This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Damac Upgraded to BB+ by S&P; View Popular UAE Real Estate Dollar Bonds

November 6, 2025

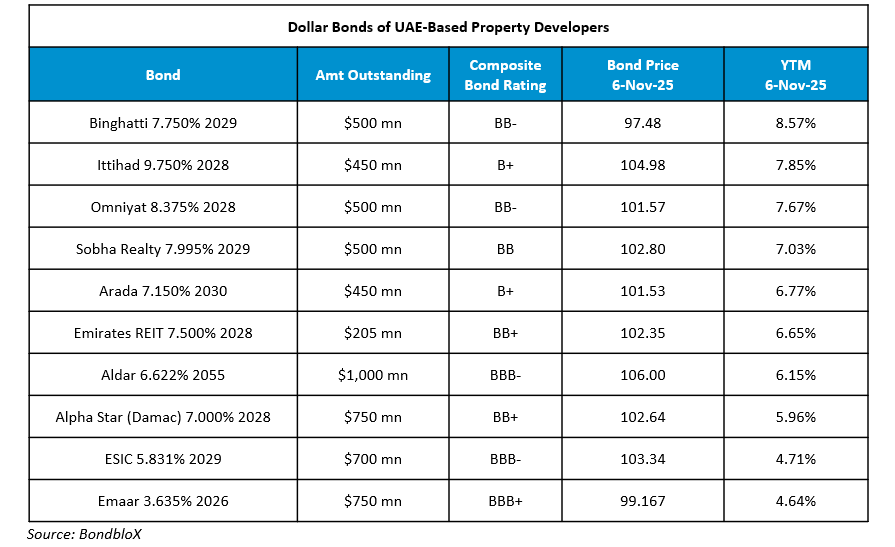

Damac Real Estate Development (Alpha Star) and its senior unsecured sukuk were upgraded by a notch to BB+ from BB by S&P. The upgrade reflects the developer’s strong revenue visibility, robust presales, and improved financial profile amid Dubai’s buoyant residential real estate market. The upgrade also reflects Damac’s conservative financial policy, strong liquidity (with about $6.7bn in cash as of end-September), along with its solid brand and market position. As of end-September, Damac’s revenue backlog rose 11% YoY to $20bn, with 70–80% of projects already presold, ensuring high visibility of earnings over the next two to three years. The company, Dubai’s second-largest developer after Emaar, has achieved $6bn in sales YTD, with over 54,000 units in its pipeline. Revenue is projected to rise to $4.0–4.3bn in 2025 and to $5.0–5.3bn in 2026, up from $3.3bn in 2024, supported by steady handovers and robust demand. S&P expects operating cash flow of $2.0–2.7bn annually in 2025–2026, despite continued land acquisitions and dividend payouts. EBITDA is forecast to grow to $1.2–1.3bn in 2025 and $1.6–1.7bn in 2026, with debt-to-EBITDA improving modestly to 1.2x–1.6x. However, financial headroom remains limited, they noted, given the likelihood of refinancing a $400mn sukuk due 2026 and rising dividends. Its dollar bonds traded stable with its 7% 2028s at 102.64, yielding 5.96%.

In a recent report, S&P said that most rated developers in Dubai will continue to post strong profits over the next two years, driven by price appreciation. It added that well-established developers have sound financial positions which will help offset potential deterioration in sales and market sentiment. In this light, we have populated a list of the dollar bonds of popular UAE-based property developers below, sorted by the YTM.

Go back to Latest bond Market News

Related Posts: