This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

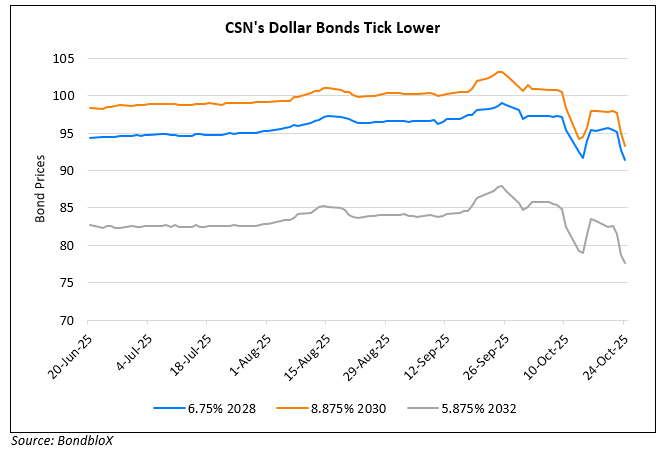

CSN’s Dollar Bonds Drop as Concerns Rise Regarding Leveraged Brazilian Companies

October 24, 2025

Companhia Siderurgica Nacional SA’s (CSN) dollar bonds fell by 1-1.5 points across the curve. Reports suggested that investor appetite for leveraged Brazilian have soured after several setbacks for Brazilian companies in recent times. As per CSN’s Q2 results, the company’s net debt-to-adjusted EBITDA stood at 3.24x. Recently, waste management firm Ambipar filed for bankruptcy. Also, Braskem was reported to have recently hired advisers for a capital review. Besides, there are fears that Banco Master’s need for fresh capital amid overexposure to risky assets could spill over to corporates and pension funds that hold its debt instruments. Roger Horn, EM credit strategist at Mariva Capital Markets said, “There’s general market nervousness over any Brazilian credits with leverage after Braskem and Ambipar surprises, and the recent sudden drop in Raizen bonds, which is actually an investment grade credit”.

Go back to Latest bond Market News

Related Posts: