This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Crescent Energy to Acquire Vital Energy in $733mn All-Stock Deal

August 26, 2025

Crescent Energy has agreed to acquire rival shale producer Vital Energy in an all-stock transaction valued at $733mn, with the total enterprise value of the deal estimated at $3.1bn. Under the terms, Vital Energy’s shareholders will receive about 1.9 Crescent Class A shares for each share they own, representing a 5% premium over Vital’s 30-day average price. The acquisition expands Crescent’s footprint in the Permian basin, adding to its existing operations in the Eagle Ford and Uinta basins. Analysts say that the deal highlights the trend of small and mid-sized shale producers consolidating to secure drilling inventory and scale amid volatile energy markets.

Equity market reaction was mixed, with Crescent shares down 4%, while Vital surged 14.5%. In bond market, Crescent Energy’s 7.625% 2032s rose by 0.5 points and currently trade at 99.05, yielding 7.81%. Vital Energy’s 9.75% 2030s jumped higher by ~14 points to trade at 103.4, yielding 8.48%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

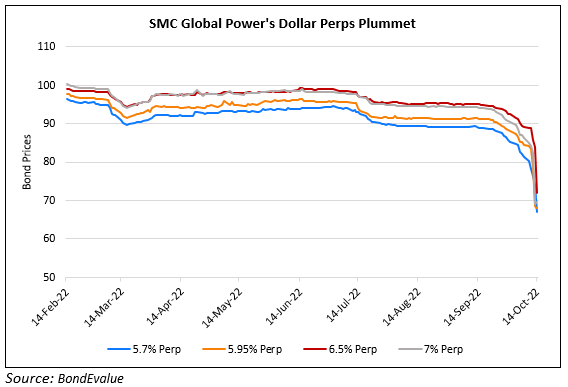

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

Fitch Expects Mexican Government to Continue Supporting Pemex

August 17, 2023