This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Dr. Peng Extends Bond Maturity by 18m; Ascott to Not Redeem S$ 4.68% Perp; Hilong Revises Exchange Offer

June 1, 2020

A late rally on Wall Street on Friday should give comfort to markets this morning after President Trump delivered a calmer-than-expected response to China’s new security legislation for Hong Kong and did not threaten the progress made on the trade talks between US and China. Counter to this tone, violent protests in response to the death of George Floyd in the US now threaten to undermine a push to re-open the economy. European markets closed before the rally and ended Friday lower with both the main and crossover CDS spreads widening. US IG CDS spreads were unchanged on Friday but spreads for Asian dollar bonds tightened for a fifth straight week, the longest rally since July of last year. Asian markets are opening higher this morning with Hang Seng leading the way up 3.3%. In Latin America, Argentina is inching closer to a deal with bondholders after defaulting on its sovereign debt for a ninth time just over a week ago, with another government deadline approaching on Tuesday.

New Bond Issues

- Starhill Global REIT S$ 5yr @ 3.35% area

UAE Emirate of Sharjah Hires Banks for $1 Billion Sukuk Sale

Rating Changes

Fitch Downgrades Socgen’s Long-Term IDR to ‘A-‘; off RWN; Outlook Stable

British Airways debt now rated as ‘junk’ by all three major credit rating agencies

S&P Global re-affirms Bulgaria’s BBB credit rating, outlook revised to stable

Fed Release Shows ETFs Totaling $1.3 Billion Purchased In First Week

The Federal Reserve’s new facility for corporate bond purchases bought about $1.3bn worth of units in 15 exchange-traded funds (ETFs) in its first week of operation through 158 trades, data released Friday showed. Total purchases reached $1.3bn by May 18, though a separate release showed the figure swelling to roughly $3 billion by Wednesday. About $223mn of the Fed’s ETF holdings are focused on high-yield debt, exposing the central bank to firms at greater risk of default amid the coronavirus recession. According to figures released late on Thursday, $96bn of the Fed’s firepower has been deployed through the facilities, after accounting adjustments calculated by TD Securities, from $95bn a week earlier. That is still less than 4% of the at least $2.6tn the central bank has said it would make available across an unprecedented range of asset classes. Here are the top five ETF holdings of the Fed, purchased through its Secondary Market Corporate Credit Facility (SMCCF).

For more on this story, click here

Dr Peng Extends Maturity On Its Debut Bond By 18 Months

Dr. Peng Telecom & Media Group won approval from investors for a proposal to restructure its ~$422 million dollar bond, according to a filing to the Singapore Stock Exchange on Friday. The original bonds were sold by Dr Peng Holdings Hong Kong in May 2017 as its debut dollar transaction. The $500m 5.05% deal is set to mature on June 1. The company repurchased $77m of the notes in 2018. The maturity on the note will be extended by 18 months to Dec. 1, 2021. The issuer will repay the principal by installments and the interest rate on the note will be raised to 7.55% from 5.05% according to the filing. The bonds have been trading at 70 cents on the dollar on the secondary markets over the past two weeks.

For the full story, click here

Ascott Residence Trust Not Calling SGD 4.68% Perp on 30 June

Ascott Residence Trust will not be redeeming its S$250m, 4.68% fixed rate perpetual issue on 30 June, the REIT announced in an SGX filing. “The distribution rate applicable to the securities shall be reset on 30 June 2020 as the securities would not be redeemed on 30 June 2020,” the announcement read. The decision was made as the REIT moved to preserve cash flow and liquidity amidst the ongoing pandemic, which has led to lower demand for accommodation. The reset of the coupon is based on SDSW5 (SGD Swap SA 5Y) Index currently at 0.55% plus a spread of 250bp. The bonds are currently trading at 97.7 cents on the dollar.

For the full story, click here

Hilong Adds Cash to Its Exchange Offer

Hilong Holdings revised the terms for its exchange offer of its $165.114mn 7.25% bonds due Jun 22. Under the revised terms, holders will receive $90 worth of new 1.75-year dollar bonds due 2022 per $100 of principal of old notes. In addition, it is offering $10 in cash as an upfront consideration and $0.5 cash as an early incentive. The earlier exchange offer involved par-to-par exchange of notes with no cash component. The new bonds due 2022 are expected to be rated B/B2 and will have a minimum yield to maturiy of 9.75%. The deadline for the exchange offer has been extended to Jun 5, 4pm GMT. Hilong upped its threshold of minimum holders that need to tender their bonds from 75% to 80%.

Pemex ‘Well’ Short of Promise

Pemex has missed its production target on 22 priority fields by 75% reveals data from CNH, reported El Economista. The company also failed in meeting the production volumes. In Q1, NOC produced only 21.8 Mboe/d against a planned 89MMboe/d from 17 of the 20 fields put in production in 2019. The company has also fallen short on the drilling of wells as it drilled only 5 out of 15 planned in Q1. The failure to meet planned targets comes at a time when the company has been struggling with the outbreak of the coronavirus within its staff. Pemex reported that it has sustained 215 fatalities due to COVID-19 amongst its insured population, which included both the present staff as well as pensioners. It has recorded 1,500 confirmed cases including 35 cases in intensive care and 6,800 suspected cases. This has forced the company to scale back staffing on its platforms. The outbreak has adversely affected the its topline. The company has the largest debt amongst oil majors and the drop in its revenues due to falling demand for oil and declining oil prices have only added to the woes of the company.

For the full story, click here

Its dollar bonds have seen a large volatility. They dropped to a low in mid April. The slight upturn since then has been reversed due to its failure to meet its planned objectives, dropping revenues and spread of the novel coronavirus among its staff.

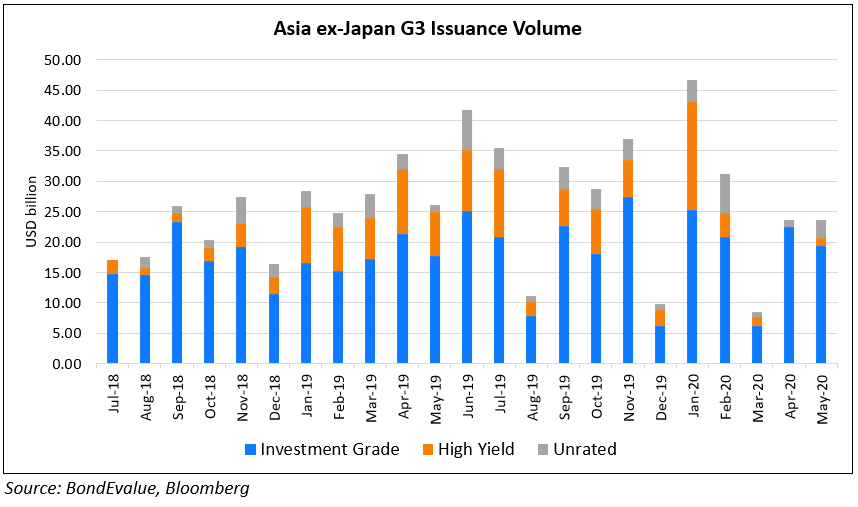

Asia Leads the Pack Among EMs to Raise Offshore Bonds

Asia ex-Japan G3 currency issaunce volume for May came in at $23.61bn, at par with April and almost 1.8x the issuance in March ($8.48bn). It was noteworthy to see high-yield or junk and unrated issuers tapping the dollar bond markets to raise funds. High yield and unrated issuance for May stood at $1.2bn and 3.02bn, vs. $0.04bn and $1.16bn in April, respectively. Chinese borrowers have dominated the high yield issuance with deals from real estate players such as Zhenro Properties and Fantasia. “In April, we saw Asia’s high-yield market returning, whereas we haven’t yet seen that in the Latam, Middle East or Africa complex,” according to Karan Talwar, senior investment specialist for emerging-market debt at BNP Paribas Asset Management in Hong Kong. He added that these high yield issuers have been successful in raising funds due to strong local investor demand. Total EM dollar bond issuance YTD (as on May 28) stands at $292, which is 18% higher than the same period last year. The chart below shows Asia ex-Japan G3 currency monthly issuance volume.

For the full story, click here.

Global Air Passenger Traffic to Fall by 50-55% in 2020; Recovery Will Take 2-3 Years – S&P Global & Fitch Ratings

According to a recent report by S&P Global Ratings, airports across the world will see a slow “swoosh-shaped” recovery in passenger traffic. It expects global air passenger traffic to fall by 50-55% in 2020 vs. 2019, and will remain below pre-pandemic levels till 2023. These estimates are significantly lower to its estimates in March of a decline of 20-30% in 2020 vs. 2019. S&P goes on to say that the path to air traffic recovery will depend not just on countries opening up its borders but also on airlines’ fleet capacity and route planning, passenger demand, and the overall economic impact of the pandemic. Given the financial stress that airlines are in and the expectation of lower passenger volume, S&P expects a fall in airports’ aeronautical revenues (50% of total revenues for airports), which consist of terminal rental space, airline landing fees and usage fees for gates. S&P has downgraded 11 airports and assigned negative outlooks/negative CreditWatch placements on 128 issuers and transactions since March 2020.

Fitch Ratings published a similar report wherein it forecast a drop of 50% in air traffic for EMEA (Europe, Middle East, Africa) airports and a drop of 20-30% for APAC airports in 2020 vs. 2019. It expects a recovery to 2019 levels by 2023 for EMEA and 2021-2022 for APAC. The table below summarizes the rating changes for airport authorities by both rating agencies.

Here is a chart of how airport authority’s bonds in our universe have performed over the last few months.

For the full story, click here

Surge in Issuance of Perpetual Bonds by Chinese Banks

There has been a surge in the issuance of perpetual bonds by Chinese banks. The issuance of the risky bank debt has spurred to 569.6 billion yuan ($79.6bn) in total issuance last year. As more unlisted city and rural lenders enter this arena, the potential risk to investors is said to have increased. However, it is interesting to note the appetite for these bonds despite the accompanying risks. Just last week, the unlisted Bank of Huzhou issued 1.2 billion yuan perps at 4.7% despite there being questions about the bank’s governance. Banks prefer perps to preference shares due to the associated tax sops. The first yuan denominated perp was issued by Bank of China last year. The present year has seen issuance of 274 billion yuan perpetual bonds, which is 5x that issued last year. The surge has come amidst a 6.8% contraction in the Chinese economy.

For full story, click here

IIFL Finance downgraded to B1

Moody’s downgraded India Infoline Finance (IIFL) to B1 from Ba3 on Friday amidst a stressed situation witnessed in the Indian NBFC sector due to challenges in liquidity. A similar fate was met by the senior secured debt and the senior secured programme rating of IIFL. IIFL had reported an 81% drop vs. last year (YoY) in net profits to Rs 58.91 crore in Q1 as a result of provisioning towards the impact of the pandemic. The consolidated income was down 13% YoY. Even though the company board has approved a bond issuance worth Rs 10,000 crore, the negative market sentiment could weigh heavily on this issuance. The company has to repay Rs 2,679 crore by September against cash and undrawn credit lines worth Rs 2,203 crore. Moody’s predicts that the disruptions from the pandemic are likely to weaken the credit fundamentals of companies in the Indian NBFC sector. IIFL’s 5.875% dollar bonds due 2023 are currently trading at 76 cents on the dollar, down over 23 points since issuance in Feb 2020.

For full story, click here

BEV Term of the Day

Social Sukuk

Social Sukuk is a Sharia-compliant asset class for raising funds to deliver better social outcomes. Through this system, the obligator (issuer of the bonds) pays back the principal plus a return to the social enterprise on achieving the promised social outcome. It is structured such that private and non-profit organisations can partner and be rewarded for the social mandate by the government or other organisations. This type of financial instrument has huge potential of providing financing solutions for some social issues affecting the community.

Talking Heads

On Secular Stagnation – Former US Treasury Secretary Lawrence Summers

In a recent Princeton Bendheim webinar, Mr Summers argues that the Covid-19 situation will trigger structural responses from households and businesses that will strengthen the forces of stagnation. Mr Summers believes risk aversion in the private sector will increase permanently, leading to more precautionary savings by households, and less investment by businesses. As he puts it, “just in case will replace just in time”, with the private sector wanting to hold greater financial reserves in case of further shocks to globalised markets. There may also be a long-lasting hit to labour utilisation — the productive deployment of people of working age — and reductions in consumer spending in sectors affected by social distancing until an effective vaccine is found.

On Dubai’s Recession & Looming Debt – Bank of America

Dubai could see a recession of around 5.5% in 2020 as it faces about $10 billion in debt maturities this year while revenues are expected to drop in line with the pattern of the 2009 crisis. Bank of America estimates that Dubai’s fiscal deficit could widen to $4.4 billion, or 3.9% of GDP, and could be as high as 5.3% if interest payments on a loan from Emirates NBD, Dubai’s biggest lender, are included.

In April, we saw Asia’s high-yield market returning, whereas we haven’t yet seen that in the Latam, Middle East or Africa complex…While we do expect the severe market disruption to result in default rates rising from recent low levels, we do not expect EM corporate bond default rates to be as high as implied by current spread levels.

Top Gainers & Losers – 1-Jun-20*

Go back to Latest bond Market News

Related Posts: