This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ECB Cuts Rates by 25bp

December 13, 2024

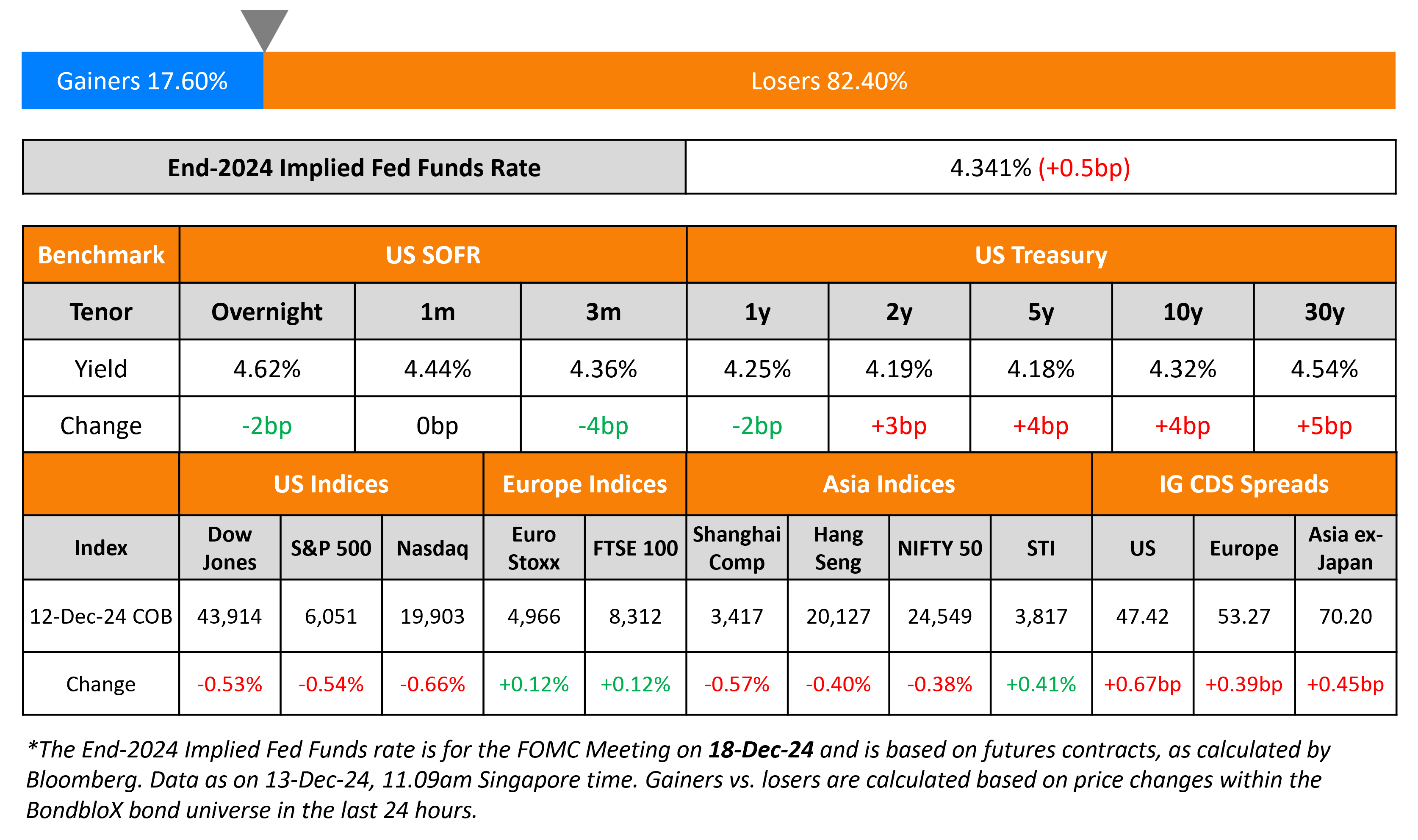

US Treasury yields rose by 3-5bp across the curve. US PPI rose by 3% YoY in November, higher than expectations and the revised prior month’s reading of 2.6%. Initial jobless claims for the previous week rose rose to a two-month high, rising by 242k, worse than expectations of 220k.

US IG and HY CDS spreads widened by 0.7bp and 3.6bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 0.5% and 0.7% lower respectively. European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.4bp and 3.3bp respectively. Asian equities have opened higher this morning. Asia ex-Japan CDS spreads were 0.5bp wider.

New Bond Issues

.png)

Rating Changes

-

Fitch Upgrades Zorlu RES to ‘B+’; Withdraws Rating

-

Fitch Downgrades Victoria Plc to ‘B’; Outlook Negative

-

Moody’s Ratings revises Bristol’s outlook to stable from negative; affirms A2 rating

-

Moody’s Ratings places Nykredit Realkredit A/S’, Nykredit Bank A/S’ and Spar Nord Bank A/S’ long-term ratings on review for upgrade

New Bonds Pipeline

- Scor hires for € PerpNC10 RT1 bond

Term of the Day

Deposit Facility Rate

The deposit facility rate (DFR) is one among the three key interest rates set by the ECB. This rate defines the interest rate that banks receive on the surplus liquidity that they deposit overnight in an account with a national central bank. The Eurosystem has several national central banks with ECB being the prime central bank that works with the other national central banks of all EU countries. There are two other key interest rates that the ECB governs – the rate on main refinancing operations (MROs) and the rate on the marginal lending facility (MLF). The MRO rate refers to the cost of borrowing for banks from the central bank for a period of one week. The MLF rate refers to the overnight rate that banks can borrow at from the central bank. The ECB cut rates yesterday with the DFR at 3%.

Talking Heads

On Credit Risks Rising as Demand Exceeds Supply – PineBridge

“Supply demand imbalance issue… the risk that it will lead to bad underwriting decisions…

On EU’s ‘Self-Inflicted’ Political Uncertainty – ECB President, Christine Lagarde

“Uncertainty that we are facing… whether it’s uncertainty resulting from political situations in some of the member states, whether it’s uncertainty resulting from the outcome in terms of policies of the US”… made the ECB’s fiscal forecasts “a little bit complicated”

On Bond Traders Make Risky Bets on Neutral Rate ‘No One Knows’

Greg Peters, PGIM Fixed Income

“It’s really, really volatile”

Thomas Kennedy, JPMorgan Private Bank

“You don’t know where the Fed is going to go. So you have to be either beholden to their volatility… you should really not be taking excessive risk here”

Henry McVey, KKR & Co.

Sell long-term bonds and load up on cash along with assets that have a “dividend or cash-flow characteristic that’s much more attractive with a higher neutral rate”

Top Gainers and Losers- 12-December-24*

Go back to Latest bond Market News

Related Posts: