This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Deutsche Bank Prices €1.5bn AT1

June 4, 2024

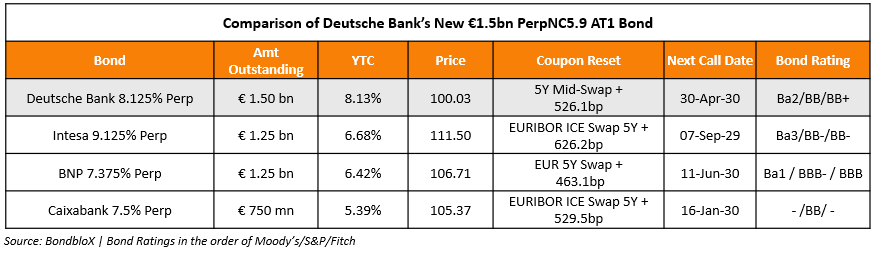

Deutsche Bank raised €1.5bn via a PerpNC5.9 AT1 bond at a yield of 8.125%, 62.5bp inside initial guidance of 8.75% area. The junior subordinated bonds are rated Ba2/BB/BB+, and received orders of over €10bn, 6.7x issue size. Coupons are fixed until 30 April 2030 and if not redeemed, resets then and every five years thereafter at the 5Y MS+526.1bp. A trigger event would occur if at any time, the CET1 ratio, determined on a consolidated basis, falls below 5.125%. Above is a comparison of the newly issued perp with other European banking peers.

Go back to Latest bond Market News

Related Posts: