that gives it access to raising debt funding. They are considered to be similar to a revolving credit facility, but can be much longer dated (going over 10 years) with less counterparty risk. The benefit that P-Caps offer is that they are held off the balance sheet, in a trust until the company eventually needs the funds. Hence, they do not contribute to financial leverage. Besides, they also offer a standby credit facility to the issuer providing them immediate liquidity especially in times of stress events. As per Santander, P-Caps are mostly issued by insurance companies and trade in the secondary market typically at a discount to comparable senior unsecured bonds from the same company. They add that P-Caps are generally rated in-line with senior debt.

Talking Heads

On Dialing Back Corporate-Debt Buying Fearing Stocks Correction – Robert Cohen, DoubleLine

“This year is going to be the risk-building year. You have more risk, less spread. It’s the worst scenario… We’re in a credit expansion phase. This is where credit risks build”

On Wary of Bonds as Inflation Risks From Government Spending, AI Grow – Bridgewater

“It depends on how willing buyers are to hold an ever-expanding supply of debt and what it takes to entice the next marginal buyer… With limited room for central banks to lower rates proactively, and with quantitative tightening continuing in Europe and Japan (with global spillovers), we see a challenging environment for bonds and favor equities”

On Looming Fed rate pause nudges bond investors back into risk

Tony Rodriguez, Nuveen

“When you factor in the policy implementation that’s happening over the course of the next few quarters, like new tax cuts and some of the fiscal impact of the previous Fed rate cuts all coming through the economy, a pause makes a lot of sense”

John Flahive, Insight Investment

“We have been telling our clients to … get out of cash, but don’t be overly aggressive within your fixed income portfolios, mainly based on valuations, which are not supportive”

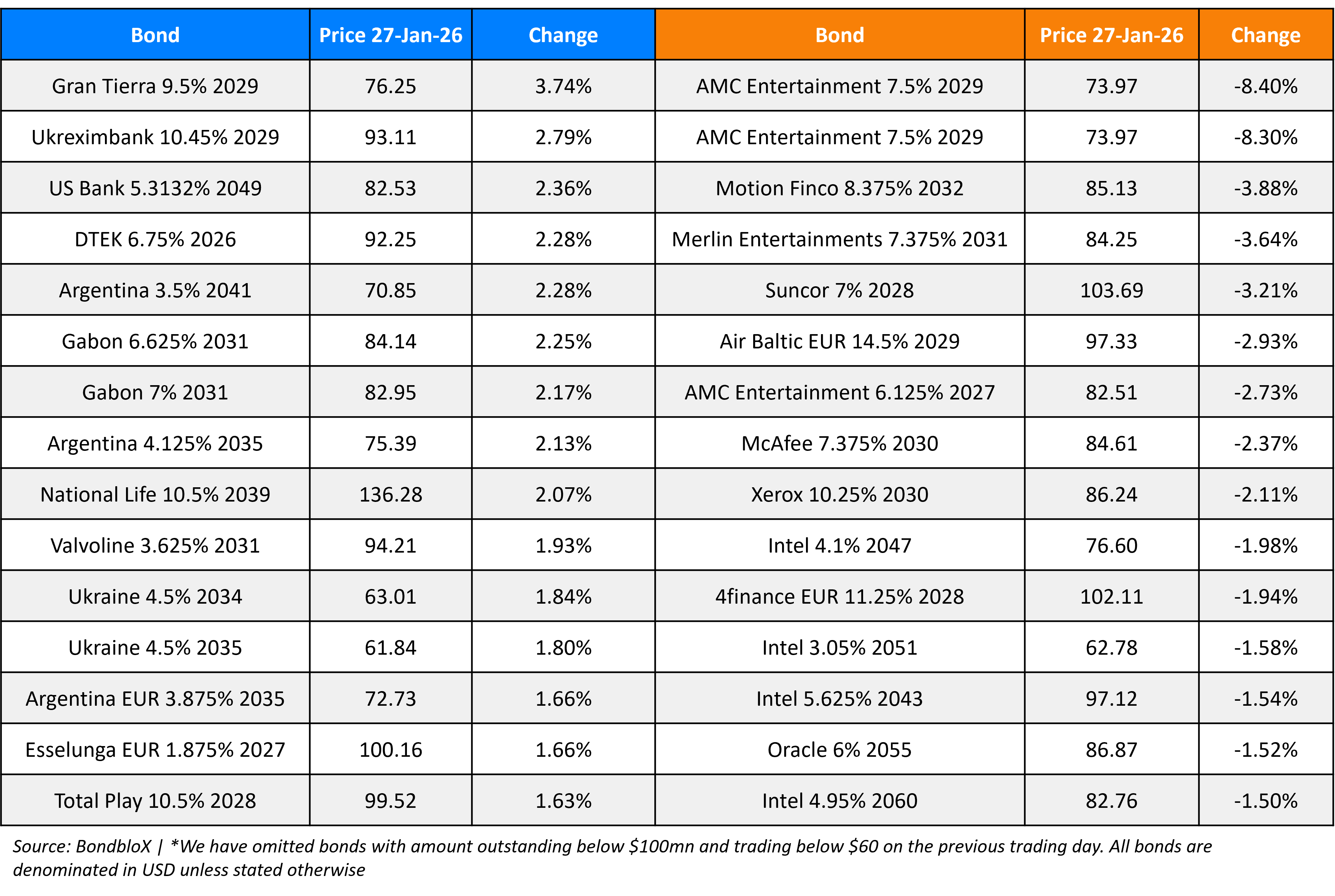

Top Gainers and Losers- 27-Jan-26*

Go back to Latest bond Market News

Related Posts: