This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

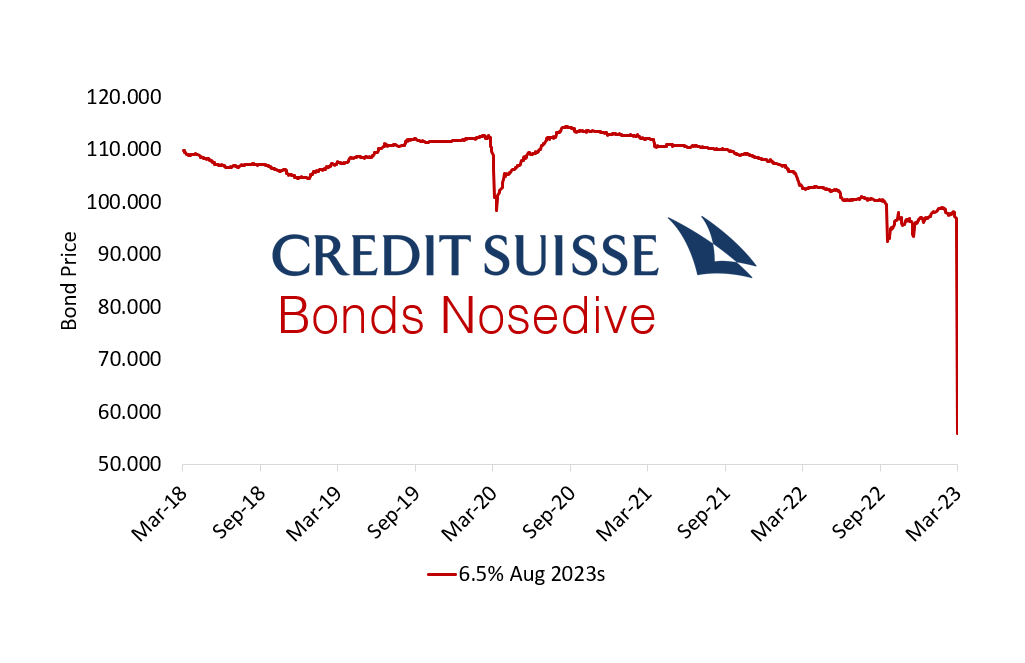

Credit Suisse Bonds Nosedive Into Distress Territory

March 16, 2023

Swiss lender Credit Suisse (CS) saw a fresh round of selling in its stock and bonds on Wednesday amid heightened concerns over its financial position. While CS has been marred by a string of negative news since September last year, the most recent selloff was triggered by comments from its largest shareholder, Saudi National Bank (SNB). When asked if SNB would inject more cash into CS, Ammar Al Khudairy, chairman of the Saudi state-owned bank responded “absolutely not,” citing “many reasons outside the simplest reason, which is regulatory and statutory.” The comments led to panic among investors, going by the rapid plunge in its stock, which lost a quarter of its value on Wednesday alone, and its bonds. As seen in the chart above, CS’ senior unsecured $2.5bn 6.5% dollar bonds due August 2023 fell off a cliff from 94.5 on 14 March to 55.9 levels on 16 March 2023. The selloff in its bonds was across the curve with senior dated bonds falling ~25 points and its subordinated AT1 perps dropping over 40 points – its most recently issued $1.65bn 9.75% perp issued in June 2022 at 100 fell 43 points on 15 March to trade at deep distress levels of 32.4 cents on the dollar. For the latest Credit Suisse bond prices, scroll down.

Track the latest Credit Suisse Bond Prices via the Links Below

Credit Suisse Bonds

Credit Suisse Bond Prices as of 16 March 2023

Credit Suisse CDS Spreads

Credit Suisse CDS (credit default swap) spreads spiked to new record highs of 975bp, up over 400bp on 15 March alone. CDS are derivative contracts used to protect against default – thus an increase in CS’ CDS spreads indicate a higher cost to protect against default on its senior debt.

.png?width=1726&height=1248&upscale=true&name=image%20(40).png)

Go back to Latest bond Market News

Related Posts:

Credit Suisse Clients Could Lose $3bn on Greensill Funds

March 26, 2021

Credit Suisse Raises $5bn Across EUR and USD Bond Issuances

November 10, 2022