This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

DIB Launches $ Perp; BNP, Ecopetrol, Sharjah Price Bonds

October 9, 2024

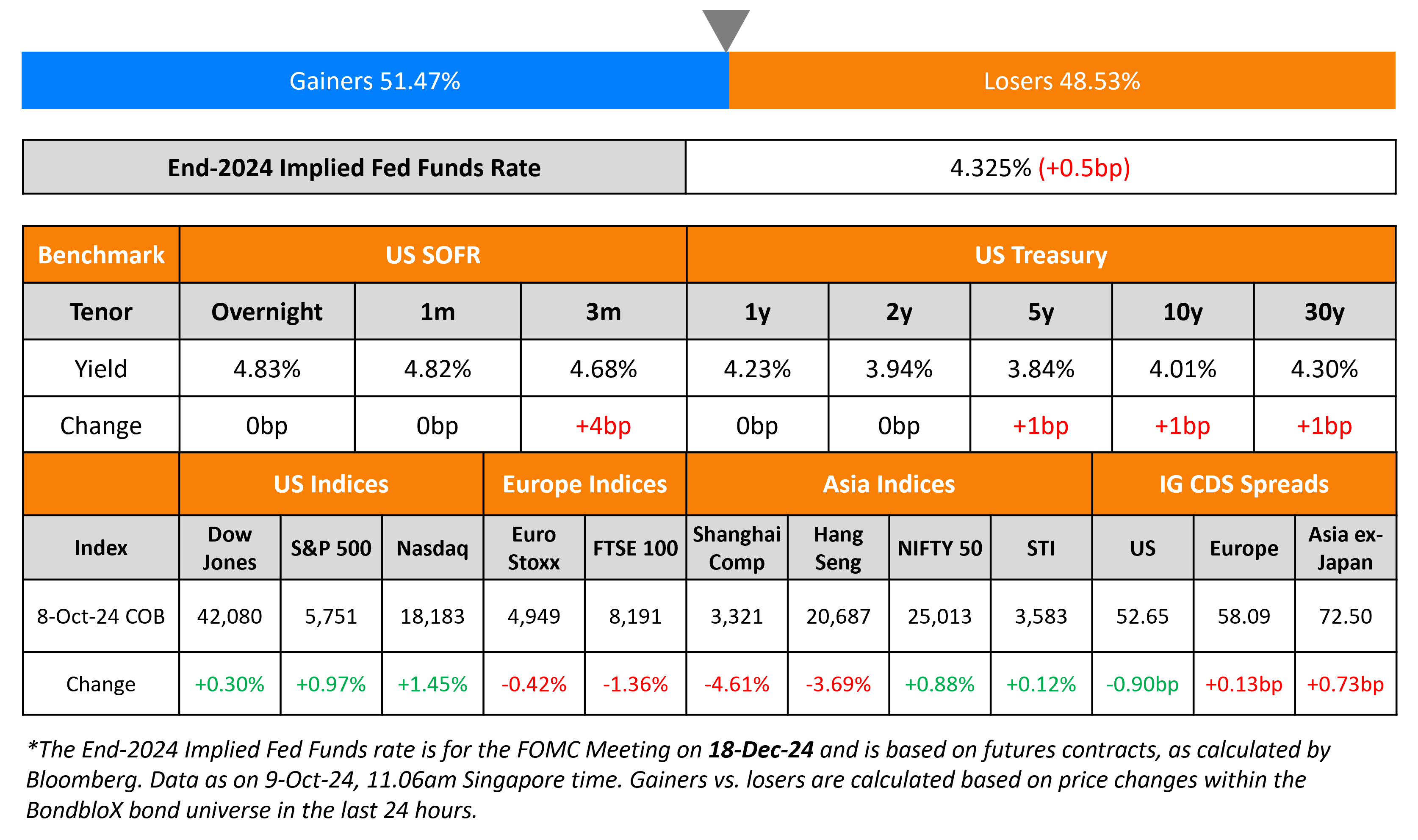

US Treasuries yields remained largely unchanged as of yesterday. The 3Y US Treasury auction saw weak demand, with a bid-to-cover of 2.45x (vs. 2.66x last month) and an indirect acceptance rate of 56.9%. The final yield for the 3Y note stood at 3.88% (vs. 3.44% last month). Aside from this, Fed Vice-Chairman Philip Jefferson and Atlanta Fed President Raphael Bostic both expressed similar dovish sentiments regarding the central bank’s future rate cut path, stating that the risks posed to both the inflation rate and the labor market must be balanced. Both individuals have reiterated that the Fed will take the rate cut decisions meeting by meeting, taking into account the incoming economic data as they get released. US IG CDS spreads tightened by 0.9bp, and HY CDS remained flat. US equity markets ended in the green with the S&P and Nasdaq closing 1.0% and 1.5% higher respectively.

European equity markets ended lower. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.1bp and 1.2bp respectively. Asian equity indices have opened broadly mixed as of this morning. Asia ex-Japan IG CDS spreads saw a 0.7bp widening.

New Bond Issues

-

Dubai Islamic Bank $ PerpNC6 Sukuk at 5.75% area

BNP Paribas raised S$550mn via a 10.5NC5.5 Tier 2 bond at a yield of 3.95%, 25bp inside initial guidance of 4.2% area. The subordinated notes are rated Baa2/A-/A. The issuer may redeem the notes at par upon the occurrence of a capital, tax deduction, withholding tax or gross-up event (subject to conditions including regulatory approval). The new bonds are priced at a new issue premium of 8bp over its existing 4.75% Tier 2s due 2034 (callable in February 2029) that yield 3.87%.

Ecopetrol raised $1.75bn via a long 7Y bond at a yield of 7.65%, 35bp inside initial guidance of 8% area. The senior unsecured bonds are rated Ba1/BB+/BB+. The new bonds are priced at a new issue premium of 31bp over its existing 4.625% 2031s that currently yield 7.34%. Proceeds will be used to (a) purchase its 2026s under the tender offer and pay related expenses (b) prepay a portion of the outstanding principal under its 2030 Loan Agreement; and/or (c) finance expenditures outside its investment plan. The company launched a tender offer to buy back any and all of its 5.375% 2026s (currently trading at 100.7, yielding 4.9%), with the offer expiring on October 15.

Standard Chartered raised $1.5bn via a 6NC5 bond at a yield of 5.005%, 30bp inside initial guidance of T+145bp area. The subordinated notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes. The notes have a clean up Call wherein the Issuer may redeem them in whole, at any time, at par, if 75% or more of the notes have been redeemed. The new bonds are priced at a new issue premium of 14bp over its existing 4.305% 2030s (callable in May 2029), that yield 4.86%.

Sharjah raised $750mn via a 10.5Y sukuk at a yield of 5.433%, 35bp initial guidance of T+175bp area. The senior unsecured notes are rated Ba1/BBB-. The issuer is Sharjah Sukuk Program Ltd (SHARSK).

Rating Changes

-

Lumen Technologies Inc. Upgraded To ‘CCC+’ On Bolstered Liquidity From Contract Wins; Outlook Developing

-

Boeing Co. Ratings, Including Its ‘BBB-‘ Issuer Credit Rating, On CreditWatch Negative On Strike-Related Financial Risk

-

Sun Hung Kai Properties Outlook Revised To Negative On Weakening Property Development Margins; ‘A+’ Ratings Affirmed

Term of the Day

Bond Buyback

A bond buyback is a mechanism where the issuer repurchases its bonds from bondholders in the open market. They work similar to share buybacks wherein the principal gets reduced by the amount bought back and the bonds tendered by bondholders get cancelled. Issuers buy back bonds so that they can reduce their overall debt and thereby interest expenses over time, using it as a liability management strategy. If the bonds are trading cheaper than its issue price, the issuer would find it particularly more attractive to buyback bonds. Tender offers are a form of buyback where bondholders could get either cash or new bonds of equivalent value at a specified price.

Talking Heads

On Turbulent US Funding Market Forewarns of a Volatile End to 2024

Peter Nowicki, Wedbush Securities

“Year-end is now a bigger issue given the volatility” at quarter-end

Jan Nevruzi, TD Securities

Companies are less likely to transact in “low margin businesses.”

On Bond Market lacking anchor for Fed Rate-Cut Path – Mohammed El Erian

“Markets are all over the place. In the last 15 days the probability of a 50bp cut in November has gone from over 60% to zero. November is next month. That is how much uncertainty there has been in this market. These are massive moves based on data points”

On Not Seeing the Fed Making ‘Significant’ Rate Cuts – Ray Dalio

“The economy right now is in relatively good balance… We have an unusual supply-demand situation (with US Treasury bond markets)… Foreign countries worry about holding bonds (they could be sanctioned)”

Top Gainers & Losers 9-October-24*

Go back to Latest bond Market News

Related Posts:

US GDP Softens; KIB Prices $ AT1

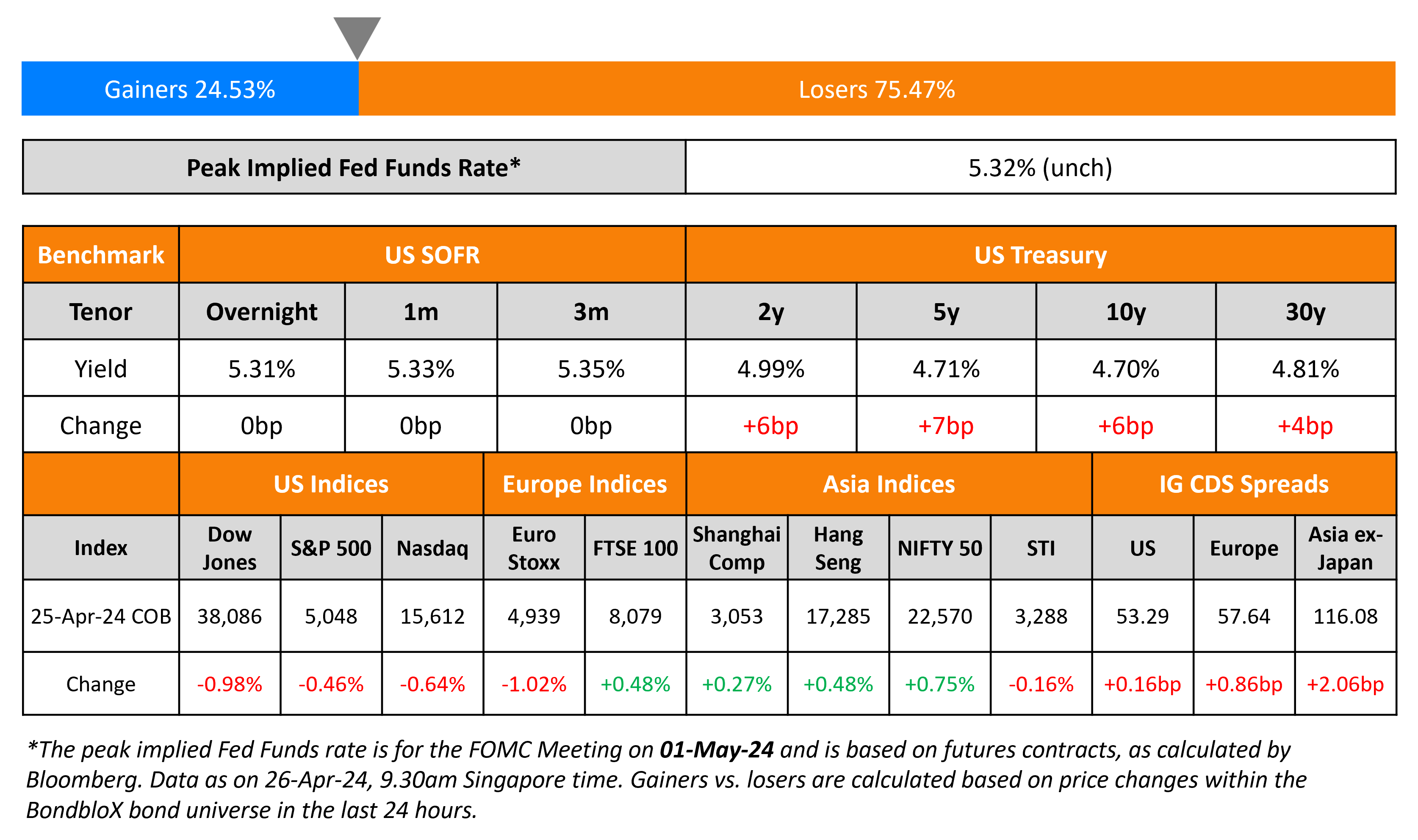

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024