This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Credit Suisse Spreads Widen; Outlook Lowered by S&P

March 31, 2021

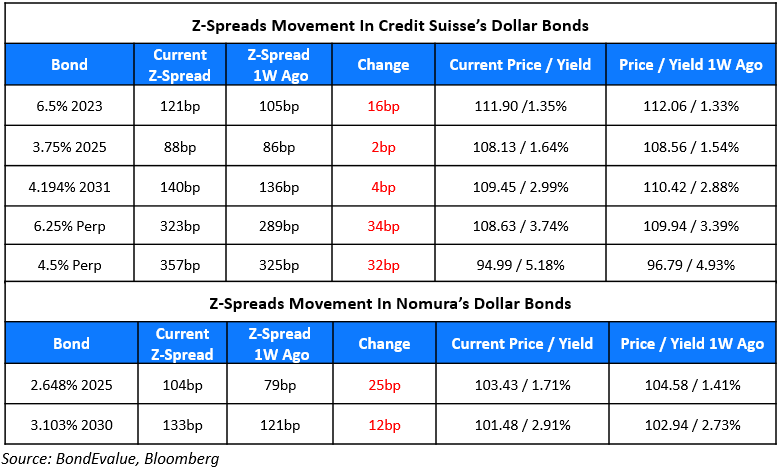

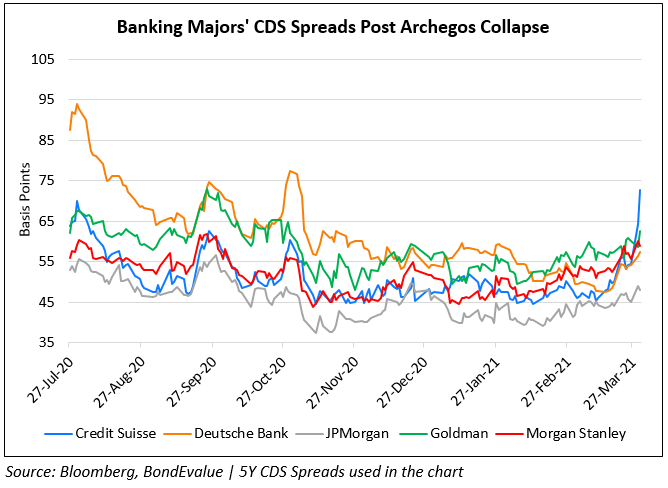

Credit Suisse (CS) saw its CDS spreads widen post the fallout from Archegos Capital. Bloomberg reports that CS is now deemed the riskiest in the eyes of derivatives traders among the big banks. Its 5Y credit default swaps (CDS) spreads widened 20bp since Friday to 74.7bp points on Tuesday, the highest since July last year. Post CS’s warning that this could have a “highly significant and material” impact on its first-quarter results, sources indicated this could amount to a few billions of dollars in losses and could derail its stock buyback plans. Given Archegos’ incident and questions on risk management, S&P revised its outlook on CS to negative from stable. The Swiss lender saw its z-spreads widen since the Archegos incident, particularly its Perps that saw a price drop and z-spreads widening.

Credit Suisse’s USD 4.5% Perp fell another 1.4 points to 93.22 cents on the dollar while its USD 5.25% Perp and USD 6.375% Perp fell 1.8 and 1.9 points to 101.08 and 106.63 respectively.

For the full story, click here

Track Credit Suisse’s bonds now on the BondEvalue App by clicking here

Go back to Latest bond Market News

Related Posts: