This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CVS Planning Up to $2.5bn Bond Issuance for Buying Back Notes Including 2025s

December 3, 2024

CVS is planning to issue up to $2.5bn in bonds, with investor calls having been arranged. The bond sale, expected as early as Tuesday, will include hybrid notes with characteristics of both debt and equity. The proceeds will be used for a debt repurchase, with CVS planning to buy back up to $2bn in bonds, including its $950mn 4.1% 2025s. The buyback is part of its strategy to manage debt after significant acquisitions, including its ~$70bn purchase of Aetna in 2018. Moody’s is reviewing a potential downgrade, while S&P is also said to consider lowering its rating. However analysts note that CVS’s buyback offer signals confidence in its liquidity and debt refinancing capabilities. The company had about $80bn in long-term debt as of June 30.

Go back to Latest bond Market News

Related Posts:

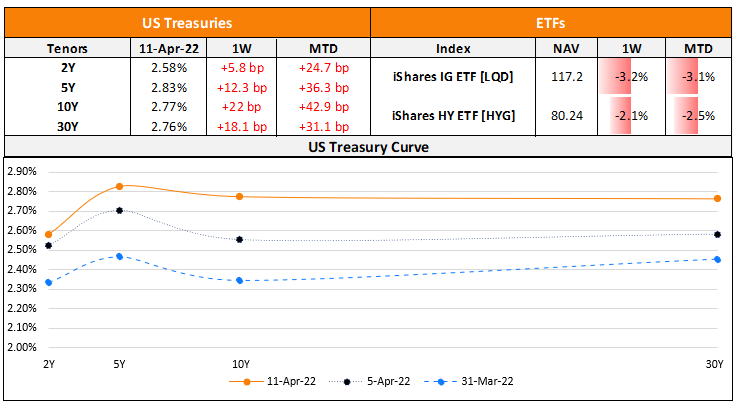

Goldman, JPM and Wells Smash Estimates With Solid Q1

April 15, 2021

JPMorgan, Morgan Stanley Report Earnings Drop

July 15, 2022

The Week That Was (April 4 – 10, 2022)

April 11, 2022