This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

DirecTV Announces Acquisition of Dish; Dish DBS Launches Exchange Offer

October 1, 2024

DirecTV announced a deal to acquire EchoStar’s satellite television business, which includes Dish Network. The transaction will involve DirecTV paying $1 for Dish DBS (which includes Dish and Sling TV) while assuming approximately $9.75bn in Dish’s debt. To facilitate the deal, Dish DBS debt holders will need to take a haircut of $1.57bn on their principal. The acquisition will also help EchoStar reduce its debt burden from over $20bn to a consolidated debt by $11.7bn. Additionally, EchoStar will receive $2.5bn in financing from TPG’s credit unit and DirecTV to help address a $2bn bond due in November. The deal also allows AT&T to exit its 70% stake in DirecTV, which it sold to TPG for $7.6bn, following a three-year agreement that limited its ability to sell the stake. The proposed merger between DirecTV and Dish may challenge regulators’ willingness to approve consolidation in the television industry, especially considering the significant changes in the media landscape since their first attempted merger in 2002. This merger was blocked by the FCC and DOJ.

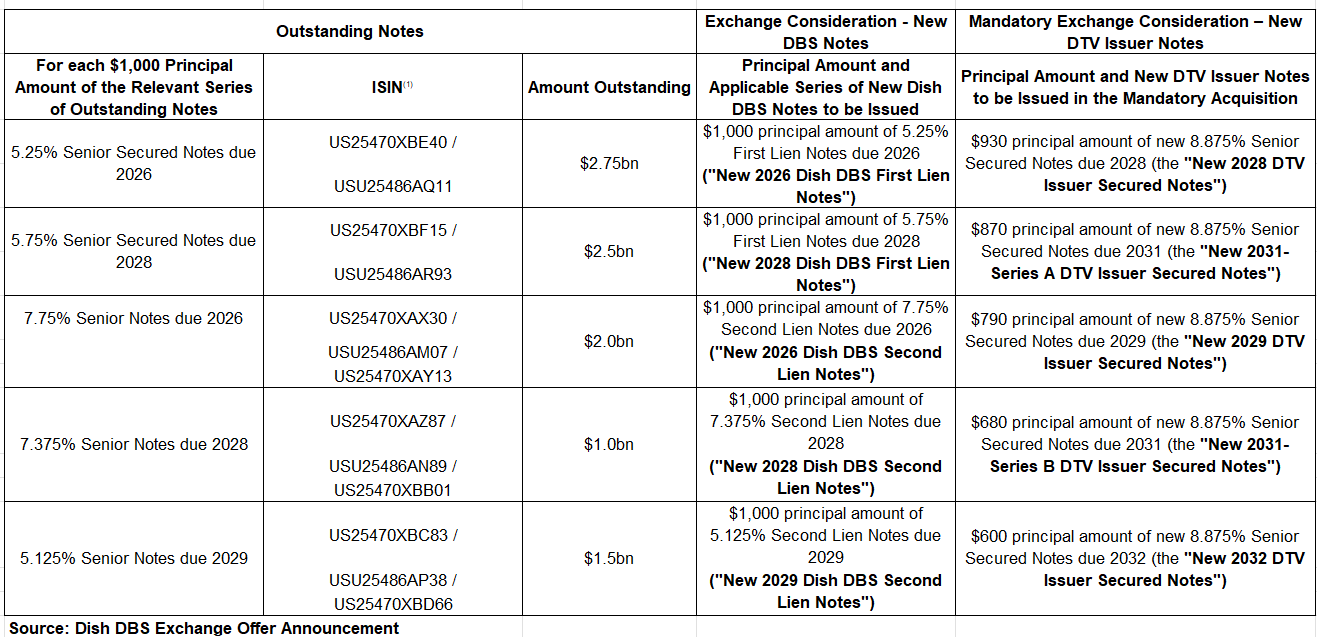

Separately, Dish DBS commenced an exchange offer for its various various senior secured and senior notes. It will issue new notes with terms similar to existing outstanding notes to facilitate Dish’s acquisition by DirecTV Holdings. The newly issued notes will include:

- New Dish DBS First Lien Notes (2026 and 2028): These will be senior secured obligations guaranteed by certain subsidiaries and secured by first-priority liens on most assets, including a pledge of equity from DISH DBS Issuer LLC.

- New Dish DBS Second Lien Notes (2026, 2028, and 2029): These will also be senior secured obligations, guaranteed by the same subsidiaries, but secured by second-priority liens on assets.

The exchange offer also states that if acquisition is completed by 29 December, 2025, the noteholders agree to their notes getting mandatorily exchanged for new notes issued by DirecTV Financing, with no further action required from them. If the acquisition does not occur by the deadline, the new notes will remain outstanding separately. The terms of the exchange can be found in the table above:

Dish’s bonds traded mixed, with its 7.375% 2028s dropping by 4.6 points to 74.9 cents on the dollar, while its 5.25% 2026s trading up by 0.1 points to 93.6, yielding 8.53%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

DISH’s Bonds Plummet on Poor Earnings

November 7, 2023

Dish Nears Restructuring Deal with Convertible Bondholders

September 26, 2024

Dish Network and DirectTV Close In on Merger Agreement

September 27, 2024