This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Credit Spreads Widen on US-China Tensions

October 13, 2025

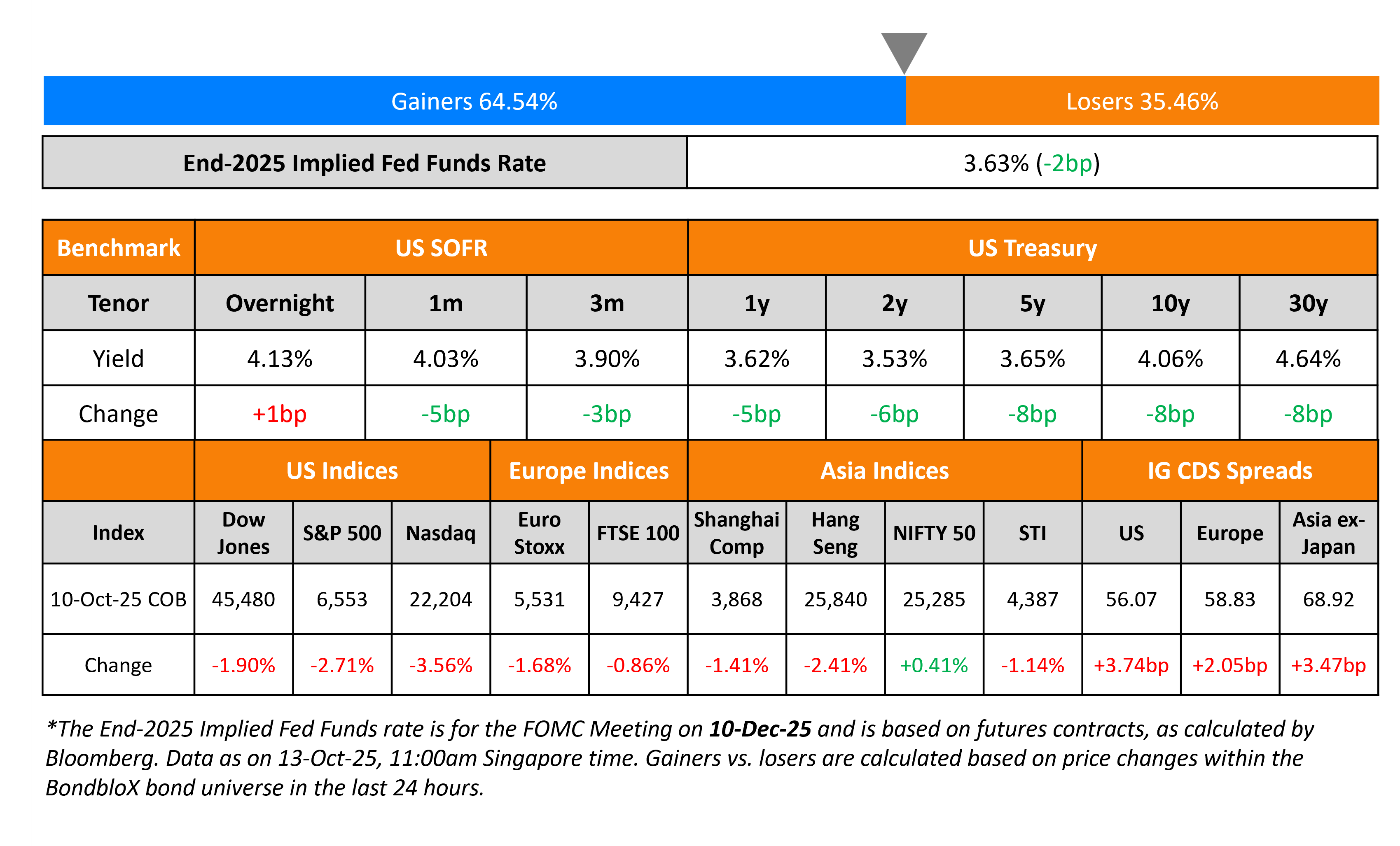

US Treasury yields eased by 6-8bp across the curve. University of Michigan sentiment index for October came in at 55 vs expectations of 54 and prior month figure of 55.1. St. Louis Fed President Alberto Musalem said that he supported last month’s interest-rate reduction as a way to take out insurance against the weakening labor market, but reiterated officials need to continue leaning against elevated inflation. Fed’s reserve governor Christopher Waller said that the labor market is weak and that’s the biggest concern for Fed’s policy. He added to support lowering rates by 25bp at each of this year’s two remaining Fed meetings, and adjusting it as more data comes in.

US President threatened to impose additional 100% of tariffs on goods imported from China in reaction to the new export controls Beijing is planning for valuable rare earth minerals. However, China defended its move and also warned the US of “resolute measures”. However, later Trump appeared to hint that he may not follow through with his tariff threat, posting that “it will all be fine”, on Truth Social. Looking at equity markets, both the S&P and Nasdaq dropped sharply by 2.7% and 3.6% respectively. The US IG and HY CDS spreads widened by 3.7bp and 19.6bp respectively. European equity indices also closed lower. The iTraxx Main CDS spreads were 2.1bp wider while the Crossover spreads were 11.3bp wider. Asian equity markets have opened weaker today. Asia ex-Japan CDS spreads were 3.5bp wider.

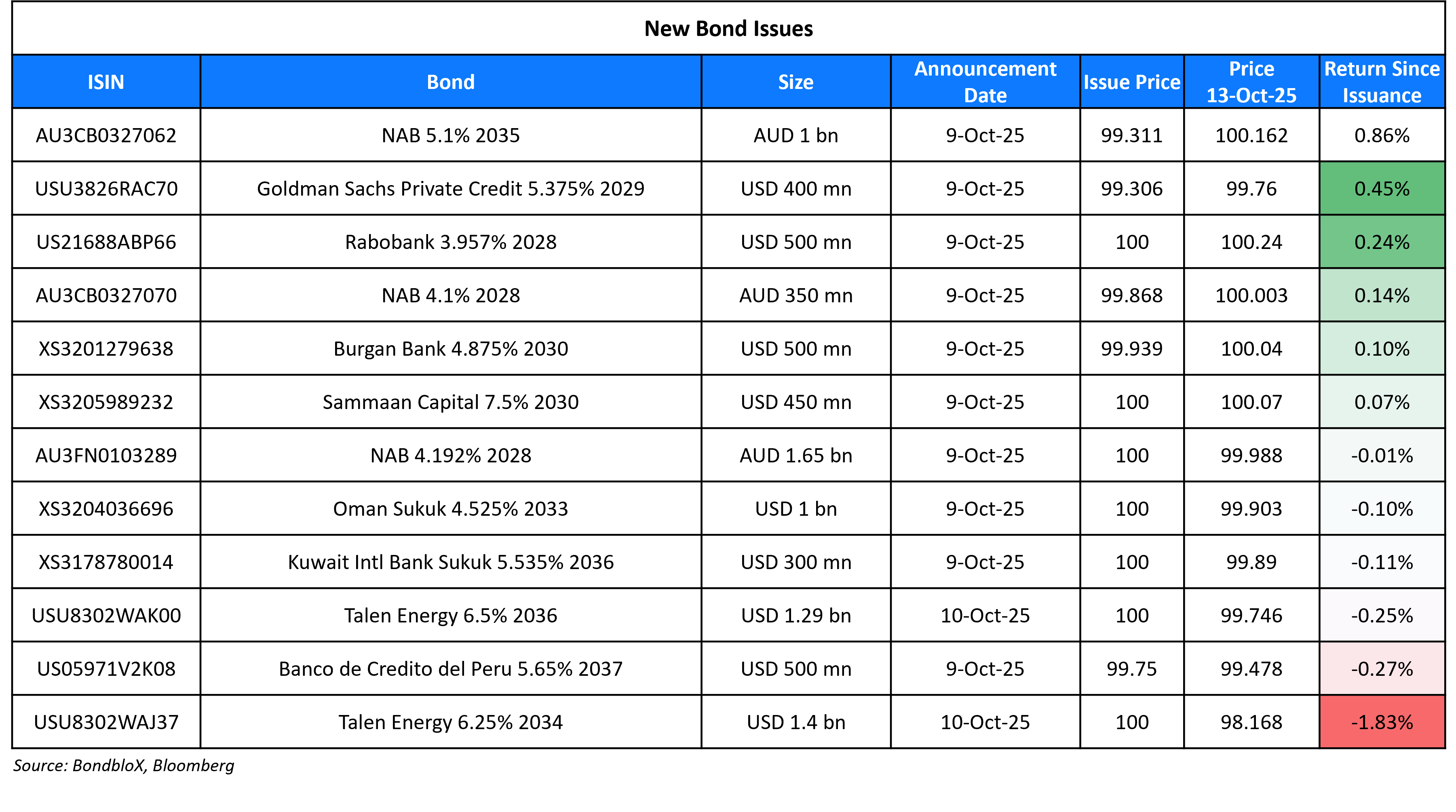

New Bond Issues

Talen Energy raised $2.69bn via two tranches. It raised:

- $1.4bn via a 8.25NC3Y bond at a yield of 6.25%, in line with initial guidance of 6.25% area.

- $1.29bn via a 10.25NC5 bond at a yield of 6.5%, in line with initial guidance of 6.5% area

The senior unsecured notes are rated B2/B(Moody’s/S&P). Proceeds, together with a new $1.2bn senior secured term loan B, will be used to fund the previously announced acquisitions of (a) the Freedom Energy Center, a 1,045 MW natural gas fired plant in Luzerne County, Pennsylvania and (b) the Guernsey Power Station, a 1,836 MW natural gas plant in Guernsey County, Ohio.

New Bonds Pipeline

- Avation $300-400mn, up to 5.5NC2 Bond

- China Water Affairs $5NC3 Blue Bond

Rating Changes

- Egypt Upgraded To ‘B’ On Ongoing Reforms, Improving Growth And External Metrics; Outlook Stable

- Moody’s Ratings upgrades Ghana’s ratings to Caa1 and changes the outlook to stable

- Fitch Upgrades Astana Motors Finance to ‘B’/Stable

- Aston Martin Lagonda Global Holdings PLC Rating Lowered To ‘CCC+’ On Continued Cash Burn; Outlook Stable

- Moody’s Ratings downgrades Senegal’s ratings to Caa1 and maintains the negative outlook

- Conduent Inc. Rating Lowered To ‘B’ Due to Slow Deleveraging, Weak Cash Flow Generation; Outlook Stable

- NOVA Chemicals Corp. Ratings Placed On CreditWatch Positive On Planned Acquisition

- Fitch Revises Banco BPI’s Outlook to Positive Following Action on Parent; Affirms Rating at ‘A-‘

- Fitch Revises Xcel Energy, Inc.’s Outlook to Stable; Affirms Ratings

Term of the Day

Blue Bonds

Blue bonds are a type of sustainable debt wherein the proceeds from such issuance are earmarked for marine/water projects related to ocean conservation (hence the name blue bonds). These are similar to green bonds, which are earmarked for green or environmentally-friendly projects. Blue bonds became popular in late 2018 when Seychelles issued the world’s first sovereign blue bond. Recently China Water Affairs has mandated a 5Y blue dollar bond.

Talking Heads

On Bonds Crashing at Breakneck Speed

Jason Mudrick, Mudrick Capital Management

“These recent blowups, could be the canary in the coal mine. The “excesses” built up in the markets over many years, the result of near-zero benchmark rates and steady growth that spurred too much corporate borrowing and encouraged aggressive risk-taking by lenders. We’re now starting to see this topple over in extreme scenarios.

Matt King, Satori Insights

“There are arguably a great many credits which ought to be insolvent, but which have been kept in business by the combination of covenant relaxation and abundant, ongoing liquidity. It’s just a question of how long they take to be discovered.”

On Corporate Blowups Rattling Investors in EM

Akbar Causer, Morgan Stanley

“These are surprising events that are deeply problematic. If this continues or things get a little bit worse, I’m scared it might shake some of the confidence. And then you might see some contagion.”

Eduardo Ordonez, BI Asset Management

“Everyone has had good performance this year, and nobody knows when the music will stop playing, so there’s no need to be a hero into year-end. It makes more sense to stay cautious — or at least more selective.”

On US Looking More like Emerging Market – Credit Weekly

“We’re seeing some concerns that in some dimensions the US government is moving more in the direction of emerging markets, but that demand for company debt remains strong.”

“With a Treasury, if there’s a hiccup with the debt ceiling that needs to be resolved, then you might not get your money. If you buy a bond from Microsoft, which is higher rated, you have to consider there’s a higher chance you get your money back when you need it.”

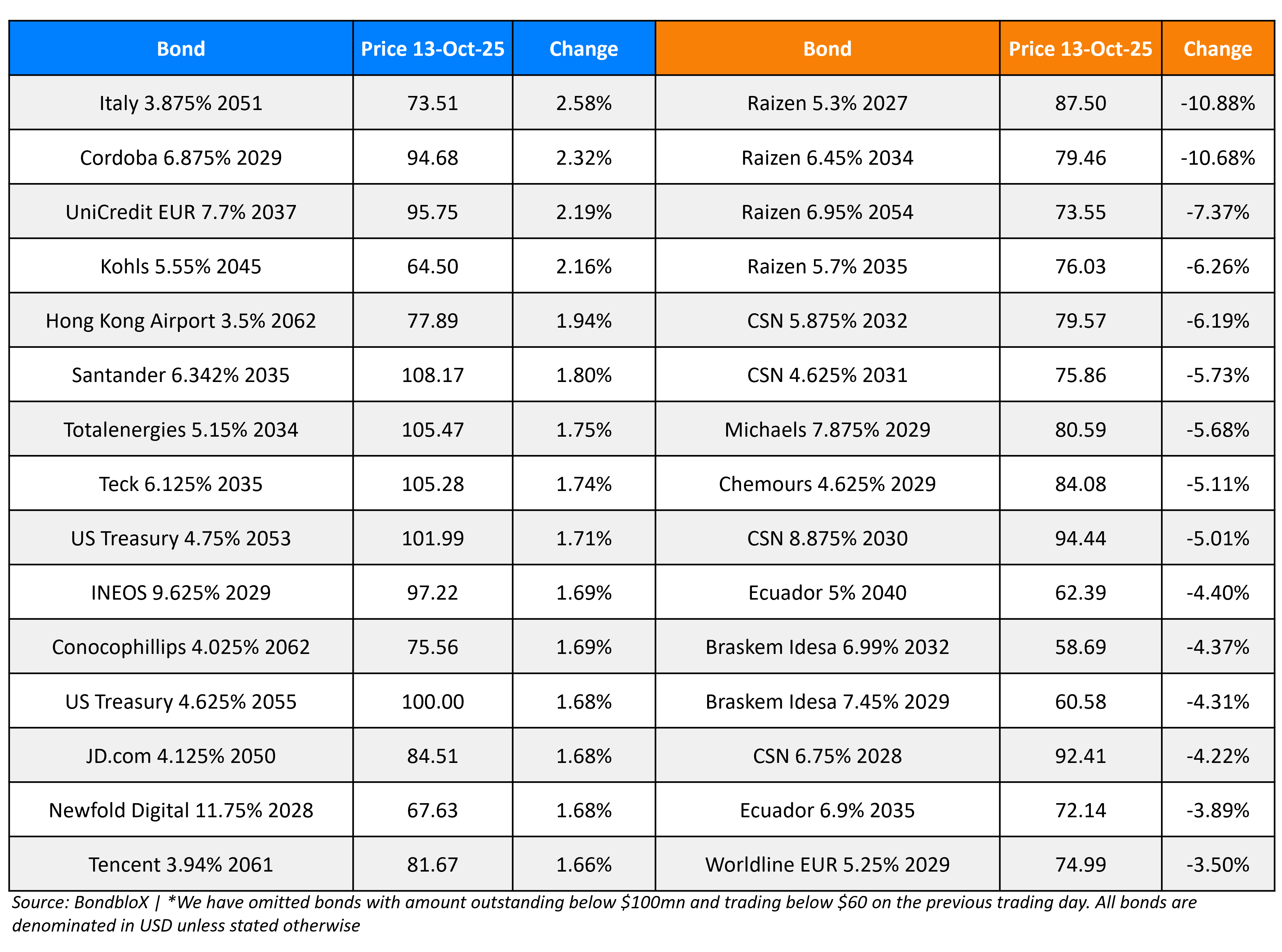

Top Gainers and Losers- 13-Oct-25*

Go back to Latest bond Market News

Related Posts: