This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Credivalores To Launch Debt Exchange Offer; Downgraded to C by Fitch

February 9, 2024

Credivalores will be launching a debt exchange offer for its $210.8mn 8.875% 2025s. It has reached agreements with its main bondholders on the terms of an exchange offer and plans to use the 30-day grace period for the coupon due 7 February 2024 to materialize these efforts. According to the company, the transaction will help strengthen its capital structure, improve its debt maturity profile, and significantly reduce its refinancing requirements. As a result of the company’s announcement to launch a debt exchange offer and company entering the grace period, Fitch downgraded Credivalores and its senior debt ratings from B- to C. Fitch notes that once the company discloses the terms and conditions of the exchange offer and if it is assessed as a Distressed Debt exchange (DDE), then it will further downgrade Credivalores’ rating to Restricted Default (RD) on completion of the DDE.

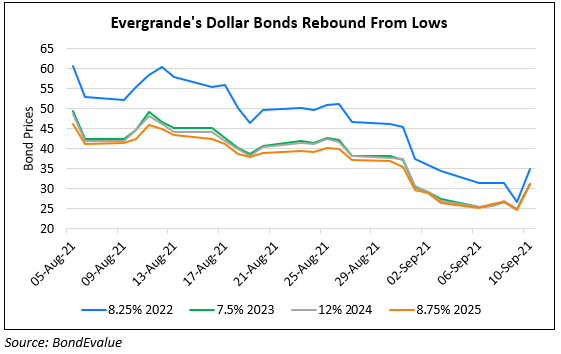

Credivalores’ 8.875% 2025s continues to trade at distressed levels of 24.3 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: