This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Dell, Petronas, UOB Price $ Bonds

March 27, 2025

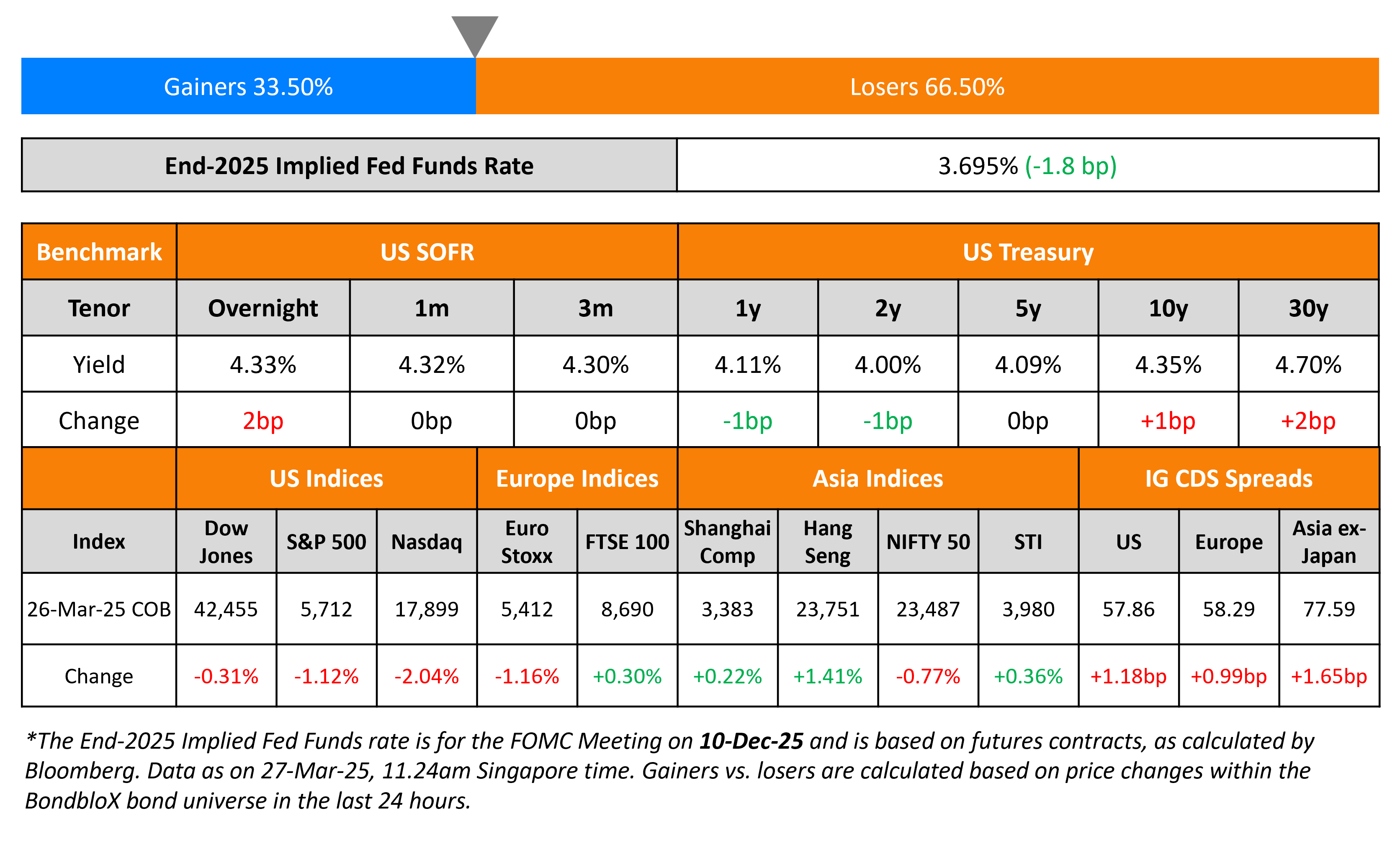

US Treasury yields held steady across the curve. US President Donald Trump signed an executive order to impose a 25% tariff on automobiles and auto parts’ imports from April 2. On the data front, US preliminary durable goods orders for February rose by 0.9% MoM vs. expectations of -1.0% and the prior month’s revised 3.3% print. Core durable goods orders rose 0.7%, higher than expectations of 0.2% and the prior month’s revised 0.1% print.

US equity markets moved lower, with the S&P and Nasdaq down by 1.1% and 2% respectively. Looking at credit markets, US IG and HY CDS spreads widened 1.2bp and 7.3bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 1bp and 8bp respectively. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were wider by 1.7bp.

New Bond Issues

-

BPI $ 5Y/10Y at T+130 / 155bp area

-

QBE Insurance $ 10.5NC5.5 at T+200bp area

- Perennial Holdings S$ 3Y at 5.75% area

Dell International raise $4bn via a four-part issuance. Details are given in the table below:

The senior unsecured bonds are rated Baa2/BBB/BBB. All the bonds have a change of control put at 101. Proceeds will be used for general corporate purposes, which may include repayment of debt.

UOB raised $2bn via a three-trancher. It raised:

- $800mn via a 3Y bond at a yield of 4.401%, 35bp inside initial guidance of T+75bp area

- $900mn via a 3Y FRN at SOFR+58bp vs. initial guidance of SOFR equivalent

- $300mn via a 5Y FRN at SOFR+65bp vs. initial guidance of SOFR+90bp area

The senior unsecured bonds are rated Aa1/AA-/AA-. Proceeds will be used for general corporate purposes.

Petronas Capital Ltd raised $5bn via a three-part offering. It raised:

- $1.6bn via a 5Y bond at a yield of 4.986%, 30bp inside initial guidance of T+120bp area

- $1.8bn via a 10Y bond at a yield of 5.34%, 30bp inside initial guidance of T+130bp area

- $1.6bn via a 30Y bond at a yield of 5.848%, 35bp inside initial guidance of T+150bp area

The senior unsecured bonds are rated A2/A-, and are guaranteed by Petroliam Nasional Bhd. Proceeds will be used for general corporate purposes.

Morocco raised €2bn via a two-trancher. It raised €900mn via a 4Y bond at a yield of 3.937%, 35bp inside initial guidance of MS+190bp area. It raised €1.1bn via a 10Y bond at a yield of 4.843%, 35bp inside initial guidance of MS+250bp area. The senior unsecured bonds are rated Ba1/BB+. Proceeds will be used to partially finance the 2025 budget deficit.

Rating Changes

-

Moody’s Ratings upgrades NVIDIA’s senior unsecured rating to Aa2; outlook positive

-

Baker Hughes Upgraded To ‘A’ From ‘A-‘ On Expanding Industrial Energy Technology Business, Improving Margins, Outlook Stable

-

Moody’s Ratings upgrades Cenovus to Baa1; stable outlook

-

Fitch Upgrades UNE EPM’s Ratings to ‘BB+’; Outlook Stable

-

Dun & Bradstreet Holdings Ratings Put On CreditWatch Negative On Announced Acquisition By Clearlake Capital Group L.P.

-

Sharjah Islamic Bank ‘A-/A-2’ Ratings Affirmed; Outlook Revised To Negative From Stable On Capital Pressure

Term of the Day: Convertible Bonds

As the name suggests, convertible bonds are debt instruments issued by a company where the bonds can be converted into equity shares of the company by the bondholders at a particular ratio and at particular points in time. Thus, it is a hybrid security as it has characteristics of both debt and equity. Convertibles generally carry a lower coupons and sometimes tax advantages for the issuer.

Talking Heads

On Warning Fed Chair Powell Could Be Fired by Trump – US Senator, Elizabeth Warren

“If he can just mow through every civil servant, if he can just mow through the Consumer Financial Protection Bureau, it’s a form of lawlessness and all the power belongs to the king”

On Bets of US Weakness Fueling a Rally Across EMs

Bob Michele, JPMorgan Asset Management

“For the past few years, investors have piled into US assets and more-developed markets… when you look at valuations, emerging markets look cheap”

Ashmore Group

“The end-of-US-exceptionalism-trade has a long way to run”

Edwin Gutierrez, aberdeen group

“Trumponomics probably presents the most genuine challenge to US exceptionalism that we’ve seen”

On Seeing Korean Convertible Boom as Shorting to Resume

Arnaud Gernath, Lombard Odier

“Lifting the short-sale ban will be a game changer for the convertible bond primary market.. expect new and former convertible bond issuers to come to the market.”

Top Gainers and Losers- 27-March-25*

Go back to Latest bond Market News

Related Posts: